Intensifying worries over out-of-control coronavirus spread in Europe push European stocks to 5-month low today. US futures also point to sharply lower open as this week’s decline would likely extend. Dollar and Yen jump on risk aversion, followed by Swiss Franc to a slightly smaller extend. Australian Dollar and New Zealand Dollar are the worst performing. Canadian Dollar is not far behind and it’s vulnerable to additional drag by oil price and BoC statement.

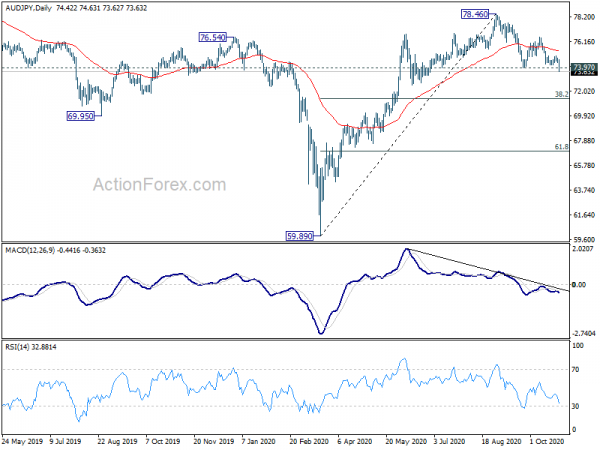

Technically, USD/CAD’s break of 1.3259 resistance confirms short term bottoming at 1.3081. Focus will now be on 1.1688 support in EUR/USD, 1.2910 support in GBP/USD, 0.7020 support in AUD/USD and 0.9165 resistance in USD/CHF. Break of these levels would bring more near term rebound in Dollar. For Yen crosses, GBP/JPY’s break of 135.38 support aligns the outlook with EUR/JPY, indicating that fall from 142.71 is likely ready to resume. AUD/JPY also breaks 73.97 support to resume the corrective fall from 78.46, heading to 38.2% retracement of 59.89 to 78.46 at 71.39.

In Europe, currently, FTSE is down -1.96%. DAX is down -3.67%. CAC is down -3.30%. German 10-year yield is down -0.0251 at -0.637. Earlier in Asia, Nikkei dropped -0.29%. Hong Kong HSI dropped -0.32%. China Shanghai SSE rose 0.46%. Singapore Strait Times dropped -1.17%. Japan 10-year JGB yield dropped -0.0028 to 0.025.

US goods trade deficit narrowed to USD -79.4B, small than expected

US goods exports for September rose USD 3.2B from August to USD 122.0B. Imports of goods dropped USD -0.5B to USD 201.4B. Goods trade deficit narrowed by -4.5% mom to USD -79.4B, smaller than expectation of USD -85.0B. Wholesale inventories dropped -0.1% in September versus expectation of 0.0%.

Released in European session, Germany import price index rose 0.3% mom in September, versus expectation of -0.3% mom. Swiss ZEW expectation dropped sharply to 2.3 in October, down from 26.2.

EU launches new measures as coronavirus situation is very serious

European Commission launches a new set of actions to curb the spread of coronavirus as Europe becomes the epicenter of the outbreak again. The measures range from securing essential supplies, increasing testing capacities, contact tracing, information flows and communications, to easier essential and safe travel.

President of the European Commission, Ursula von der Leyen, said: “The COVID-19 situation is very serious. We must step up our EU response. Today we are launching additional measures in our fight against the virus; from increasing access to fast testing, and preparing vaccination campaigns to facilitating safe travel when necessary. I call on Member States to work closely together. Courageous steps taken now will help save lives and protect livelihoods. No Member State will emerge safely from this pandemic until everyone does.”

DIW: Second wave of coronavirus threatens to stifle German economy upswing

Germany’s DIW institute warned that second wave of coronavirus infections “has arrived” and “threatens to stifle the economy upswing”. After growing around 6% in Q3, further prospects are “gloomy considerably”. DIW economic barometer for Q4 dropped from 122 pts to 105 pts.

“The upswing will very likely be slowed down significantly,” says DIW economic chief Claus Michelsen. “There are again the threat of sharper restrictions on social and economic life – the pandemic is taking consumers and companies away from confidence. And that at a time when many companies are still struggling with the consequences of the lockdown in spring and have hardly any financial reserves”.

Australia CPI rose 1.6% qoq in Q3 as childcare fees returned to pre-pandemic rate

Australia CPI rose 1.6% qoq in Q3, above expectation of 1.5% qoq. But that was insufficient to recover the record -1.9% qoq fall in Q2. Annually, CPI turned positive to 0.7% yoy, matched expectation. RBA trimmed mean CPI came in at 0.4% qoq, 1.2% yoy, above expectation of 0.3% qoq, 1.1% yoy.

Head of Prices Statistics at the ABS Andrew Tomadini said: “In the September quarter child care fees returned to their pre-COVID-19 rate having been free during the June quarter. This was the largest contributor to the CPI rise in the September quarter. Excluding the impact of child care, the CPI would have risen 0.7 per cent.”

Tomadini said: “Annual inflation returned to positive territory rising 0.7 per cent in the September quarter. This followed negative annual inflation for only the third time in the 72-year history of the CPI of 0.3 per cent in the June quarter.”

USD/CAD Mid-Day Outlook

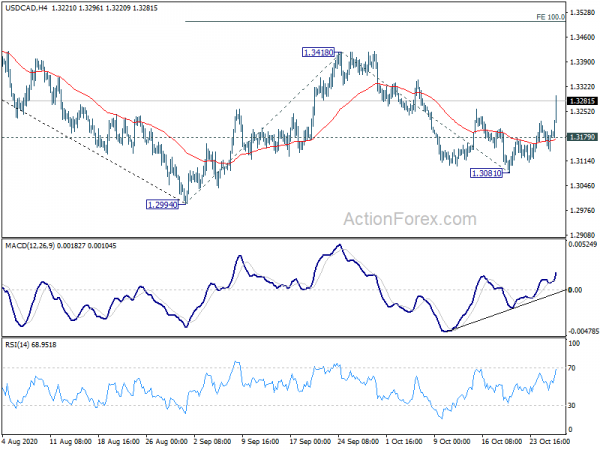

Daily Pivots: (S1) 1.3149; (P) 1.3180; (R1) 1.3218; More….

USD/CAD’s strong break of 1.3259 resistance suggests that choppy fall from 1.3418 has completed at 1.3081. More importantly, corrective rebound from 1.2994 is still in progress, and starting the third leg. Intraday bias is back on the upside for retesting 1.3418 resistance first. Break will confirm this case and target 100% projection of 1.2994 to 1.3418 from 1.3081 at 1.3505. On the downside, break of 1.3179 minor support will mix up the near term outlook again, and turn intraday bias neutral first.

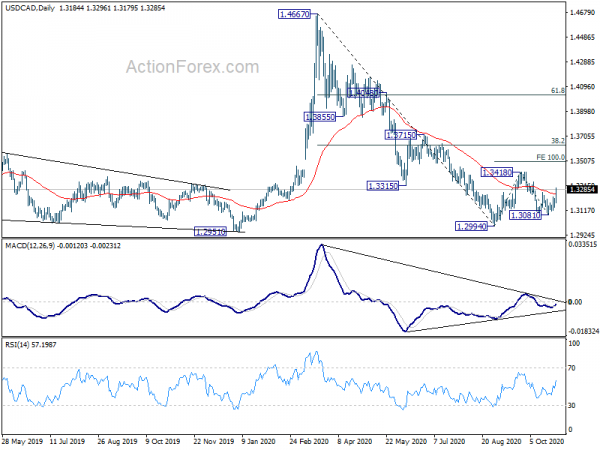

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Sustained break of 61.8% retracement of 1.2061 to 1.4667 at 1.3056 will target a test on 1.2061 (2017 low). But we’d expect loss of downside momentum as it approaches this key support. On the upside, firm break of 1.3715 resistance will argue that this falling leg has completed and turn focus back to 1.4667/89 resistance zone.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | CPI Q/Q Q3 | 1.60% | 1.50% | -1.90% | |

| 00:30 | AUD | CPI Y/Y Q3 | 0.70% | 0.70% | -0.30% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q3 | 0.40% | 0.30% | -0.10% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q3 | 1.20% | 1.10% | 1.20% | |

| 07:00 | EUR | Germany Import Price Index M/M Sep | 0.30% | -0.30% | 0.10% | |

| 09:00 | CHF | ZEW Expectations Oct | 2.3 | 26.2 | ||

| 12:30 | USD | Goods Trade Balance (USD) Sep | -79.4B | -85.0B | -82.9B | -83.1B |

| 12:30 | USD | Wholesale Inventories Sep P | -0.10% | 0.00% | 0.40% | |

| 14:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 14:30 | USD | Crude Oil Inventories | 1.5M | -1.0M |