Dollar’s rally is accelerating as markets enter into US session. Swiss Franc and Canadian are following the greenback. But Australian Dollar is the worst, together with New Zealand Dollar. But Yen is also weak, with little help from risk off sentiment. Euro is mixed even though a market inflation gauge, the five-year, five-year forward inflation swap, fell below 2% target of ECB for the first time since March.

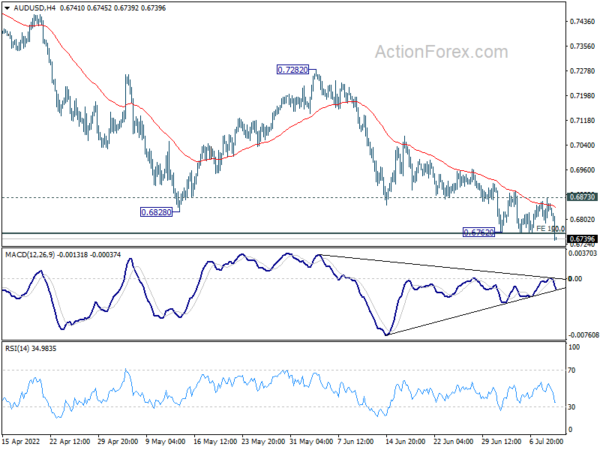

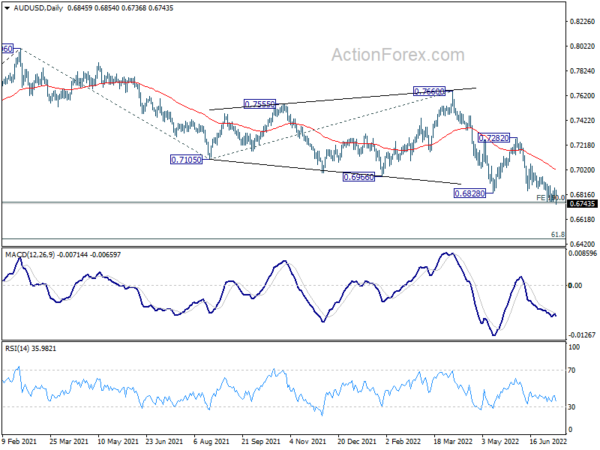

Technically, following upside break out in USD/JPY earlier today, AUD/USD also breaks through 0.6762 low. Attention will now be on other Dollar pairs to confirm buying. Levels to watch include 1.0700 in EUR/USD, 1.1874 in GBP/USD and 1.3082 in USD/CAD. Break of these levels will confirm underlying momentum in the greenback.

In Europe, at the time of writing, FTSE is down -0.40%. DAX is down -0.98%. CAC is down -0.78%. Germany 10-year yield is down -0.0764 at 1.270. Earlier in Asia, Nikkei rose 1.1%. Hong Kong HSI dropped -2.77%. China Shanghai SSE dropped -1.27%. Singapore Strait Times rose 0.06%. Japan 10-year JGB yield dropped -0.0011 to 0.250.

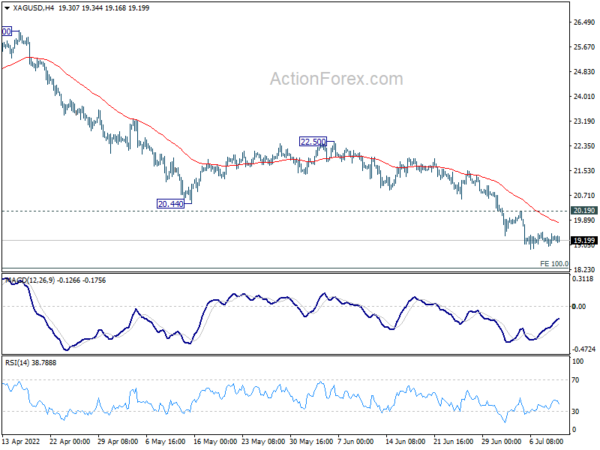

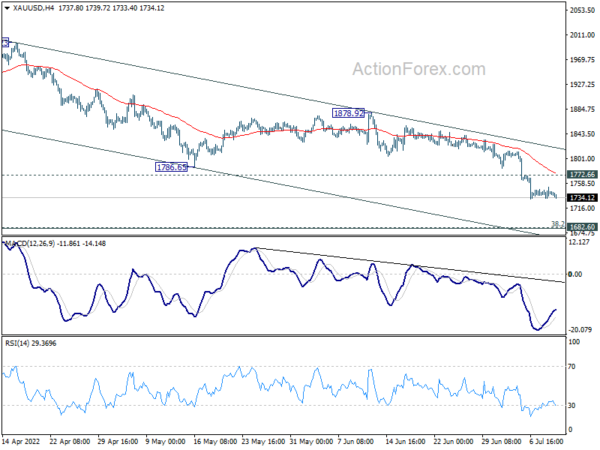

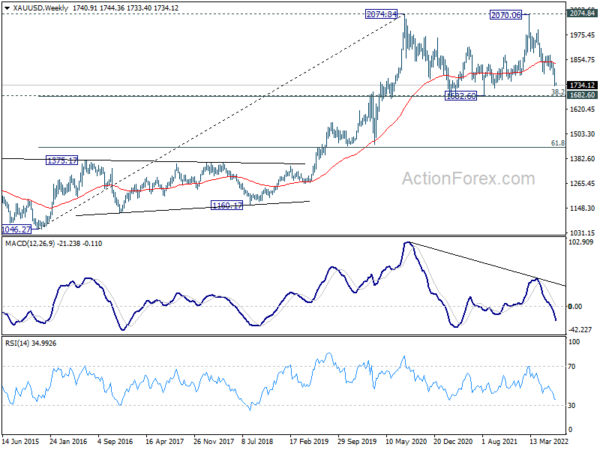

No rebound in Gold and Silver, risks heavily on the downside

Both Gold and Silver turned into sideway trading after steep selloff last week, on the back on stronger Dollar and weak commodity prices in general. There is no sign of a sustainable bounce in both and they’re vulnerable to another selloff soon.

For gold, risk will stay heavily on the downside as long as 1772.66 minor resistance holds. Current decline from 2070.06 is seen as the third leg of the sideway pattern from 2074.84 (2020 high). Further fall is likely towards 1682.60 support, which is close to 38.2% retracement of 1046.27 (2015 low) to 2074.84 at 1681.92. Strong support should be seen there to bring rebound.

Similarly, risk stays heavily on the downside in Silver as long as 20.19 minor resistance holds. Current down trend from 30.07 (2021 high) should target 100% projection of 30.07 to 21.41 from 26.93 at 18.27. Some support could be seen there to bring rebound. But sustained break there will pave the way to 138.2% projection at 14.96.

Similarly, risk stays heavily on the downside in Silver as long as 20.19 minor resistance holds. Current down trend from 30.07 (2021 high) should target 100% projection of 30.07 to 21.41 from 26.93 at 18.27. Some support could be seen there to bring rebound. But sustained break there will pave the way to 138.2% projection at 14.96.

BoJ Kuroda: We won’t hesitate to take additional monetary easing steps as necessary

BoJ Governor Haruhiko Kuroda warned of the “very high uncertainty” on economic outlook due to surging commodity prices. While the economy is showing some signs of weakness, overall it’s still picking up as a trend.

“We won’t hesitate to take additional monetary easing steps as necessary,” he added, repeating that short- and long-term interest rate targets to “move at current or lower levels.”

Released from Japan, M2 rose 3.3% yoy in June versus expectation of 3.4% yoy. Machine orders dropped -5.6% mom in May, versus expectation of -5.5% mom.

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6809; (P) 0.6842; (R1) 0.6891; More…

AUD/USD’s down trend resumes by breaking through 0.6762 temporary low and intraday bias is back on the downside. Sustained trading below 0.6756/60 will carry larger bearish implication. Next target will be 0.6461 fibonacci level. On the upside, though, break of 0.6873 resistance will indicate short term bottoming, and turn bias back to the upside for stronger rebound.

In the bigger picture, price actions from 0.8006 could still be a corrective pattern to rise from 0.5506 (2020 low). But current downside acceleration is raising the chance that it’s a bearish impulsive move. Sustained trading below 0.6756/60 ( 50% retracement of 0.5506 to 0.8006 at 0.6756, 100% projection of 0.8006 to 0.7105 from 0.7660 at 0.6760), will pave the way to 61.8% retracement at 0.6461). For now, outlook will remain bearish as long as 0.7282 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jun | 3.30% | 3.40% | 3.20% | 3.10% |

| 23:50 | JPY | Machinery Orders M/M May | -5.60% | -5.50% | 10.80% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Jun P | 17.10% | 23.70% | ||

| 08:00 | EUR | Italy Retail Sales M/M May | 1.90% | 0.70% | 0.00% |