Dollar is back in control in Asian session, with some help from risk averse sentiment. Euro is staying firm against Sterling and Swiss Franc, and is picking up upside momentum against commodity currencies. In particular, Aussie is sold off on poor manufacturing data from both Australia and China. Yen is also weak along with renewed rally in benchmark treasury yields.

Technically, US 10-year yield will be a focus today as could be trying to break away from 3.101 resistance decisively. In that case, a near term rally extension would be set up towards 3.483 high. Such development could push Yen pairs higher. In particular, USD/JPY could follow and break through 139.37 resistance in sustained way to resume larger up trend.

In Asia, at the time of writing, FTSE is down -1.05%. DAX is down -0.97%. CAC is down -1.37%. Japan 10-year JGB yield is up 0.0057 at 0.236. Overnight, DOW dropped -0.88%. S&P 500 dropped -0.78%. NASDAQ dropped -0.56%. 10-year yield rose 0.023 to 3.133.

Australia AiG manufacturing dropped to 49.3, back in contraction

Australia AiG Performance of Manufacturing Index dropped from 52.5 to 49.3 in August, indicating the first contraction since January. Production fell -1.8 pts to 45.7. Employment dropped -2.6 to 47.5. New orders dropped -4.1 to 55.8. Exports dropped -4.3 to 46.9. Sales tumbled -8.8 to 45.2. Input prices rose 2.0 to 81.7. Selling prices rose 4.6 to 69.1. Average wages rose 11.3 to 74.1.

Innes Willox, Chief Executive of Ai Group said: “The Ai Group Australian PMI for August points to the end of the recent expansion of manufacturing activity. Production, employment and sales were all down in August and most manufacturing sectors reported lower performance in the month…. Prices and wages continued to push higher and with the Reserve Bank seeking to ease these pressures by raising interest rates, further slowing in manufacturing looks increasingly likely over the coming months.”

Also released, private capital expenditure dropped -0.3% in Q2, below expectation of 1.1%.

Japan PMI manufacturing finalized at 51.1 in Aug, dip likely to continue near term

Japan PMI Manufacturing was finalized at 51.1 in August, down from July’s 52.1. The health of the sector that was the joint-weakest since February 2021. S&P Global also noted new orders had the sharpest reduction since October 2020. Backlogs of work decreased for the first time in 18 months. Rise in input prices was slowest for 8 months.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said: “Latest PMI data pointed to deteriorating current activity in the Japanese manufacturing sector midway through the third quarter of 2022…. The dip is likely to continue in the near term… A benefit that has come from softer demand conditions is that pressure on supply chains has been given the opportunity to ease.”

Also from Japan, capital spending rose 4.6% in Q2, above expectation of 3.0%.

China Caixin PMI manufacturing dropped to 49.5 in Aug

China Caixin PMI Manufacturing dropped from 50.4 to 49.5 in August, below expectation of 50.2, back in contraction. Caixin added that output growth slowed as firms faced power supply disruption amid heatwave. New orders declined for the first time in three months. Input costs fell at quickest rate since January 2016.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the Covid-19 flare-ups, the extreme heat wave and restricted power usage resulted in a slight deterioration in overall business conditions in the manufacturing sector. Supply remained stronger than demand, with the latter recording a contraction. The job market remained weak, while lower input costs and output prices eased inflationary pressures. At the same time, firms were cautious about increasing purchases and inventory levels. Market sentiment remained optimistic, although some were worried about the global economic outlook.”

Looking ahead

The calendar is rather busy today. Germany retail sales, Swiss CPI and PMI, Eurozone PMI final and unemployment rate, and UK PMI manufacturing final will be released in European session.

Later in the day, US will release jobless claims, non-farm productivity, ISM manufacturing and construction spending. Canada will release building permits and PMI manufacturing.

USD/JPY Daily Outlook

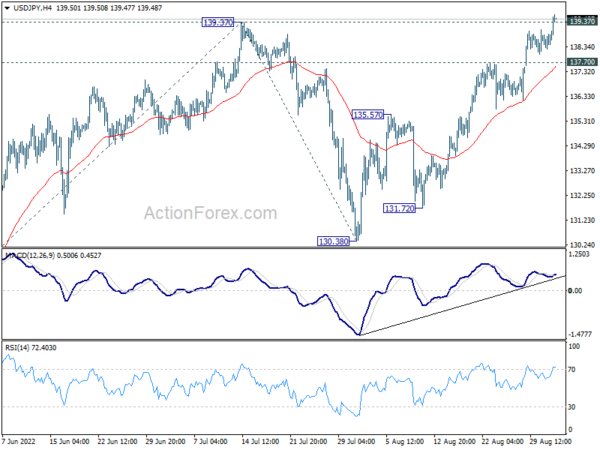

Daily Pivots: (S1) 138.48; (P) 138.75; (R1) 139.22; More…

Intraday bias in USD/JPY is back on the upside as rise from 130.38 resumes and picks up some momentum. Focus is now on 139.37 resistance. Sustained break there will confirm up trend resumption. Next target is 100% projection of 126.35 to 139.37 from 130.38 at 143.40. However, break of 137.70 resistance turned support will suggest rejection from 139.37, and turn bias to the downside to extend the corrective pattern from there with another falling leg.

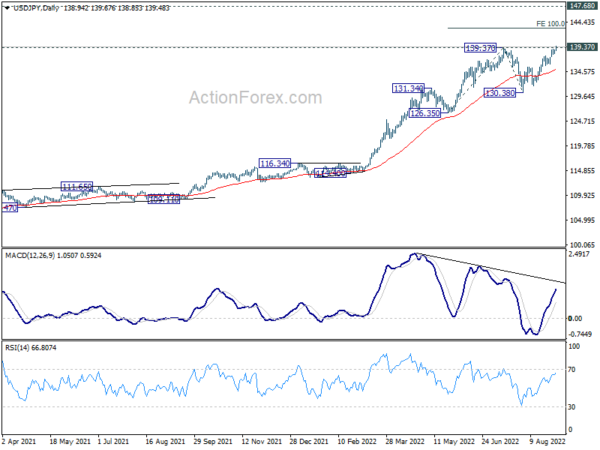

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). Further rise should be seen to 147.68 (1998 high). For now, break of 130.38 support is needed to be the first indicate of medium term topping. Otherwise, outlook will stay bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Mfg Index Aug | 49.3 | 52.5 | ||

| 23:50 | JPY | Capital Spending Q2 | 4.60% | 3.00% | 3.00% | |

| 00:30 | JPY | Manufacturing PMI Aug F | 51.5 | 51 | 51 | |

| 01:30 | AUD | Private Capital Expenditure Q2 | -0.30% | 1.10% | -0.30% | |

| 01:45 | CNY | Caixin Manufacturing PMI Aug | 49.5 | 50.2 | 50.4 | |

| 06:00 | EUR | Germany Retail Sales M/M Jul | -0.40% | -1.60% | ||

| 06:30 | CHF | Real Retail Sales Y/Y Jul | 0.90% | 1.20% | ||

| 06:30 | CHF | CPI M/M Aug | 0.40% | 0.00% | ||

| 06:30 | CHF | CPI Y/Y Aug | 3.50% | 3.40% | ||

| 07:30 | CHF | SVME – PMI Aug | 58 | |||

| 07:45 | EUR | Italy Manufacturing PMI Aug | 48.4 | 48.5 | ||

| 07:50 | EUR | France Manufacturing PMI Aug F | 49 | 49 | ||

| 07:55 | EUR | Germany Manufacturing PMI Aug F | 49.8 | 49.8 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Aug F | 49.7 | 49.7 | ||

| 08:00 | EUR | Italy Unemployment Jul | 8.10% | 8.10% | ||

| 08:30 | GBP | Manufacturing PMI Aug F | 46 | 46 | ||

| 09:00 | EUR | Eurozone Unemployment Rate Jul | 6.60% | 6.60% | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Aug | 25.81K | |||

| 12:30 | USD | Initial Jobless Claims (Aug 26) | 250K | 243K | ||

| 12:30 | USD | Nonfarm Productivity Q2 | -4.60% | -4.60% | ||

| 12:30 | USD | Unit Labor Costs Q2 | 10.60% | 10.80% | ||

| 12:30 | CAD | Building Permits M/M Jul | -1.50% | -1.50% | ||

| 13:30 | CAD | Manufacturing PMI Aug | 52.5 | |||

| 13:45 | USD | Manufacturing PMI Aug F | 51.3 | 51.3 | ||

| 14:00 | USD | ISM Manufacturing PMI Aug | 52.6 | 52.8 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Aug | 59.5 | 60 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Aug | 49.9 | |||

| 14:00 | USD | Construction Spending M/M Jul | -0.10% | -1.10% | ||

| 14:30 | USD | Natural Gas Storage | 58B | 60B |