It seems that the markets are not having a clue on what to do next. While US initial jobless claims doubled to 6.6m, reactions are rather muted. DOW futures are staying positive for now, while European indices are mixed. Dollar seems to be picking up some buying after the release, but gold also trades firmer. Euro’s weakness, together with Swiss Franc, is the clearer development. Yet, downside is so far limited.

Technically, Euro could be a focus before weekend. EUR/GBP is now in proximity to near term fibonacci level at 0.8747. We’re still expecting strong support from there to bring rebound. But decisive break will dampen near term bullishness and turn focus back to 0.8282 key support. EUR/JPY is heading back to 115.86/116.12 support zone and break will resume medium term down trend. EUR/USD’s down side momentum is relatively week, but it’s still on track to deeper fall back towards 1.0635 low. It would be interesting to if the combined actions of EUR/JPY and EUR/USD would push USD/JPY through 106.75 support or 109.70 resistance.

In Europe, currently, FTSE is up 0.31%. DAX is down -0.32%. CAC is up 0.27%. German 10-year yield is up 0.023 to -0.438. Earlier in Asia, Nikkei dropped -1.37%. Hong Kong HSI rose 0.84%. China Shanghai SSE rose 1.69%. Singapore Strait Times rose 0.52%. 10-year JGB yield dropped -0.0181 to -0.011, continued to fluctuate around 0%.

US initial jobless claims doubled to 6.6m, another record high

US initial jobless claims jumped 3341k to 6648k in the week ending March 28, making another historical high. Four-week moving average of initial claims rose 1608k to 2612k.

Continuing claims rose 1.245m to 3.029m in the week ending March 21. That’s the highest level since July 6, 2013. Four-week moving average of continuing claims rose 327k to 2.054m, highest since January 2017.

Also released, US trade deficit narrowed to USD -39.9B in February versus expectation of USD -43.6B. Canada trade deficit narrowed to CAD -1.0B versus expectation of CAD -2.3B.

Eurozone PPI at -0.6% mom, -1.3% yoy in Feb

Eurozone PPI came in at -0.6% mom, -1.3% yoy in February, versus expectation of -0.1% mom, -0.6% yoy. Looking at some details, energy decreased -2.3% mom, intermediate goods dropped -0.2% mom. Capital goods rose 0.1% mom. Durable and non-durable consumer goods rose 0.2% mom.

EU PPI came in at 0.6% mom, -1.0% yoy. The largest decreases in industrial producer prices were recorded in Denmark (-2.2% mom), Spain and Portugal (both -1.3% mom), while the highest increases were observed in Slovakia (2.2% mom), Ireland and Cyprus (both 0.2% mom).

Also released Swiss CPI came in at 0.1% mom, -0.5% in Mach, matched expectations.

EU Gentiloni: Italy losing 3% GDP for each month of lockdown

EU’s Commissioner for Economy Paolo Gentiloni warned that each month of lockdown in Italy would cause a -3% annualized GDP decline. But for now, there is no discussion on an Italian bailout. Confirmed coronavirus cases in Italy surged pass 110k this week while death tolls broke 13k. There is tentative signs of slowing after rigorous measures but no end in sight yet.

Earlier in the week Gentiloni a mentioned the absolute need to have coordinated European actions, which is growing already in the healthcare side and border management. EU members have taken measures of around EUR 270B and the efforts should be strongly coordinated in the new weeks and months. The suspension of fiscal rules is sufficient for a first immediate reaction. But there is a need to finance a general European recovery plan for the months ahead.

Australia NAB business confidence dropped to -11 in Q1

Australia NAB Business Confidence dropped from -2 to -11 in Q1. Current Business Conditions dropped from 6 to -3. Conditions for the next 3 months dropped from 8 to -4. Conditions for the next 12 months dropped from 16 to 7.

Alan Oster, NAB Group Chief Economist: “While the bulk of the survey was collected prior to the introduction of the more significant containment measures, the spread of the coronavirus and international developments has clearly impacted confidence. Business conditions were also weaker – and this was before activity saw a significant disruption”.

“Unsurprisingly, the forward indicators point to ongoing weakness in the business sector. While there was clearly a large amount of uncertainty at the time of the survey, it was clear that looming lockdowns and an escalation in social distancing measures would materially impact economic activity”.

EUR/USD Mid-Day Outlook

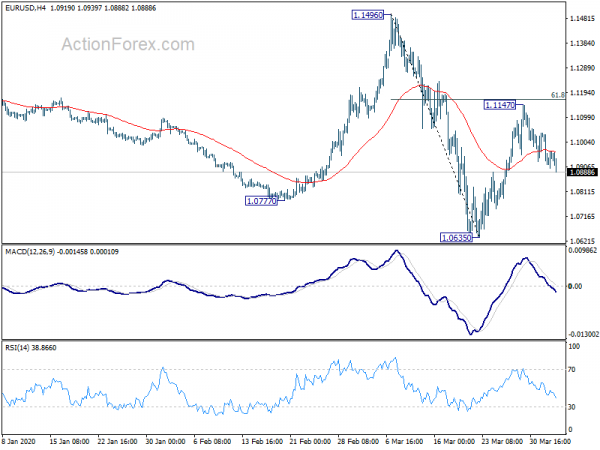

Daily Pivots: (S1) 1.0900; (P) 1.0969; (R1) 1.1036; More…

Intraday bias in EUR/USD remains on the downside at this point. Corrective rebound from 1.0635 could have completed at 1.1147 already. Retest of 1.0635 low should be seen next. On the upside, however, decisive break of 61.8% retracement of 1.1496 to 1.0635 at 1.1167 will raise the chance of larger trend reversal and turn focus to 1.1496 key resistance.

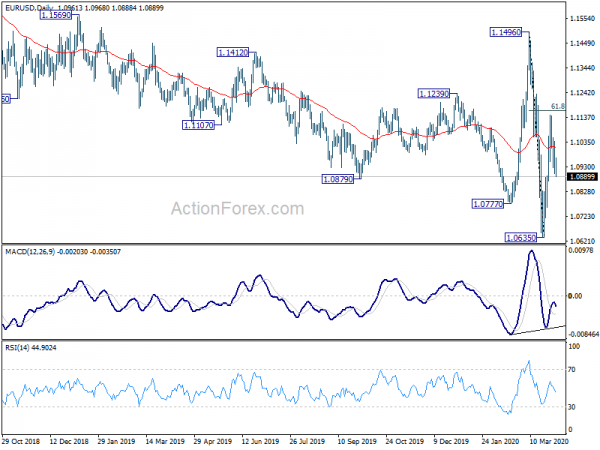

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Mar | 2.80% | 3.70% | 3.60% | |

| 06:30 | CHF | CPI M/M Mar | 0.10% | 0.10% | 0.10% | |

| 06:30 | CHF | CPI Y/Y Mar | -0.50% | -0.50% | -0.10% | |

| 09:00 | EUR | Eurozone PPI M/M Feb | -0.60% | -0.10% | 0.40% | 0.20% |

| 09:00 | EUR | Eurozone PPI Y/Y Feb | -1.30% | -0.60% | -0.50% | -0.70% |

| 11:30 | USD | Challenger Job Cuts Y/Y Mar | 266.90% | -26.30% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 27) | 6648K | 3283K | 3307K | |

| 12:30 | USD | Trade Balance (USD) Feb | -39.9B | -43.6B | -45.3B | -45.5B |

| 12:30 | CAD | International Merchandise Trade (CAD) Feb | -1.0B | -2.3B | -1.5B | -1.7B |

| 14:00 | USD | Factory Orders M/M Feb | -0.70% | -0.50% | ||

| 14:30 | USD | Natural Gas Storage | -31B | -29B |