Markets sentiment stabilized a bit in Asia, following the recovery in US stocks overnight. Commodity currencies are paring some losses while Dollar and Yen are retreating. But so far, the Japanese currency is still the strongest one for the week, backed by overall risk-off sentiment, while Dollar is also firm, except versus Loonie. Euro is currently the worst performing one, followed by Sterling. With the downside breakout in EUR/USD, there’s likely more selloff in Euro ahead.

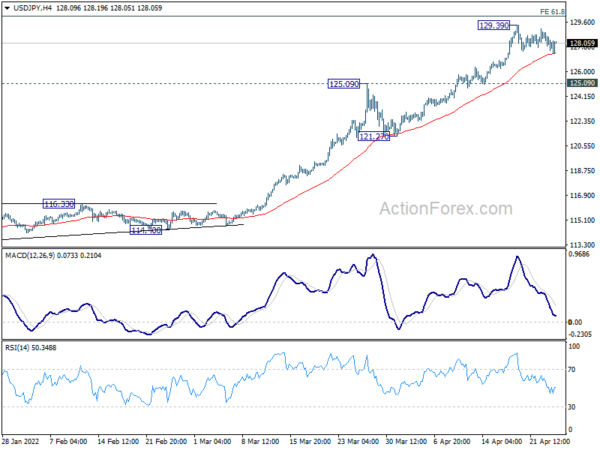

Technically, while the pull back in some Yen crosses was deep, USD/JPY is just engaging in very shallow retreat. There is prospect of rally resumption soon, if the pair could draw enough support from 4 hour 55 EMA. Yet the main hurdle is in the long term projection level at 61.8% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 130.04. 130 is also a level that’s rumored to trigger currency intervention. So, let’s see.

In Asia, at the time of writing, Nikkei is up 0.61%. Hong Kong HSI is up 1.77%. China Shanghai SSE is up 0.69%. Singapore Strait Times is down -0.18%. Japan 10-year JGB yield is up 0.0005 at 0.251. Overnight DOW rose 0.70%. S&P 500 rose 0.57%. NASDAQ rose 1.29%. 10-year yield dropped -0.08 to 2.826.

IMF slashes Asia Pacific growth forecast to 4.9%, warns of stagflationary outlook

IMF lowered growth forecast for Asia Pacific by -0.5% to 4.9% in 2022. Inflation forecast, on the other hand, was raised by 1% to 3.4%. Anne-Marie Gulde-Wolf, acting director of the IMF’s Asia and Pacific Department, warned, “the region faces a stagflationary outlook, with growth being lower than previously expected, and inflation being higher.”

In a blog post, she also warned of three main headwinds to the outlook. An escalation of the war in Ukraine would further increase food and energy prices. A tightening of US monetary policy that is materially faster or larger than currently expected by markets—or both—would have large spillovers to Asia. Also, a greater slowdown in China’s economy due to broader virus lockdowns or other risk factors such as the continued weakness in the real estate sector, would also have large implications for the region

“More broadly, a potential fragmentation of supply chains and added geopolitical tensions will remain risks for the longer term for a region that has flourished in recent decades from rising wealth and other economic gains from globalization,” she added.

Japan unemployment rate dropped to 2.6% in Mar, lowest in 2 years

Japan unemployment rate dropped from 2.7% to 2.6% in March, better than expectation of 2.7%. That;s also the lowest rate since April 2020. Number of workers rose 180k while unemployed dropped -90k. Job-to-applicant ratio rose 0.01 pts to 1.22.

“The drop in unemployment rate indicates signs of recovery” in the labour market, a government official told a media briefing. “But the impact of the pandemic appears to be lingering and requires close attention.”

Looking ahead

Swiss trade balance and UK public sector net borrowing will be released in European session. But focuses will be on US durable goods orders and consumer confidence later in the day.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0668; (P) 1.0741 (R1) 1.0786; More…

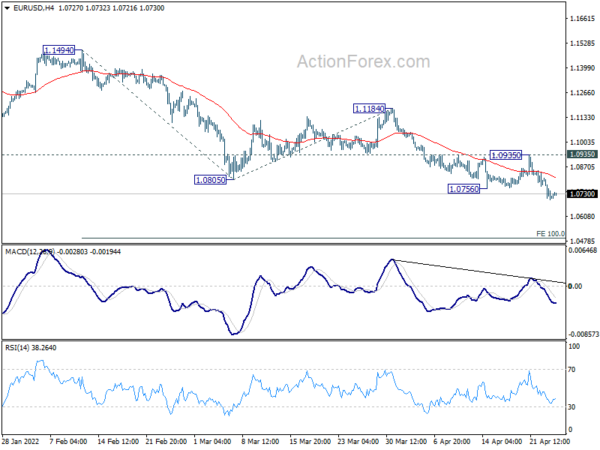

EUR/USD’s decline is still in progress and intraday bias remains on the downside. Current down trend should target 100% projection of 1.1494 to 1.0805 from 1.1184 at 1.0495 next. On the upside, break of 1.0935 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1185 support turned resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1185 will maintain medium term neutral outlook, and extending term range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Mar | 2.60% | 2.70% | 2.70% | |

| 06:00 | CHF | Trade Balance (CHF) Mar | 6.23B | 5.95B | ||

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Mar | 14.2B | 12.3B | ||

| 12:30 | USD | Durable Goods Orders Mar | 1.00% | -2.10% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Mar | 0.50% | -0.60% | ||

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Feb | 18.40% | 19.10% | ||

| 13:00 | USD | Housing Price Index M/M Feb | 1.40% | 1.60% | ||

| 14:00 | USD | Consumer Confidence Apr | 108.5 | 107.2 | ||

| 14:00 | USD | New Home Sales Mar | 774K | 772K |