Dollar’s rally continues in early US session as supported by risk aversion and rising yields. On the other hand, Euro is staying to digest this week’s gain, and broadly. As for today, Canadian Dollar is currently the second strongest, following the greenback. Aussie and Kiwi follow. Sterling and Yen are the next weakest following Euro.

Technically, as Euro is starting to lose momentum in crosses while Dollar is heading higher, it’s probably time for EUR/USD to break to the downside. Outlook is staying bearish with 1.0094 resistance intact in EUR/USD. The key level is 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Decisive break there will confirm that bears are back in control and would setup downside acceleration to 100% projection at 0.9546.

In Europe, at the time of writing, FTSE is down -1.38%. DAX is down -1.10%. CAC is down -1.26%. Germany 10-yaer yield is up 0.037 at 1.579. Earlier in Asia, Nikkei dropped -1.53%. Hong Kong HSI dropped -1.79%. China Shanghai SSE dropped -0.54%. Singapore Strait Times rose 0.07%. Japan 10-year JGB yield rose 0.122 to 0.240.

US initial jobless claims dropped to 232k

US initial jobless claims dropped -5k to 232k in the week ending August 27, below expectation of 250k. Four-week moving average of initial claims dropped -4k to 241.5k.

Continuing claims rose 26k to 1438k in the week ending August 20. Four-week moving average of continuing claims rose 4.5k to 1428.5k.

Eurozone unemployment rate dropped to 6.6% in Jul, EU down to 6.0%

Eurozone unemployment dropped from 6.7 to 6.6% in July, matched expectations. EU unemployment dropped from 6.1% to 6.0%.

Eurostat estimates that 12.959 million men and women in the EU, of whom 10.983 million in the euro area, were unemployed in July 2022. Compared with June 2022, the number of persons unemployed decreased by 113 000 in the EU and by 77 000 in the euro area. Compared with July 2021, unemployment decreased by 1.854 million in the EU and by 1.576 million in the euro area.

Eurozone PMI manufacturing finalized at 49.6 in Aug, downturn likely to intensify potentially markedly

Eurozone PMI Manufacturing was finalized at 49.6 in August, down slightly from July’s 49.8. But that’s still a 26-month low. Readings for the Netherlands at 52.6 (22-month low), Ireland at 51.1 (22-month low), France at 50.6 (2-month high) were in expansion. Readings for Spain at 49.9 (2-month high), Germany at 49.1 (26-month low), Austria at 48.8 (20-month low), Greece at 48.8 (20-month low), Italy at 48.0 (26-month low) were in contraction.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “The euro area’s beleaguered manufacturers reported a further steep drop in production in August, meaning output has now fallen for three successive months to add to the likelihood of GDP falling in the third quarter. Forward-looking indicators suggest that the downturn is likely to intensify – potentially markedly – in coming months, meaning recession risks have risen.

UK PMI manufacturing finalized at 47.3 in Aug, steepest downturn since first lockdown

UK PMI Manufacturing was finalized at 47.3 in August, down sharply from July’s 52.1. That’s also the lowest level in 27 months. S&P Global added that output, new business and new export orders contracted sharply. Still elevated input cost and selling price inflation eased further.

Rob Dobson, Director at S&P Global Market Intelligence, said: “August saw the UK manufacturing sector suffer its steepest downturn since the first COVID-19 lockdown. Output and new orders contracted at the fastest rates since May 2020, as inflows of work from both domestic and export markets slumped sharply lower. There were reports of clients postponing, rescheduling or cancelling agreements due to increased economic uncertainties, recession warnings, rising prices and component shortages, while port congestion and Brexit complications constrained export opportunities.”

Swiss CPI rose to 3.5% yoy in Aug, core CPI at 2.0% yoy

Swiss CPI rose 0.3% mom in August, slightly below expectation of 0.4% mom. The monthly rise was due to several factors including rising prices for in-patient hospital services, social protection services and housing rentals. CPI core rose 0.3% mom. Domestic product prices rose 0.2% mom. Imported products prices rose 0.6% mom.

Comparing with August 2021, CPI rose 3.5% yoy, accelerated from 3.4% yoy, matched expectations. Core inflation came in at 2.0% yoy. Domestic product prices were up 1.8% yoy. Imported product prices were up 8.6% yoy.

Also released, real retail sales rose 2.6% yoy in July, above expectation of 0.9% yoy.

Australia AiG manufacturing dropped to 49.3, back in contraction

Australia AiG Performance of Manufacturing Index dropped from 52.5 to 49.3 in August, indicating the first contraction since January. Production fell -1.8 pts to 45.7. Employment dropped -2.6 to 47.5. New orders dropped -4.1 to 55.8. Exports dropped -4.3 to 46.9. Sales tumbled -8.8 to 45.2. Input prices rose 2.0 to 81.7. Selling prices rose 4.6 to 69.1. Average wages rose 11.3 to 74.1.

Innes Willox, Chief Executive of Ai Group said: “The Ai Group Australian PMI for August points to the end of the recent expansion of manufacturing activity. Production, employment and sales were all down in August and most manufacturing sectors reported lower performance in the month…. Prices and wages continued to push higher and with the Reserve Bank seeking to ease these pressures by raising interest rates, further slowing in manufacturing looks increasingly likely over the coming months.”

Also released, private capital expenditure dropped -0.3% in Q2, below expectation of 1.1%.

Japan PMI manufacturing finalized at 51.1 in Aug, dip likely to continue near term

Japan PMI Manufacturing was finalized at 51.1 in August, down from July’s 52.1. The health of the sector that was the joint-weakest since February 2021. S&P Global also noted new orders had the sharpest reduction since October 2020. Backlogs of work decreased for the first time in 18 months. Rise in input prices was slowest for 8 months.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said: “Latest PMI data pointed to deteriorating current activity in the Japanese manufacturing sector midway through the third quarter of 2022…. The dip is likely to continue in the near term… A benefit that has come from softer demand conditions is that pressure on supply chains has been given the opportunity to ease.”

Also from Japan, capital spending rose 4.6% in Q2, above expectation of 3.0%.

China Caixin PMI manufacturing dropped to 49.5 in Aug

China Caixin PMI Manufacturing dropped from 50.4 to 49.5 in August, below expectation of 50.2, back in contraction. Caixin added that output growth slowed as firms faced power supply disruption amid heatwave. New orders declined for the first time in three months. Input costs fell at quickest rate since January 2016.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the Covid-19 flare-ups, the extreme heat wave and restricted power usage resulted in a slight deterioration in overall business conditions in the manufacturing sector. Supply remained stronger than demand, with the latter recording a contraction. The job market remained weak, while lower input costs and output prices eased inflationary pressures. At the same time, firms were cautious about increasing purchases and inventory levels. Market sentiment remained optimistic, although some were worried about the global economic outlook.”

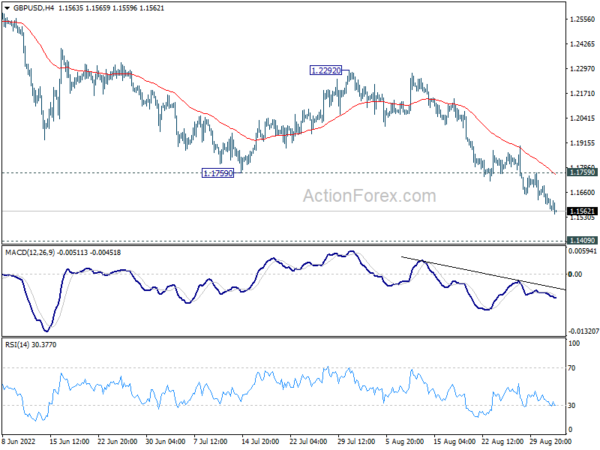

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1584; (P) 1.1639; (R1) 1.1679; More…

GBP/USD’s down trend is in progress and intraday bias stays on the downside. Current fall should target 1.1409 long term support next. On the upside, above 1.1759 minor resistance will turn intraday bias neutral for consolidations. But outlook will stay bearish as long as 1.2292 resistance holds, in case of recovery.

In the bigger picture, fall from 1.4248 (2018 high) could be a leg inside the pattern from 1.1409 (2020 low), or resuming the longer term down trend. Deeper decline is expected as long as 1.2292 resistance holds. Next target is 1.1409 low. However, firm break of 1.2292 will bring stronger rise back to 55 week EMA (now at 1.2859).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Mfg Index Aug | 49.3 | 52.5 | ||

| 23:50 | JPY | Capital Spending Q2 | 4.60% | 3.00% | 3.00% | |

| 00:30 | JPY | Manufacturing PMI Aug F | 51.5 | 51 | 51 | |

| 01:30 | AUD | Private Capital Expenditure Q2 | -0.30% | 1.10% | -0.30% | |

| 01:45 | CNY | Caixin Manufacturing PMI Aug | 49.5 | 50.2 | 50.4 | |

| 06:00 | EUR | Germany Retail Sales M/M Jul | 1.90% | -0.40% | -1.60% | |

| 06:30 | CHF | Real Retail Sales Y/Y Jul | 2.60% | 0.90% | 1.20% | 0.70% |

| 06:30 | CHF | CPI M/M Aug | 0.30% | 0.40% | 0.00% | |

| 06:30 | CHF | CPI Y/Y Aug | 3.50% | 3.50% | 3.40% | |

| 07:30 | CHF | SVME – PMI Aug | 56.4 | 56.4 | 58 | |

| 07:45 | EUR | Italy Manufacturing PMI Aug | 48 | 48.4 | 48.5 | |

| 07:50 | EUR | France Manufacturing PMI Aug F | 50.6 | 49 | 49 | |

| 07:55 | EUR | Germany Manufacturing PMI Aug F | 49.1 | 49.8 | 49.8 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Aug F | 49.6 | 49.7 | 49.7 | |

| 08:00 | EUR | Italy Unemployment Jul | 7.90% | 8.10% | 8.10% | 8.00% |

| 08:30 | GBP | Manufacturing PMI Aug F | 47.3 | 46 | 46 | |

| 09:00 | EUR | Eurozone Unemployment Rate Jul | 6.60% | 6.60% | 6.60% | 6.70% |

| 11:30 | USD | Challenger Job Cuts Y/Y Aug | 30.30% | 36.30% | ||

| 12:30 | USD | Initial Jobless Claims (Aug 26) | 232K | 250K | 243K | 237K |

| 12:30 | USD | Nonfarm Productivity Q2 | -4.10% | -4.60% | -4.60% | |

| 12:30 | USD | Unit Labor Costs Q2 | 10.20% | 10.60% | 10.80% | |

| 12:30 | CAD | Building Permits M/M Jul | -6.60% | -1.50% | -1.50% | -0.60% |

| 13:30 | CAD | Manufacturing PMI Aug | 52.5 | |||

| 13:45 | USD | Manufacturing PMI Aug F | 51.3 | 51.3 | ||

| 14:00 | USD | ISM Manufacturing PMI Aug | 52.6 | 52.8 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Aug | 59.5 | 60 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Aug | 49.9 | |||

| 14:00 | USD | Construction Spending M/M Jul | -0.10% | -1.10% | ||

| 14:30 | USD | Natural Gas Storage | 58B | 60B |