Yen and Dollar trades mildly firmer today as markets turn cautious ahead of Trump-Kim summit. But the biggest risks could lie on US Trade Representative Robert Lighthizer’s testimony at the House Ways and Means Committee. After Trump postponed trade truce deadline with China “indefinitely”, there is added optimism on a deal between the two countries. But so far there is little details on what would be agreed. Lighthizer’s testimony might finally reveal something concrete, rather than just definitions of MOUs.

Staying in the currency markets, European majors are the weakest ones as led by Euro. But if should be noted that Sterling is only digesting this week’s strong gains. For the week, Sterling remains overwhelmingly the strongest one. While there is no sign of having an approvable Brexit deal yet, no-deal scenario is a big step further away. It will now take explicit consent in the Commons, by a vote on March 13, to trigger no-deal Brexit. Otherwise, it’s more likely that Article 50 will be extended for a short, limited time.

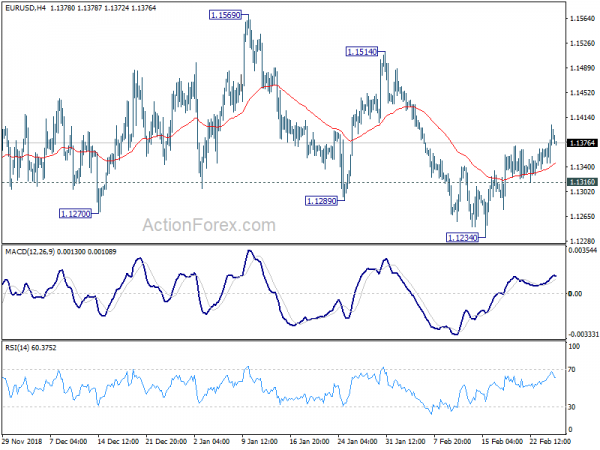

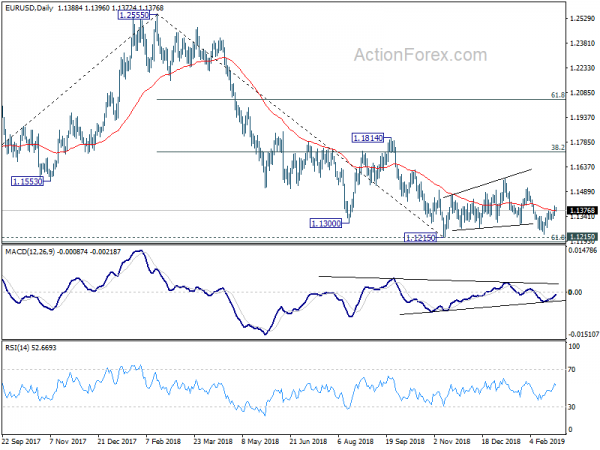

Technically, EUR/USD’s break of 1.3171 resistance confirmed resumption of rebound from 1.1234, further rise is now in favor towards 1.1514 resistance. But such rebound is viewed as a leg inside the consolidation pattern from 1.1215 after all. USD/CHF will have at 0.9981 temporary low again and Swiss Franc might follow Euro higher. Yesterday GBP/USD has taken out 1.3217 resistance while EUR/GBP broke 0.8617 key support. Technical development in both pairs favor more upside in the pound.

In Asia, Nikkei closed up 0.50%. Hong Kong HSI is down -0.21%. Shanghai SSE is down -0.40%. Singapore Strait Times is down -0.16%. Japan 10-year JGB yield is up 0.0043 at -0.021. Overnight, DOW dropped -0.13%. S&P 500 dropped -0.08%. NASDAQ dropped -0.7%. 10-year yield dropped -0.037 to 2.636. 30-year yield dropped -0.028 to 3.006. 3% handle looks vulnerable again.

Fed Powell: We’re going to be patient to allow things to clarify

In the semi-annual testimony overnight, Fed Chair Jerome Powell said there were “crosscurrents and conflicting signals” in the past few months. Financial markets became “more volatile” toward year-end. Financial conditions are now “less supportive”. Also, growth slowed in some major foreign economies, “particularly China and Europe”. And there is “elevated” uncertainty in issues including Brexit and trade negotiations.

Domestically, the US is facing “important longer-run challenges”. Productivity “has been too low”. Labor force participation among “prime-age men and women” is now lower in the US than in most other advanced economies. “relatively stagnant incomes”, “lack of upward economic mobility” are also important challenges. Federal government debt is also on an “unsustainable path”.

Overall, Powell noted, “we have the makings of a good outlook and our committee is really monitoring the crosscurrents, the risks, and for now we are going to be patient with our policy and allow things to take time to clarify.”

On monetary policy, Powell reiterated that “going forward, our policy decisions will continue to be data dependent and will take into account new information as economic conditions and the outlook evolve.” And, “the extent and timing of any further rate increases would depend on incoming data and the evolving outlook.” He noted that inflation pressure were “muted” in January. and the cumulative development warranted “taking a patient approach” to future policy changes. Also, Fed will evaluate the appropriate timing and approach for the end of balance sheet runoff ahead.

Trump to friend Kim: Denuclearize and thrive like Vietnam

Trump arrived in Vietnam for the summit with Korean leader Kim Jong-un. Ahead of the meeting, he urged his “friend” Kim to denuclearize and said North Korea could be like Vietnam, “thriving like few places on earth”. He added that “he potential is AWESOME, a great opportunity, like almost none other in history”.

The two are expected to meet at French-colonial-era Metropole Hotel in Hanoi at 1130 GMT and have a 20-minute one-on-one conversation before a dinner.

UK Gov’t: Lack of preparation by businesses on no-deal Brexit, particular SMEs

In a report titled “Implications for Business and Trade of a No Deal Exit on 29 March 2019“, the UK government noted that businesses and individuals are under-prepared for no-deal Brexit because they see it as unlikely. But it’s warned that the disruption risk could heighten if it does eventually take place.

The reported noted that “despite communications from the government, there is little evidence that businesses are preparing in earnest for a no-deal scenario, and evidence indicates that readiness of small and medium-sized enterprises in particular is low”.

The government “judges that the reason for this lack of action is often because a no-deal scenario is not seen as a sufficiently credible outcome to take action or outlay expenditure”. And “the lack of preparation by businesses and individuals is likely to add to the disruption experienced in a no-deal scenario”.

Brexit debates will continue today and some amendments will be voted for. But the overall plan should now be set after Prime Minister Theresa May’s statement yesterday. There will be another meaningful vote on the Brexit deal on March 12. May could get a last minute provisional agreement from EU on March 11, if any, with needed change on Irish backstop. If the deal is voted down, there will be a vote on March 13 for the Parliament to give explicit consent to no-deal Brexit. Then on March 14, if no-deal Brexit is ruled out, there will be another vote on Article 50 extension.

BoJ Kataoka: Uncertainty heightened if current monetary easing is prolonged

BoJ board member Goushi Kataoka continued his call for more monetary stimulus in a speech to business leaders today. He argued that the central bank should ramp up its monetary easing to achieve inflation target earlier.

And he warned, “if the current monetary easing is prolonged, it would mean the period in which Japan’s economy faces various uncertainties will be longer. That means uncertainty on achieving our price target will heighten.”

Kataoka is a known dove who persistently vote against BoJ’s policy in push for more easing.

On the data front

New Zealand trade deficit came in much larger than expected at NZD -914m in January, versus consensus of NZD -300m. Australia construction work done dropped -3.1% in Q4, below expectation of -0.5%. UK BRC shop price rose 0.7% yoy in February versus expectation of 0.3% yoy.

Eurozone M3 and confidence indicators will be the main feature in European session. Canada CPI will take center stage in US session. From US, trade balance, pending home sales and factory orders will also be released. Fed Chair Jerome Powell will have part two of his Congressional testimony.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1355; (P) 1.1379; (R1) 1.1412; More…..

EUR/USD rises to as high as 1.1402 so far as rebound from 1.1234 extends. Intraday bias remains on the upside for further rally. Current rise is seen as another leg in the consolidation pattern from 1.1215 and could target 1.1514 resistance and above. On the downside, though, break of 1.1316 minor support will argue that the rebound is completed. Intraday bias will be turned back to the downside for 1.1215 low.

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance Jan | -914M | -300M | 264M | 12M |

| 0:01 | GBP | BRC Shop Price Index Y/Y Feb | 0.70% | 0.30% | 0.40% | |

| 0:30 | AUD | Construction Work Done Q4 | -3.10% | 0.50% | -2.80% | -3.60% |

| 9:00 | EUR | Eurozone M3 Money Supply Y/Y Jan | 4.00% | 4.10% | ||

| 10:00 | EUR | Eurozone Business Climate Feb | 0.67 | 0.69 | ||

| 10:00 | EUR | Eurozone Economic Confidence Feb | 106 | 106.2 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Feb | 0.1 | 0.5 | ||

| 10:00 | EUR | Eurozone Services Confidence Feb | 11 | 11 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Feb F | -7.4 | -7.4 | ||

| 13:30 | CAD | CPI M/M Jan | 0.10% | -0.10% | ||

| 13:30 | CAD | CPI Y/Y Jan | 1.40% | 2.00% | ||

| 13:30 | CAD | CPI Core-Common Y/Y Jan | 1.90% | 1.90% | ||

| 13:30 | CAD | CPI Core-Median Y/Y Jan | 1.80% | 1.80% | ||

| 13:30 | CAD | CPI Core-Trim Y/Y Jan | 1.90% | 1.90% | ||

| 13:30 | USD | Advance Goods Trade Balance (USD) Dec | -75.3B | -71.6B | ||

| 13:30 | USD | Wholesale Inventories M/M Dec F | 0.40% | 0.30% | ||

| 15:00 | USD | Fed Powell testifies Before House Panel | ||||

| 15:00 | USD | Pending Home Sales M/M Jan | 0.80% | -2.20% | ||

| 15:00 | USD | Factory Orders Dec | 0.80% | -0.60% | ||

| 15:30 | USD | Crude Oil Inventories | 3.7M |