Commodity currencies are under broad-based pressure today, as markets are trading in risk-off mode on the spread of Omicron. Canadian Dollar is leading the way lower as WTI oil tumbles below 70. But Euro and Swiss Franc are currently the main beneficiaries, followed by Yen. Dollar and Sterling are mixed.

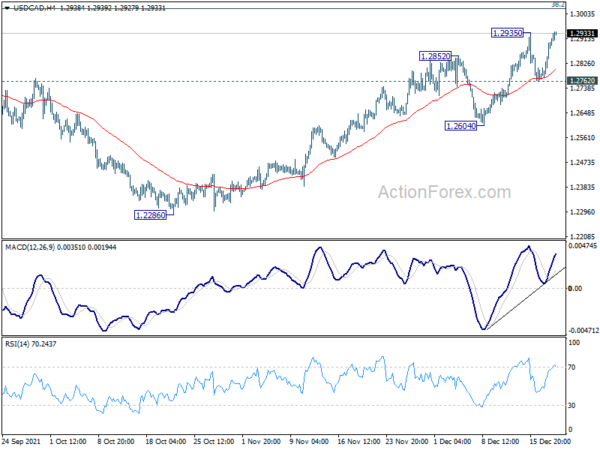

Technically, EUR/CAD’s break of 1.4580 support turned resistance now suggests short term bottoming after 1.4162. Stronger rise would now be seen back towards 1.5096 resistance. At the same time, CAD/JPY is pressing 9768 support and break will resume whole decline from 93.00. USD/CAD’s rise from 1.2286 is also resuming by breaking 1.2935 resistance. We’ll see if Canadian Dollar’s selloff would pick up momentum again.

In Europe, at the time of writing, FTSE is down -1.04%. DAX is down -1.93%. CAC is down -1.11%. Germany 10-year yield is up 0.0222 at -0.356. Earlier in Asia, Nikkei dropped -2.13%. Hong Kong HSI dropped -1.93%. China Shanghai SSE dropped -1.07%. Singapore Strait Times dropped -1.24%. Japan 10-year JGB yield dropped -0.0114 to 0.039.

WTI oil dips below 70 as Omicron spreads quickly

Oil prices dip today on concern that the rapid spread of Omicron would push more countries back into restrictions, and hurt demand at least in the near future. That’s also in-line with overall risk-off sentiment in the markets.

WTI’s recovery from 62.90 was choked off after hitting 73.66 and it’s back below 69. For now, unless there will be any disastrous development, we’re seeing price actions from 85.92 high as development into a sideway consolidation pattern, in form a a three-wave flat, or a five-wave triangle. The range should be set inside 61.90/85.92.

In other words, we’re not expecting a break of 61.90 support even in case of further selloff. Break of 73.66 resistance will extend the rebound from 62.90. And even in this case, we’re not expecting a break of 85.92 high too.

Joachim Nagel named as new Bundesbank president

German Finance Minister Christian Lindner said said today that he and Federal Chancellor Olaf Scholz proposed Joachim Nagel as the new Bundesbank President. Nagel, a former Bundesbank board member, is expected to take over on January 1 from Jens Weidmann.

Linder said on twitter, “In view of inflation risks, the importance of a stability-oriented monetary policy is growing. He is an experienced personality who ensures the continuity of #Bundesbank”.

“Nagel can be trusted to continue the German Bundesbank tradition in the debates in the ECB,” Friedrich Heinemann, an expert at the ZEW economic research institute hailed. “He has extensive monetary policy and financial expertise, which is essential for today’s complex monetary policy decisions.”

BoJ Kuroda: Too early to consider normalizing policy

BoJ Governor Haruhiko Kuroda said today, “there’s quite a distance from the 2% inflation target. It is still too early now to consider normalizing policy.” “Unlike the Western countries, inflation is extremely low and inflation expectations remain very low,” he added. “We’re in a phase to patiently continue large-scale monetary easing.”

BoJ’s balance sheet has grown the equivalent of 135% of GDO . But Kuroda said “I don’t think expansion of the BoJ’s assets will affect our ability to keep monetary policy and financial system stable.” Though, he added it’s important for the government market confidence on the country’s fiscal health in the medium- to long-term.

New Zealand goods exports rose 13% yoy in Nov, imports rose 37% yoy

New Zealand goods exports rose 13% yoy to NZD 5.9B in November. Goods imports rose 37% yoy to NZD 6.7B. Monthly trade balance was a deficit of NZD -864m, versus expectation of NZD -1867m.

China led rises in monthly exports across all top destinations, up 13% yoy. Exports to Australia were up 21% yoy, to USA up 5.5% yoy, to EU up 8.6% yoy, to Japan up 38% yoy.

Imports from all tot partners were also up, with China up 45% yoy, EU up 38% yoy, Australia up 28%, USA up 43%, Japan up 7.9% yoy.

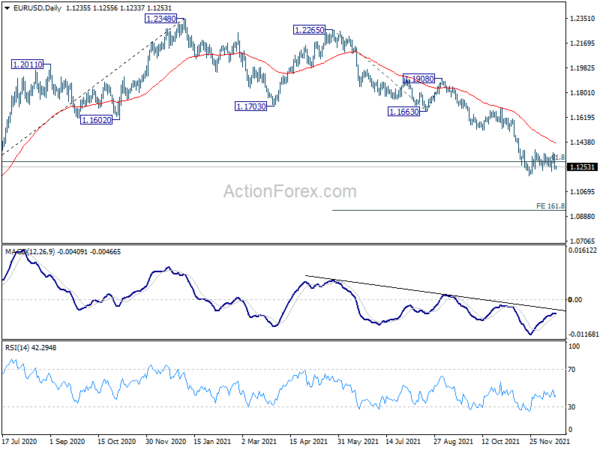

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2812; (P) 1.2857; (R1) 1.2941; More…

USD/CAD’s breach of 1.2935 suggests resumption of 1.2286. Intraday bias is back on the upside for 1.2947 resistance, and then 1.3022 key medium term fibonacci level. Sustained break of 1.3022 will carry larger bullish implications. On the downside, break of 1.2762 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, focus will be on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. On the downside, however, break of 1.2286 will turn focus back to 1.2005 low again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -864M | -1867M | -1286M | -1302M |

| 9:00 | EUR | Eurozone Current Account (EUR) | 18.1B | 20.3B | 18.7B | 17.6B |

| 11:00 | GBP | CBI Industrial Order Expectations | 24 | 20 | 26 |