Dollar dips in early US session following lower than expected PCE and core inflation data. But loss is so far limited as traders are holding their bets ahead of Fed Chair Jerome Powell’s speech. Euro, Aussie and Swiss Franc are so far the stronger ones for the day, while Yen and Kiwi are the weaker ones. Trading in the stock markets is subdued with major European indexes, and US futures flat.

Technically, to confirm selloff in Dollar, some levels need to be violated decisively, at least. The levels include 1.0121 resistance in EUR/USD, 1.2002 resistance in GBP/USD, 0.9951 support in USD/CHF and 1.2826 support in USD/CAD. Otherwise, any dip in Dollar as reactions to Powell would be considered temporary first.

In Europe, at the time of writing, FTSE is up 0.18%. DAX is down -0.04%. CAC is down -0.09%. Germany 10-year yield is up 0.0382 at 1.357. Earlier in Asia, Nikkei rose 0.57%. Hong Kong HSI rose 1.01%. China Shanghai SSE dropped -0.31% Singapore Strait Times rose 0.05%. Japan 10-year JGB yield dropped -0.0094 to 0.221.

US PCE price index slowed to 6.3% yoy, PCE core slowed to 4.6% yoy

US personal income rose 0.2% mom, or USD 47.0B in July, below expectation of 0.6% mom. Spending rose 0.1% mom or USD 23.7B, also below expectation of 0.4% mom.

From the preceding month, PCE price index dropped -0.1% mom. prices for goods dropped -0.4% mom while prices for services rose 0.1% mom. Food prices rose 1.3% mom. Energy prices decreased -4.8% mom. PCE core, excluding food and energy, rose 0.1% mom.

Over the year, PCE price index rose 6.3% yoy, slowed from 6.8% yoy. Prices for goods rose 9.5% yoy while prices for services rose 4.6% yoy. Food prices rose 11.9% yoy. Energy prices rose 34.4% yoy. PCE core, excluding food and energy, rose 4.6% yoy, slowed from 4.8% yoy.

Also released, exports of goods dropped USD -0.4% to USD 181.0B in July. Import of goods dropped USD -9.9B to USD 270.0B. Trade deficit came in at USD -89.1B, smaller than June’s USD -98.6B.

Germany Gfk consumer sentiment dropped to -36.5, another record low

Germany Gfk consumer sentiment for September dropped from -30.9 to -36.5, Worse than expectation of -31.5. In August, economic expectations improved from -18.2 to -17.6. Income expectations ticked up from -45.7 to -45.3. Propensity to buy dropped from -14.5 to -15.7. Propensity to save rose 17.6 pts to 3.5.

“The sharp increase in the propensity to save this month means that the consumer sentiment is continuing its steep descent. It has once again hit a new record low,” explains Rolf Bürkl, GfK consumer expert.

“The fear of significantly higher energy costs in the coming months is forcing many households to take precautions and put money aside for future energy bills. This is further dampening the consumer sentiment, as in return there are fewer financial resources available for consumption elsewhere.”

RBNZ Orr: There’ll be least another couple of rate hikes

RBNZ Governor Adrian Orr told Bloomberg TV earlier today, “We know we have to slow the economy. We knew we had to be 3% plus (on interest rates) to begin that slowing journey and now we’re in a much more comfortable position.”

“We think there’ll be least another couple of rate hikes, but then we hope to be in a position where we can be data driven,” he added.

As about the risks of recession, Orr said, “Our core view is no, that we won’t see technical recession. There’s quite a reasonable bounce back in economic activity.”

“Our outlook is for almost flat real consumption so for us to see retail sales come off like that, it’s not a surprise,” Orr said. “It’s a good signal that that monetary policy is biting and we’re doing our work.”

“Consumers will be taking a significant part of the brunt of the slowdown because, we’re an open trading economy. Our monetary policy mostly bites on domestic spending.” But, while “slower growth is a necessary position. It doesn’t have to be negative growth.”

EUR/USD Mid-Day Outlook

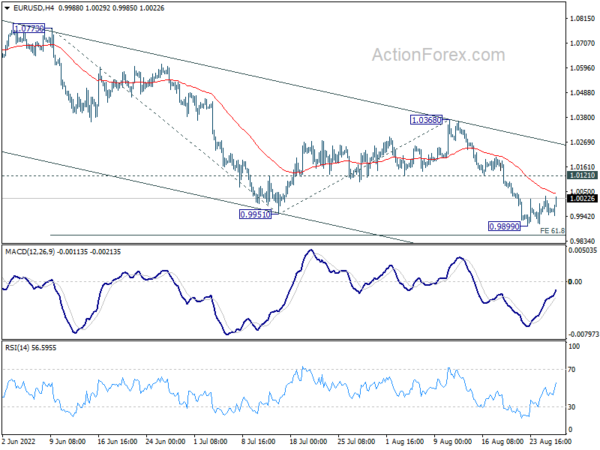

Daily Pivots: (S1) 0.9939; (P) 0.9986; (R1) 1.0024; More…

EUR/USD recovers mildly today but outlook is unchanged. Intraday bias remains neutral first. Consolidation from 0.9899 could extend, but upside of recovery should be limited by 1.0121 minor resistance to bring another fall. Break of 0.9899 will resume larger down trend to 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm break there should prompt downside acceleration to 100% projection at 0.9546. However, firm break of 1.0121 will dampen this view and turn focus to 1.0368 resistance instead.

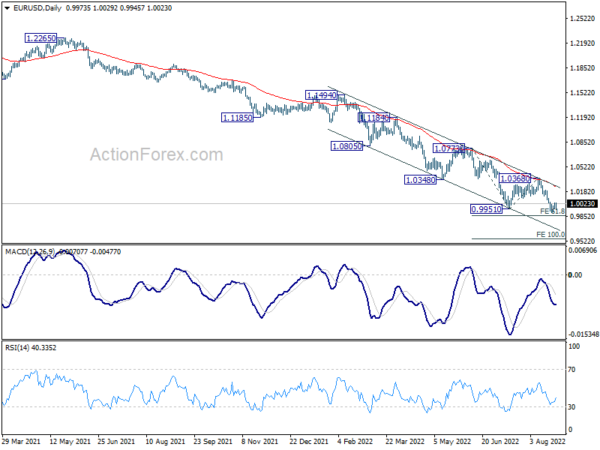

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0368 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Aug | 2.60% | 2.50% | 2.30% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Sep | -36.5 | -31.5 | -30.6 | -30.9 |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jul | 5.50% | 5.60% | 5.70% | |

| 12:30 | USD | Personal Income M/M Jul | 0.20% | 0.60% | 0.60% | 0.70% |

| 12:30 | USD | Personal Spending M/M Jul | 0.10% | 0.40% | 1.10% | 1.00% |

| 12:30 | USD | PCE Price Index M/M Jul | -0.10% | 1.00% | ||

| 12:30 | USD | PCE Price Index Y/Y Jul | 6.30% | 6.80% | ||

| 12:30 | USD | Core PCE Price Index M/M Jul | 0.10% | 0.30% | 0.60% | |

| 12:30 | USD | Core PCE Price Index Y/Y Jul | 4.60% | 4.70% | 4.80% | |

| 12:30 | USD | Goods Trade Balance (USD) Jul P | -89.1B | -99.0B | -98.6B | |

| 12:30 | USD | Wholesale Inventories Jul P | 0.80% | 1.50% | 1.80% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Aug F | 55.2 | 55.1 |