The forex markets are mixed in rather quiet trading today. Swiss Franc apparently stronger but there isn’t much follow through buying yet. Euro could be turning weaker again but it has to dip more to confirm downside momentum. Other major pairs and crosses are still stuck inside Friday’s range. Global benchmark treasury yields are on the rise again but there is much movement in Yen.

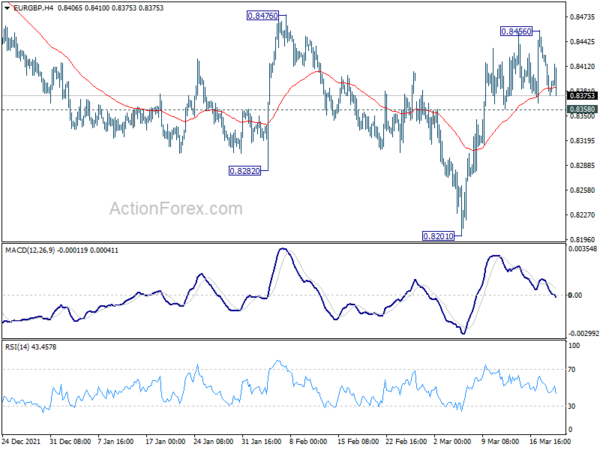

Technically, attentions stays in some Euro crosses including 0.8358 minor support in EUR/GBP. Break there will suggest completion of rebound from 0.8201, and bring deeper fall back to retest this low. The question is, if that happens, whether EUR/USD would be dragged through 1.0899 minor support, or, GBP/USD would be pushed through 1.3210 minor resistance. Let’s see.

In Europe, at the time of writing, FTSE is up 0.44%. DAX is down -0.01%. CAC is down -0.14%. Germany 10-year yield is up 0.0718 at 0.443. Earlier in Asia, Hong Kong HSI dropped -0.89%. China Shanghai SSE rose 0.08%. Singapore Strait Times rose 0.75%. Japan was on holiday.

Fed Bostic penciled in only six hikes this year

Atlanta Fed President Raphael Bostic said, “I penciled in six rate hikes for 2022 and two more for 2023,”

“I recognize that I am toward the bottom of the distribution relative to my colleagues, but the elevated levels of uncertainty are front forward in my mind and have tempered my confidence that an extremely aggressive rate path is appropriate today,” he added.

“The risks go both ways,” Bostic said. “Should demand falter in the face of economic uncertainty or removal of monetary policy accommodation, then the appropriate path may be shallower than I currently project. But there are other developments, such as shifts in supply strategies, that could mean higher costs and thus motivate a steeper policy path than I expect.”

ECB Lagarde: Even in the bleakest scenario, there is no stagflation

ECB President Christine Lagarde said that Russia invasion of Ukraine will have “consequences” for growth. However, “even in the bleakest scenario, with second-round effects, with a boycott of gas and petrol and a worsening of the war that goes on for a long time — even in those scenarios we have 2.3% growth.” Hence, “we are not seeing elements of stagflation now,” she said.

Lagarde also reiterated that the US and Eurozone are in “difference universes”, at a “different stage” in the economic cycle, with “different starting points”. “We in the euro area are at negative rates, while the U.S. never went below zero.”

ECB de Guindos: No stagflation but inflation to remain higher for longer

In an interview with Handelsblatt, ECB Vice President Luis de Guindos said Eurozone is not heading towards stagflatoin. “In the most recent projections, even in our most adverse scenario for the current year, we still foresee growth of more than 2%, so no stagflation,” he said. “Inflation, however, is likely to remain higher for a longer period than expected before the war.”

De Guindos also said what matters for the central bank now is the extent to which wages respond. “If wage increases are too high, they can push prices up even more and contribute to persistently higher inflation.” But he added, “We have not seen any signs of that yet”.

He added last week’s statement “delink the potential interest rate hikes from the asset purchase programme”. The timing of rate hike “all depends on the data”. “The price shock in energy and commodities that we’re currently experiencing is making many firms and workers worse off. Fiscal policy should provide temporary, targeted support to help reduce the burden. This would also reduce the danger of a wage-price spiral,” he said.

Bundesbank: Significantly weaker recovery expected in Q2

In the monthly report, Bundesbank said “significantly weaker recovery expected in the second quarter”. The effects of Russia’s attack on Ukraine are “likely to have a noticeable impact on economic activity in Germany from March”. Supply chain problems are likely to “intensify again”, and energy prices have “risen massively”.

“From today’s perspective, the strong recovery planned for the second quarter is likely to be significantly weaker”. Also, the extent of the effects of war is “very uncertain and depends on how events unfold”.

Germany PPI up 1.4% mom, 25.9% yoy in Feb, Russia invasion impact not yet included

Germany PPI rose 1.4% mom, 25.9% yoy in February, below expectation of 1.7% mom, 26.1% yoy, comparing to January’s 2.2% mom, 25.0% yoy.

Destatis said, “the recent price development in the context of Russia’s attack on Ukraine are not yet included in the results… Mainly responsible for the increase of producer prices compared to February 2021 still was the price increase of energy.”

Energy prices as a whole rose 68.0% yoy. Price of intermediate goods rose 21.0% yoy. Prices of non-durable consumer goods rose 7.4% yoy. Prices of durable consumer goods rose 6.7% yoy. Capital goods prices rose 5.5% yoy.

New Zealand goods export rose 22% yoy in Feb, imports rose 37% yoy

New Zealand goods exports rose 22% yoy to NZD 5.5B in February. Goods imports rose 37% yoy to NZD 5.9B. Trade deficit came in at NZD -385m, smaller than expectation of NZD -808m.

Exports to all top destinations increased, including China (up NZD 80m or 5.4%), Australia (up NZD 119m or 22.0%), US (up NZD 37m or 7.4%), EU (up NZD 62m or 25%), and Japan (up NZD 71m or 34%).

Imports from all top partners also rose, including China (up NZD 490m or 45%), EUR (up NZD 209m or 32%), Australia (up NZD 137m or 26%), US (up NZD 105m or 29%), and Japan (up NZD 167m or 60%).

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3127; (P) 1.3162; (R1) 1.3213; More…

Intraday bias in GBP/USD remains neutral at this point. Some more consolidation could be seen. On the downside, break of 1.2999 will resume larger down trend from 1.4248. However, firm break of 1.3210 should confirm short term bottoming. Stronger rise should be seen back to 55 day EMA (now at 1.3361).

In the bigger picture, current development suggests that the up trend from 1.1409 (2020 low) has completed at 1.4248. Decline from 1.4248 could still be a corrective move, or it could be the start of a long term down trend. In either case, deeper decline would be seen back to 61.8% retracement of 2.1161 to 1.1409 at 1.2493. In any case, break of 1.3748 resistance is needed to indicate medium term bottoming, or outlook will stay bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Feb | -385M | -808M | -1082M | -1126M |

| 14:01 | GBP | Rightmove House Price Index M/M Mar | 1.70% | 2.30% | ||

| 02:00 | EUR | Germany PPI M/M Feb | 1.40% | 1.70% | 2.20% | |

| 07:00 | EUR | Germany PPI Y/Y Feb | 25.90% | 26.10% | 25.00% |