Asian markets generally strengthen today and are given another lift after US politicians finally agreed to a USD 2T coronavirus stimulus deal. Australian Dollar leads other commodity currencies higher. On the other hand, Yen weakens broadly, followed by Yen and then Dollar. Some important economic data will be released today including German Ifo, UK CPI and US durable goods orders. But these data might be shrugged off again by the markets. Main focus remain on the development of coronavirus pandemic, which has led to 18900 deaths globally already.

Technically, we’d maintain then current pull back in Dollar is just a leg inside a consolidation pattern. levels to watch include 1.0981 resistance in EUR/USD, 1.2129 resistance in GBP/USD, 0.9901 support in USD/CHF, and to a lesser extent 1703.28 high in Gold. As long as these levels hold, we’d expect Dollar to make a come back sooner or later. Though, the picture could be complicated by USD/JPY, which is facing 112.22 key resistance. Reactions from there could spread to other Yen pairs, or Dollar pairs, or both.

In Asia, Nikkei closed up 8.04%. Hong Kong HSI is up 2.78%. China Shanghai SSE is up 2.11%. Singapore Strait Times is up 3.25%. Japan 10-year JGB yield is down -0.0023 to -0.037. Overnight, DOW rose 2112.98 pts or 11.37%. S&P 500 rose 9.38%. NASDAQ rose 8.12%. 10-year yield rose 0.052 to 0.816.

Senate reached stimulus deal, DOW in recovery towards 22551

It’s reported that Senate Democrats and Republicans have finally reached an agreement of the USD 2T economic response package for coronavirus pandemic, after some unexpected jitters. No details were released yet but the package should include assistance to companies, cities and states. There will be checks to most Americans, with loans and aid for small business, unemployment insurance, tax deferrals etc. Senate vote could be held as soon as Wednesday, then followed by House vote.

DOW surged 2112.98 pts, or 11.37% overnight on optimism over the stimulus. After the biggest rise since 1933, DOW is back above 20000 handle at 20704.91. A short term bottom should be in place at 18213.65, on bullish convergence condition in hourly MACD. Stronger recovery could be seen to 38.2% retracement of 29568.57 to 18213.65 at 22551.22. Reactions from there would reveal some hints on the eventual depth of the fall from 29568.57.

AmCham China: 22% US companies resumed normal operations in China

The American Chamber of Commerce in China (“AmCham China”) released a coronavirus impact survey, taken between March 14 and 18 on 199 US businesses in China. 57% of respondents expect 2020 revenues to decrease if business cannot return to normal before April 30. 60% expect revenue to drop anyway between 10% and 50% or more if business cannot return to normal before August 30.

Chairman Greg Gilligan: “Close to half of the companies said the global spread of the virus would have a moderate-to-strong impact on their China operations. But the views aren’t all grim: nearly a quarter of our companies expect a return to normal business operations by the end of April, while 22% have already resumed normal operations, and 40% report they will maintain previously planned investment levels, up significantly from last month’s survey.”

BoJ opinions: Impact of coronavirus could be significant and not just temporary

In the summary of opinions of BoJ’s March 16 meeting, it’s noted that “global financial and capital markets have been unstable” and “Japan’s economic activity has been week” due to growing uncertainties over coronavirus pandemic. “Downward pressure on Japan’s economy has been increasing due to a constrain on economic activity”. Firms are facing a “sudden deterioration in business conditions” and “the situation has been very serious”.

It’s also warned that the impact of the pandemic can be “significant and not just temporary”. And there is concern that the economy could “remain weak even after overseas economies recover”. There are “doubts regarding the scenario that the economy will strongly recover after the crisis caused by COVID-19 recedes.”

Regarding policy responses, “it is essential to maintain a strong cooperative framework between the Bank and the government as well as among major central banks, while closely sharing information.”

On the data front

New Zealand trade balance reported NZD 594m surplus in February, above expectation of NZD 550m. Looking ahead, German Ifo business claims is a major focus in European session. US will also release CPI and PPI. Later in the day, focus will turn to US durable goods orders, house price index.

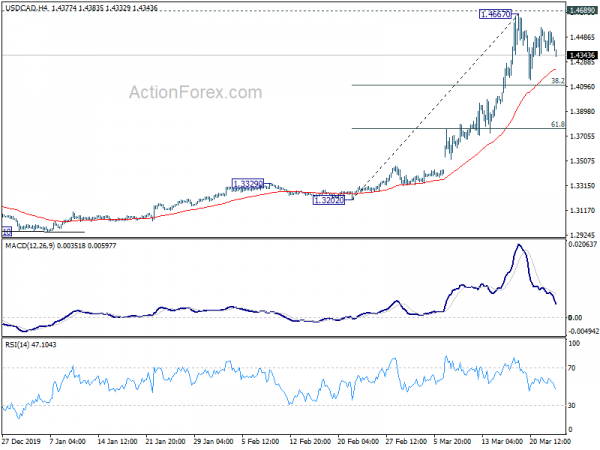

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.4373; (P) 1.4452; (R1) 1.4530; More….

USD/CAD drops mildly today as consolidation from 1.4667 is extending. Deeper pull back could be seen. But downside should be contained well above 61.8% retracement of 1.3202 to 1.4667 at 1.3762 to bring rebound. On the upside, sustained break of 1.4689 will confirm larger up trend resumption.

In the bigger picture, rise from 1.2061 is likely resuming whole up trend from 0.9056 (2007 low). Decisive break of 1.4689 will confirm this bullish case. Next medium term target is 161.8% projection of 1.2061 to 1.3664 from 1.2951 at 1.5545. Rejection form 1.4689 will bring some consolidations first. But outlook will remain bullish as long as 1.3664 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Feb | 594M | 550M | -340M | -414M |

| 9:00 | EUR | Germany IFO Business Climate Mar | 87.7 | 87.7 | ||

| 9:00 | EUR | Germany IFO Current Assessment Mar | 93.7 | 93.8 | ||

| 9:00 | EUR | Germany IFO Expectations Mar | 82 | 82 | ||

| 9:30 | GBP | DCLG House Price Index Y/Y Jan | 2.40% | 2.20% | ||

| 9:30 | GBP | CPI M/M Feb | 0.30% | -0.30% | ||

| 9:30 | GBP | CPI Y/Y Feb | 1.70% | 1.80% | ||

| 9:30 | GBP | Core CPI Y/Y Feb | 1.50% | 1.60% | ||

| 9:30 | GBP | RPI M/M Feb | 0.60% | -0.40% | ||

| 9:30 | GBP | RPI Y/Y Feb | 2.40% | 2.70% | ||

| 9:30 | GBP | PPI Input Y/Y Feb | 3.60% | 2.10% | ||

| 9:30 | GBP | PPI Input M/M Feb | 0.20% | 0.90% | ||

| 9:30 | GBP | PPI Output M/M Feb | 0.00% | 0.30% | ||

| 9:30 | GBP | PPI Output Y/Y Feb | 1.40% | 1.10% | ||

| 9:30 | GBP | PPI Core Output M/M Feb | 0.20% | 0.10% | ||

| 9:30 | GBP | PPI Core Output Y/Y Feb | 0.60% | 0.70% | ||

| 11:00 | GBP | CBI Realized Sales Mar | -15 | 1 | ||

| 12:30 | USD | Durable Goods Orders Feb | -0.90% | -0.20% | ||

| 12:30 | USD | Durable Goods Orders ex Trans Feb | -0.20% | 0.80% | ||

| 13:00 | CHF | SNB Quarterly Bulletin Q1 | ||||

| 13:00 | USD | Housing Price Index M/M Jan | 0.30% | 0.60% | ||

| 14:30 | USD | Crude Oil Inventories | 2.0M |