Trading in the financial markets is rather subdued today. Swiss Franc is the stronger one at the time of writing, followed by Dollar and Sterling. Commodity currencies, on the other hand, turn softer with Australian Dollar leading the retreat. But overall movements in the markets are limited. Gold and crude oil are also struggling in tight range.

Technically, the weak recovery in Dollar doesn’t warrant short term bottoming yet. The levels to watch include 1.1992 minor support in EUR/USD, 0.7676 minor support in AUD/USD, 0.9194 minor resistance in USD/CHF and 108.53 minor resistance in USD/JPY. As long as these levels holds, selloff in Dollar should resume sooner rather than later.

In Europe, at the time of writing, FTSE is down -0.23%. DAX is down -0.24%. CAC is down -0.12%. Germany 10-year yield is down -0.0077 at -0.258. Earlier in Asia, Nikkei dropped -0.46%. Hong Kong HSI dropped -0.04%. China Shanghai SSE rose 0.04%. Singapore Strait Times rose 0.30%. Japan 10-year JGB yield rose 0.0102 to 0.085.

Germany upgrades 2021 GDP forecasts to 3.5% despite current serious infection situation

German government upgraded 2021 GDP growth forecasts to 3.5%, up from prior projection of 3.0%. GDP growth is expected to remain strong at 3.6% in 2022. On the whole, the economy would reach its pre-pandemic level next year at the latest.

Economy Minister Peter Altmaier said “today’s spring projection is an encouragement despite the currently serious infection situation.” He added that most pandemic restrictions should be lifted in the course of summer.

BoE announces liquidity with BIS to ease any potential future strains

BoE announced to enter into a liquidity facility with the Bank for International Settlements to “ensure the provision of Sterling liquidity during any future periods of market stress”.

“Together with the swap lines the BoE has with a number of central banks, this new facility will provide a further liquidity backstop in Sterling to help ease any potential future strains in funding markets,” BoE said.

BoJ stands pat, continue to closely monitor impacts of pandemic

BoJ kept monetary policy unchanged today as widely expected. Under the yield curve control framework, short-term policy interest rate is held at -0.1%. 10-year JGB yield target is kept at around 0%. The central bank will continue to purchase ETFs and J-REITS with upper limits of about JPY 12T and JPY 180B respectively. CP and Corporate bonds purchases will continue with upper limit of JPY 20Y until the end of September 2021.

BoJ also pledged to continue with QQE with Yield Curve Control “as long as it is necessary” and “continue expanding the monetary base” until core CPI exceeds 2% target in a “stable manner”. It will also “closely monitor” of the impact of COVID-19 and “will not hesitate to take additional easing measures if necessary”.

BoJ upgrades GDP forecasts on strong domestic and external demand

In the Outlook for Economic Activity and Prices, BoJ said, “the economy is likely to recover” with as impact of COVID-19 wanes gradually. Thereafter, it is projected to “continue growing with a virtuous cycle from income to spending intensifying”.

GDP growth forecasts were revised higher, “on the back of stronger domestic and external demand”. CPI forecast for fiscal 2021 was lowered “due to the effects of reduction in mobile phone charges”. But outlook is “highly unclear”. The assumption that impact of COVID-19 will “almost subside” in the middle of the projection period “entail high uncertainties.

In the new economic projections, Fiscal 2021 GDP forecast was raised slightly to 4.0%, up from January’s 3.9%. Fiscal 2022 GDP forecast was raised to 2.4%, from 1.8%. GDP growth is projected to to slow to 1.3% in fiscal 2023.

CPI forecast was downgraded to 0.1% in 2021, from 0.5%. But for fiscal 2022, CPI forecast was upgraded to 0.8%, from 0.7%. CPI is projected to rise further to 1.0% in fiscal 2023.

Suggested reading on BoJ: BOJ Downgrades Inflation Forecasts Significantly as It Struggles with Limited Tools

USD/CHF Mid-Day Outlook

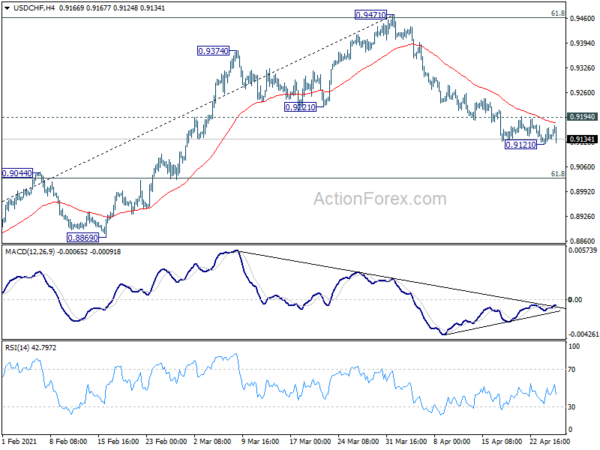

Daily Pivots: (S1) 0.9119; (P) 0.9142; (R1) 0.9163; More….

USD/CHF dips mildly today but stays above 0.9121 temporary low. Intraday bias remains neutral first and deeper decline is expected with 0.9194 minor resistance holds. Below 0.9121 will resume the fall from 0.471 for 61.8% retracement of 0.8756 to 0.9471 at 0.9029 next. On the upside, though, break of 0.9194 resistance will indicate short term bottoming. Intraday bias will be turned back to the upside for rebound.

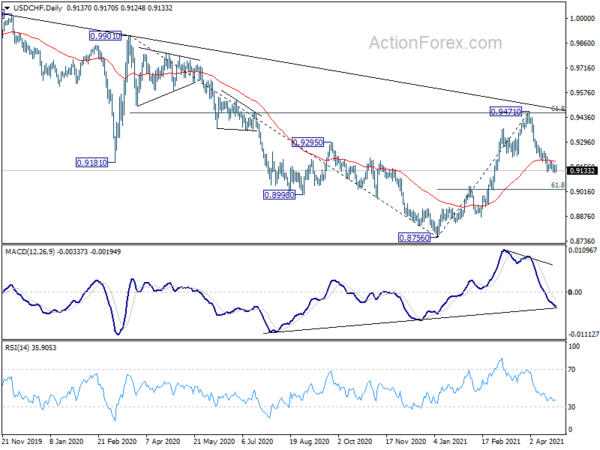

In the bigger picture, rejection by 61.8% retracement of 0.9901 to 0.8756 at 0.9464 argues that rebound from 0.8756 was probably just a corrective move. That is, larger down trend from 1.0237 might be still in progress. We’ll monitor the downside momentum of the decline from 0.9471, to assess the chance of breakthrough 0.8756 low at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 3:00 | JPY | BoJ Press Conference | ||||

| 13:00 | USD | S&P/CS Composite-20 Home Price Indices Y/Y Feb | 11.80% | 11.10% | ||

| 13:00 | USD | Housing Price Index M/M Feb | 1.00% | 1.00% | ||

| 14:00 | USD | Consumer Confidence Apr | 112 | 109.7 |