Dollar recovers mildly today, continuing to stabilize from this week’s selloff. The greenback is staying in range established earlier except versus Canadian. There is some optimism on the outcome of US-Mexico negotiations. Or at least, tariffs won’t go up to the worst case of 25% down the road. Together with expectations on Fed rate cut, sentiments improved notably, which is clearly reflected in the rebound in the stock markets. Nevertheless, today’s non-farm payroll report could be the ultimate test for investor sentiments for the near term.

In the currency markets, Canadian is currently the strongest one for today, helped by mild recovery in oil prices. Sterling is the second strongest, followed by Dollar. Euro is the weakest one but it’s generally bounded in range only. Aussie is the second weakest after poor housing data. For the week, Yen overtook Dollar’s position as worst performing while Dollar is second, than Aussie. Kiwi is the strongest one, followed by Canadian and then Franc.

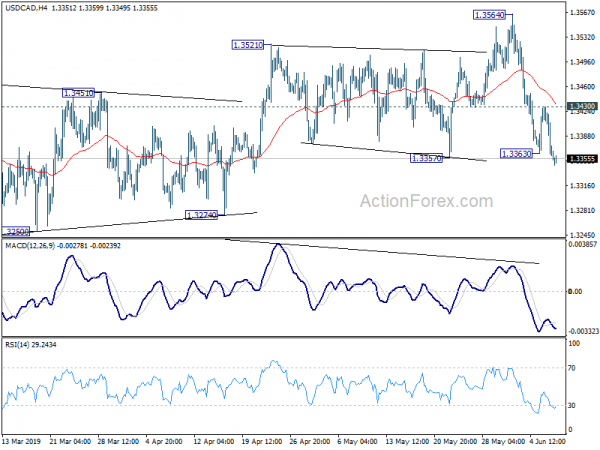

Technically, USD/CAD’s breach of 1.3357 support is a sign of bearish reversal. That is, rise from February low at 1.3068 has possibly completed at 1.3564 already. But of course the outlook will very much depend on today’s job data from both Canada and US. As for Dollar, further decline remains in favor in general. Some near term levels are needed to be taken out, at least some of them, to confirm a turn around in the greenback. Otherwise, we won’t be convinced by any knee jerk bullish reactions to NFP. Those levels include 1.1200 support in EUR/USD, 0.6938 support in AUD/USD, 1.0008 resistance in USD/CHF, 109.02 resistance in USD/JPY and 1.3430 resistance in USD/CAD.

In Asia, Nikkei rose 0.58%. Singapore Strait Times is up 0.38%. China and Hong Kong are on holiday. Japan 10-year JGB yield is up 0.0029 at -0.118. Overnight, DOW rose 0.71%. S&P 500 rose 0.61%. NASDAQ rose 0.53%. 10-year yield rose 0.001 to 2.092.

Mexico offered more to US but tariffs still loom

The negotiations between US and Mexico on migration and tariff issues appeared to have made some progress. But the talks would continue on Friday and probably into the weekend. It’s reported that the US is considering to delaying the 5% tariffs on all Mexican imports, which is due on Monday, June 10. But White House spokesperson Sarah Sanders reiterated Trump is still moving forward with the tariffs.

After the meeting on Thursday, US Vice President Mike Pence said Mexico had offered “more”. “There has been some movement on their part. It’s been encouraging,” he said. “The discussions are going to continue in the days ahead.” Mexican Foreign Minister Marcelo Ebrard said 6000 members of the National Guard were sent to secure its southern border with Guatemala.

Fed Williams: Shifts in demographics and productivity growth fundamentally altered the world after

In a speech delivered yesterday, New York Fed President John Williams said he viewed the pre-2008 crisis era as “the world before” and the period after that as “the world after”. Inflation was a “major concerns” in the pre-2008 era. But now “inflation that’s too low is now a more pressing problem.” The experience of a slow recovery and persistently low inflation is a symptom of deeper problems afflicting advanced economies.

Two changes have taken place in “shifts in demographics and productivity growth” that fundamentally altered the economic environment. And that “translate directly into slower trend economic growth”. Also, “an abundance of savings, and a decline in demand for savings resulting from slower trend growth, together lead to lower interest rates”. Combined, they have contributed to “dramatic declines” in the longer-term neutral rate of interest, or r-star.

On the economy, he said “my baseline is a very good one” with GDP growth at above-trend 2.25% to 2.50%. Though, tailwinds from last year’s tax cuts are fading. Headwinds from trade tensions are rising. He added the yield curve inversion is a “pretty strong signal” of “perception that rates are going to be lower”. But he didn’t take that as “an oracle”.

IMF raises US growth forecasts to 2.6% in 2019, agrees to Fed pausing rate hikes

IMF Managing Director Christine Lagarde said economic forecasts for US for 2019 will be raised by 0.3% to 2.6%. For 2020, growth is expected to slow to 1.9%. IMF is “seeing a lot of positives in the macroeconomic outcomes” and “there is a lot for Americans to be proud of”.

Meanwhile, IMF “full agree” with Fed’s approach in “pausing its process of raising interest rates”. That will “give policymakers time to gauge the balance of risks to both inflation and employment outcomes and to build a clearer picture of whether further adjustments in the federal funds rate are warranted.”

On trade, however, Lagarde emphasized “it will be essential that the U.S. and its trading partners work constructively together to better address distortions in the trading system”. And, “it is especially important that the trade tensions between the U.S. and its trading partners including China and Mexico… are quickly resolved through a comprehensive agreement that results in a stronger and more integrated international trading system.”

PBoC Yi: Tremendous room in fiscal and monetary policy to counter trade war

People’s Bank of China Governor Yi Gang said in a Bloomberg interview that China has “tremendous” room for adjusting its fiscal and monetary policy to counter the impact of trade war with US. And, there is no red line in Yuan’s exchange rate.

“We have plenty of room in interest rates, we have plenty of room in required reserve ratio rate, and also for the fiscal, monetary policy toolkit, I think the room for adjustment is tremendous,” Yi said. He also noted that China’s fiscal policy this year is “probably the largest and strongest fiscal reform package”. That include tax cuts and fiscal resources allocation. If situation is getting “a little bit worse”, the current fiscal package “is able to cover”. But it situations gets “tremendously worse”, they will “open the discussion”.

On Yuan exchange rate, Yi said “trade war would have a temporary depreciation pressure on renminbi”. However, he insisted “after the noise, renminbi will continue to be very stable and relatively strong compared to emerging market currencies, even compared to convertible currencies.” Meanwhile, Yi also emphasized there is no red line in the exchange rate, and no “numeric number” is more important than the others.

Euro in familiar range after ECB triggered moves

Much volatility was seen in Euro yesterday on ECB, but it settled in familiar range after all the moves. In short, ECB said interest rates are going to stay at currently level for longer, “at least through the first half of 2020”. The post meeting press conference was not too dovish at all. It just rejected, as President Mario Draghi described “confidence in the present baseline, but also clear acknowledgement of risks”. Growth outlook for 2019 was revised up, but slightly down for 2020 and 21. Inflation outlook for 2019 was revised up, down for 2020.

More on ECB:

- ECB Not Dovish Enough – Low Rate to Stay until Mid-2020 and TLTRO Pricing Revealed.

- ECB Promises Additional Easing If Needed

- ECB Not Delivering to Market Expectations

- ECB Not Panicking Yet

- Breaking Market Commentary: European Central Bank meeting

- Euro lifted by not so dovish ECB Draghi

- (ECB) Introductory Statement to the Press Conference

- ECB Not Dovish Enough

- ECB press conference live stream

- ECB keeps interest rate at 0.00%, will stay there through H1 2020

On the data front

Australia home loans dropped -1.2% mom in April versus expectation of -0.3% mom. AiG Performance of Construction index dropped further to 40.4 in May, down from 42.6. From Japan, household spending rose 1.3% yoy in April versus expectation of 2.7% yoy. Labor cash earnings dropped -0.1% yoy versus expectation of -0.7% yoy. Leading indicator dropped to 95.5, down from 95.9.

Looking ahead, German industrial production and trade balance will be featured in European session. Swiss will release foreign currency reserves. Later in the day, US non-farm payroll and Canada job data will be the major focuses.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3337; (P) 1.3385; (R1) 1.3410; More…

USD/CAD’s fall resumed after brief recovery and intraday bias is turned back to the downside. Current development suggests that choppy rise from 1.3068 has completed at 1.3564, on bearish divergence condition in daily MACD. Sustained trading below 1.3357 support should confirm this bearish case and target 1.3274support next. More importantly, that could also have medium term channel support taken out, which carries larger bearish implications too. However, break of 1.3430 resistance will revive near term bullishness and turn bias back to retest 1.3564.

In the bigger picture, USD/CAD is staying well inside medium term rising channel (support at 1.3335). Thus, the up trend from 1.2061 (2017 low) could be in progress. On the upside, decisive break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will pave the way to 78.6% retracement at 1.4127 next. This will remain the favored case as long as 1.3068 support holds. However, sustained break of the channel support will be the first sign of medium term reversal. Firm break of 1.3068 would confirm.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index May | 40.4 | 42.6 | ||

| 23:30 | JPY | Overall Household Spending Y/Y Apr | 1.30% | 2.70% | 2.10% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | -0.10% | -0.70% | -1.90% | -1.30% |

| 1:30 | AUD | Home Loans M/M Apr | -1.20% | -0.30% | -2.80% | -2.30% |

| 5:00 | JPY | Leading Index CI Apr P | 95.5 | 96 | 95.9 | |

| 5:45 | CHF | Unemployment Rate May | 2.40% | 2.40% | 2.40% | |

| 6:00 | EUR | German Industrial Production M/M Apr | -1.90% | -0.50% | 0.50% | |

| 6:00 | EUR | German Trade Balance (EUR) Apr | 17.0B | 18.7B | 20.0B | |

| 7:00 | CHF | Foreign Currency Reserves (CHF) May | 772B | |||

| 12:30 | CAD | Net Change in Employment May | -5.5K | 106.5K | ||

| 12:30 | CAD | Unemployment Rate May | 5.70% | 5.70% | ||

| 12:30 | USD | Change in Non-farm Payrolls May | 180K | 263K | ||

| 12:30 | USD | Unemployment Rate May | 3.60% | 3.60% | ||

| 12:30 | USD | Average Hourly Earnings M/M May | 0.30% | 0.20% | ||

| 14:00 | USD | Wholesale Inventories M/M Apr F | 0.70% | 0.70% |