Dollar weakens again in rather quiet markets today. But there is no committed selling so far, as the greenback is staying inside yesterday’s range. European majors also soften, on lockdown concerns, and shrug of solid German economic data. Commodity currencies are stronger in general, even though risk markets are rather sluggish. US futures are pointing to a slightly lower open, and could extend yesterday’s pull back.

Technically, there is no clear development yet. We’re still watching if EUR/JPY and GBP/JPY would break through 125.92 and 139.44 support to bring deeper near term decline. USD/CHF and USD/JPY are staying in near term decline but momentum is unconvincing. EUR/USD and AUD/USD are also appearing to be topping in near term, yet there is no notable pull back yet. Gold’s picture is relatively much clearer as it’s on track to 1965.50 resistance.

In Europe, FTSE is currently down -0.13%. DAX is down -0.75%. CAC is down -0.83%. German 10-year yield is up 0.0151 at -0.590. Earlier in Asia, Nikkei dropped -0.37%. Hong Kong HSI rose 0.64%. China Shanghai SSE rose 0.73%. Singapore Strait Times rose 0.03%. Japan 10-year JGB yield dropped -0.0076 to 0.015.

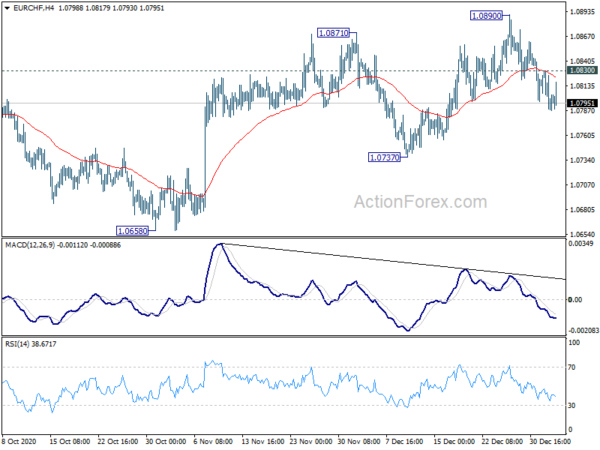

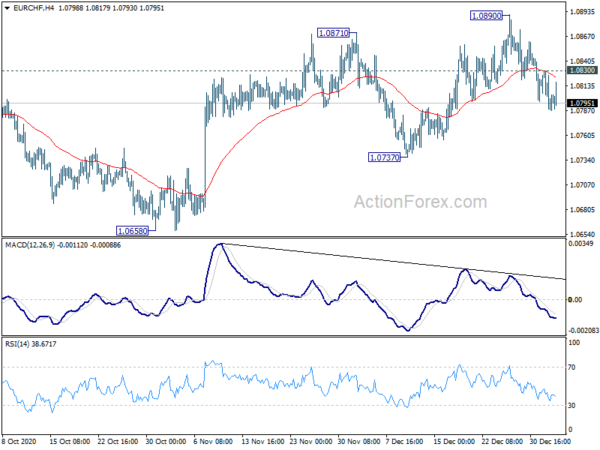

EUR/CHF to gyrate lower despite positive German data

Economic data from Germany are generally positive. Retail sales rose 1.9% mom in November, versus expectation of -2.2% mom contraction. Destatis added that retail turnover in 202 is expected to be between 3.9% and 4.3% higher than in 2019.

Unemployment dropped -37k in December, versus expectation of 10k. Unemployment rate was unchanged at 6.1%, versus expectation of 6.2%.

Euro has little reactions to the data. EUR/CHF’s choppy decline from 1.0890 is still in progress for 1.0737 support. Break will suggest completion of whole rise from 1.0658 and bring deeper fall back to this support. This will remain the favor case for now, as long as 1.0830 minor resistance holds.

Swiss CPI dropped to -0.8% yoy in Dec, on holiday packages, petroleum and air transport

Swiss CPI dropped -0.1% mom in December, below expectation of 0.0% mom. The monthly decrease can be explained by several factors including falling prices for international package holidays. Medicines also recorded a price decrease, as did fruiting vegetables. In contrast, prices for heating oil and air transport increased.

Annually, CPI dropped further to -0.8% yoy, below expectation of -0.7% yoy. This decrease is due in particular to lower prices for international package holidays, petroleum products and for air transport. In contrast, prices for housing rentals and new cars increased. Prices for domestic products remained stable on average, those for imported products decreased by 2.9%.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 102.80; (P) 103.06; (R1) 103.41; More..

Despite diminishing downside momentum, intraday bias in USD/JPY remains on the downside. Current down trend from 111.17 is in progress for retesting 101.18 low. On the upside, break of 103.89 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Dec | 18.30% | 16.50% | ||

| 7:00 | EUR | Germany Retail Sales M/M Nov | 1.90% | -2.20% | 2.60% | |

| 7:30 | CHF | CPI M/M Dec | -0.10% | 0.00% | -0.20% | |

| 7:30 | CHF | CPI Y/Y Dec | -0.80% | -0.70% | -0.70% | |

| 8:55 | EUR | Germany Unemployment Change Dec | -37K | 10K | -39K | |

| 8:55 | EUR | Germany Unemployment Rate Dec | 6.10% | 6.20% | 6.10% | |

| 9:00 | EUR | Eurozone M3 Money Supply Y/Y Nov | 11.00% | 10.70% | 10.50% | |

| 13:30 | CAD | Industrial Product Price M/M Nov | -0.40% | |||

| 13:30 | CAD | Raw Material Price Index Nov | 0.50% | |||

| 15:00 | USD | ISM Manufacturing PMI Dec | 56.5 | 57.5 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Dec | 62.1 | 65.4 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Dec | 48.4 |