The financial markets are relatively quite in Asia today. Stocks turned mixed following the pull back in US overnight. But losses are limited while the resilient Chinese SSE is having slight gain. Chinese government lowered 2019 growth target to 6.0-6.5%, with the lower bound at lowest pace in more than three decades. But the move was widely expected and thus triggered little reactions.

RBA kept interest rate unchanged at 1.50% as widely expected. It maintained the central scenarios of growth, inflation and employment forecasts. The tone of the statement is a touch more optimistic comparing to February’s. But it’s also largely shrugged off by the Australian Dollar. Focus will now turn to services data from UK and US today.

In the currency markets, Dollar is trading as the strongest one for today so far. Recent rally in treasury yield is giving the greenback some additional support. Yield curve has also become less inverted. 5-year yield at 2.531 is now back above 6-month yield at 2.504. Ad it’s not far from 1-year yield at 2.557. But while the greenback looks solid, it has yet to take out important resistance level against Euro, Swiss Franc, and not even Aussie and Canadian. Staying in the currency markets, Euro and Swiss franc are next strongest. Commodity currencies are weakest as led by New Zealand Dollar.

In Asia, Nikkei closed down -0.54% at 21703. Hong Kong HSI is down -0.16%. China Shanghai SSE is up 0.07%. Singapore Strait Times is down -0.58%. Japan 10-year JGB yield is up 0.0057 at 0.007, staying positive. Overnight, DOW dropped -0.79%. S&P 500 dropped -0.39%. NASDAQ dropped -0.23%. 10-year yield dropped -0.033 to 2.722.

RBA kept cash rate at 1.50%, central scenarios of growth, inflation, employment unchanged

RBA left cash rate unchanged at 1.50% today as widely expected. The message of the accompanying statement is largely unchanged. RBA maintained the central scenarios of growth, inflation, employment outlook. And continued to expect the “gradual” progress of reducing unemployment and inflation returning to target.

The central back acknowledged that “economy slowed over the second half of 2018”. But it maintained the “central scenario” is still to grow by around 3% this year. The outlook is supported by “rising business investment, higher levels of spending on public infrastructure and increased employment.” Inflation remains “low and stable”. The central scenario is for underlying inflation to be at 2% in 2019 and 2.25% in 2020. Labor markets remains “strong” and further decline in unemployment rate to 4.75% is expected over the next couple of years.

Main domestic uncertainty remains the “strength of household consumption in the context of weak growth in household income and falling housing prices in some cities.” But RBA expects household income growth to pick-up and support spending over the next year. On housing markets, it’s noted that adjustment in Sydney and Melbourne is continuing. Conditions remains “soft” in both markets with low rent inflation. Credit demand by investors slowed noticeably. And growth in owner-occupiers eased further.

China, facing tough struggle, lowers 2019 growth target to 6-6.5%

Chinese Premier Li Keqiang delivered his annual work report to the National People’s Congress today. Li warned that “China will face a graver and more complicated environment as well as risks and challenges that are greater in number and size”. And he emphasized “China must be fully prepared for a tough struggle.”

GDP growth target for 2019 is lowered to 6-6.5%, notably down from 2018’s target of around 6.5%. The lower bound at 6% would be the slowest pace of growth in nearly three decades.

To help the manufacturing sector, a 3% cut to top bracket of VAT was announced, from from 16% to 13%. Also, there will be with 1% cut to the 10% VAT bracket for transport and construction sectors, down from 10% to 9%. It’s estimated the cuts are equivalent to as much as CNY 800B. Social security fees paid by businesses will be reduced to 16%.

Budget deficit for 2019 was set at 2.8% of GDP, larger than 2018 target of 2.6%. Total reduction in tax and social security fees would add up to CNY 2T.

China CBIRC Guo: Can absolutely open financial market access to US

China’s top banking regulator said today that it can “absolutely” reach an agreement top open up the financial sector to the US. Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, said “On the opening of the financial sector, China and the United States absolutely can reach agreement. Though at present there may be a few small disagreements, the problems are not that great”

Separately, Commerce Minister Zhong Shan said trade talks have achieved a breakthrough in some areas. While the negotiations were difficult, Zhong said both teams are continuing with their work.

Trump to end preferential trade treatment to India and Turkey

Trump sent a letter to Congressional leaders notifying his intention to end preferential trade treatment to India. He complained that “I am taking this step because, after intensive engagement between the United States and the Government of India, I have determined that India has not assured the United States that it will provide equitable and reasonable access to the markets of India.”

Under Trump’s instruction, the US Trade Representative also issued a statement on its intention to terminate Generalized System of Preferences (GSP) designation of both India and Turkey. The statement noted that “India’s termination from GSP follows its failure to provide the United States with assurances that it will provide equitable and reasonable access to its markets in numerous sectors. Turkey’s termination from GSP follows a finding that it is sufficiently economically developed and should no longer benefit from preferential market access to the United States market.”

And, “by statute, these changes may not take effect until at least 60 days after the notifications to Congress and the governments of India and Turkey, and will be enacted by a Presidential Proclamation.”

India Commerce Secretary Anup Wadhawan said US ending the preferential treatment to India has “relatively limited impact. The duty benefits were just at USD 190m even though it’s the largest beneficiary of the GSP with $5.7 billion in imports to the U.S. given duty-free status. Also, Wadhawan said India doesn’t plan to impose retaliatory tariffs on US goods. Both countries have been working on a trade package to address each other’s concerns.

On the data front

Australia AiG Performance of Services rose 0.2 to 44.5 in February. Australia current account deficit narrowed to AUD -7.2B in Q4. New Zealand ANZ commodity price rose 2.8% in February. China Caixin PMI services dropped to 51.1 in February, down from 53.6 and missed expectation of 53.5. UK BRC retail sales monitor dropped -0.1% yoy in February.

Looking ahead, Swiss will release CPI in European session. Eurozone will release PMI services final. But main focus will be on Eurozone retail sales and UK PMI services. Later in the day, US will also release ISM services and new home sales.

SNB board member Zurbrugg, Fed’s Rosengren , BoE governor Carney will speak today.

USD/CAD Daily Outlook

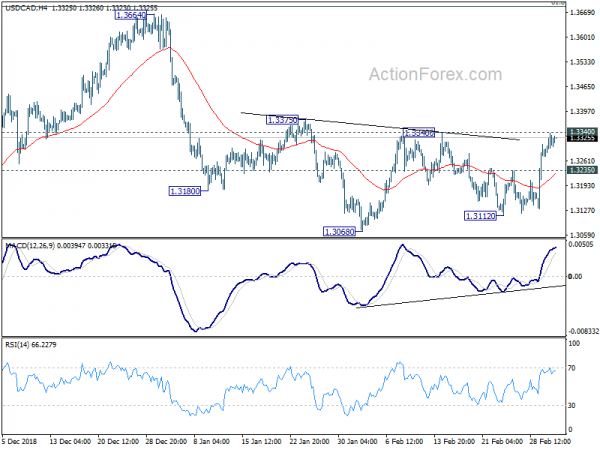

Daily Pivots: (S1) 1.3274; (P) 1.3306; (R1) 1.3338; More…

Intraday bias in USD/CAD remains on the upside with focus on 1.3340 resistance. Decisive break there will complete a head and shoulder bottom pattern (ls: 1.3180, h: 1.3068, rs: 1.3112). That should indicate completion of pull back from 1.3664. In this case, further rally should be seen back to 1.3664 high. On the downside, though, break of 1.3235 minor support will turn bias neutral again first.

In the bigger picture, structure of the medium term rise from 1.2061 (2017 low) to 1.3664 is not clearly impulsive. Hence, we’d stay cautious on strong resistance from 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 and 1.3793 resistance to limit upside, and bring medium term topping. But in any case, medium term outlook will stay bullish as long as channel support (now at 1.3118) holds. Sustained break of 1.3793 will pave the way to retest 1.4689 (2015 high). Firm break of the channel support should confirm reversal target 1.2061 low again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Service Index Feb | 44.5 | 44.3 | ||

| 0:00 | NZD | ANZ Commodity Price Feb | 2.80% | 2.10% | 2.00% | |

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Feb | -0.10% | 0.10% | 1.80% | |

| 0:30 | AUD | Current Account (AUD) Q4 | -7.2B | -9.1B | -10.7B | -10.8B |

| 1:45 | CNY | Caixin China PMI Services Feb | 51.1 | 53.5 | 53.6 | |

| 3:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 7:30 | CHF | CPI M/M Feb | 0.40% | -0.30% | ||

| 7:30 | CHF | CPI Y/Y Feb | 0.60% | 0.60% | ||

| 8:45 | EUR | Italy Services PMI Feb | 49.5 | 49.7 | ||

| 8:50 | EUR | France Services PMI Feb F | 49.8 | 49.8 | ||

| 8:55 | EUR | Germany Services PMI Feb F | 55.1 | 55.1 | ||

| 9:00 | EUR | Eurozone Services PMI Feb F | 52.3 | 52.3 | ||

| 9:30 | GBP | Services PMI Feb | 50 | 50.1 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | 1.30% | -1.60% | ||

| 14:45 | USD | Services PMI Feb F | 56.2 | 56.2 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Feb | 57.3 | 56.7 | ||

| 15:00 | USD | New Home Sales Dec | 590K | 657K |