Dollar is trying to extend recent rally again but buying is mostly seen against Yen and Sterling. The Yen finally broke out and fell to new 24-year low against the greenback, and it’s on track to take on the level seen back in 1998. Sterling, on the other hand, is pressured after BoE ruled out extending the emergency intervention in bond markets beyond this weekend. Selloff in the Pound is giving some support to Euro and Swiss Franc. Aussie is also weak with risk-off sentiment in Asia.

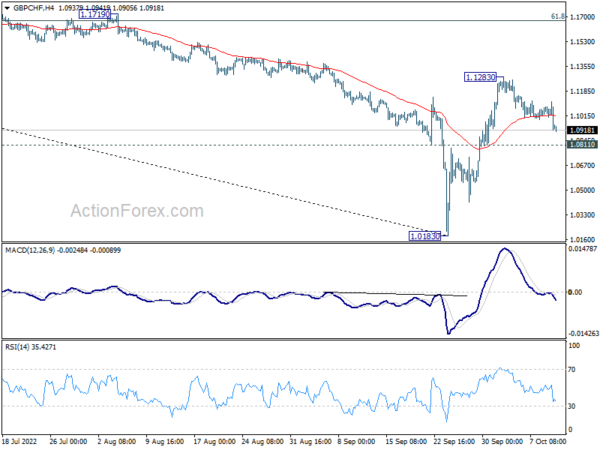

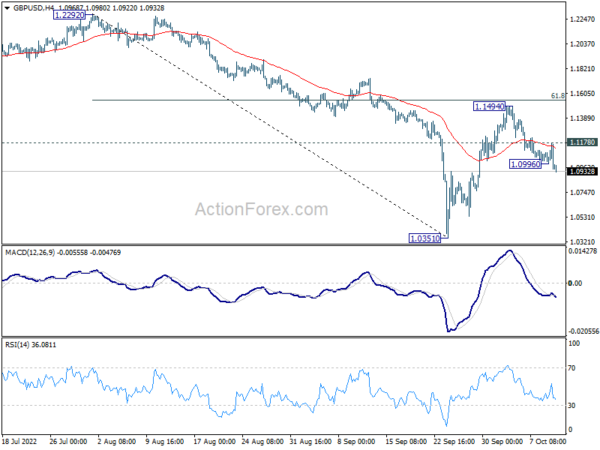

Technically, EUR/GBP’s break of 0.8848 minor resistance is a sign that Sterling bears are back in control, and further rise could be seen back to retest 0.9267 high. At the same time, GBP/USD is also resuming its fall towards 1.0351 low. Break of 1.0811 minor support tin GBP/CHF will also align the outlook. That is, rebound from 1.0183 has completed at 1.1283, and retest of 1.0183 low could be seen next.

In Asia, at the time of writing, Nikkei is down -0.14%. Hong Kong HSI is down -1.86%. China Shanghai SSE is down -1.10%. Singapore Strait Times is down -0.67%. Japan 10-year JGB yield is up 0.0010 at 0.256. Overnight, DOW rose 0.12%. S&P 500 dropped -0.65%. NASDAQ dropped -1.10%. 10-year yield rose 0.051 to 3.939.

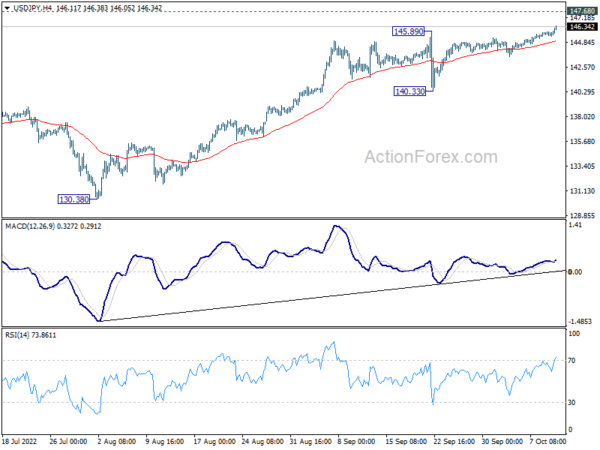

USD/JPY breaks to new 24-yr high as Japan just closely watching

USD/JPY finally breaks through 145.89 resistance to resume up trend to new 24-year high. It’s on track towards 1998 high at 147.68. But there is not clear sign of imminent intervention by Japan yet.

Finance Minister Shunichi Suzuki just repeated that what was important was the speed of forex moves. Japan will closely watch forex moves with a sense of urgency.

Chief Cabinet Secretary Matsuno Hirokazu said echoed that the government is “closely watching FX moves with a high sense of urgency” and will ” take appropriate steps on excess FX moves”.

The message has been consistent that Japan is mindful of fast, one-sided depreciation of yen, rather than the actual rate.

ECB Villeroy: Interest rate should be at neutral by year end

ECB Governing Council member Francois Villeroy de Galhau said it’s still too early to decide whether the central bank should hike by 50bps or 75bps at October 27 meeting. But he noted interest rate should be at neutral level, or “a bit less than 2%” by year end.

Then, ECB could start shrinking its balance sheet. “It would not be consistent to keep a very large balance sheet for too long in order to compress the term premium, whilst at the same time contemplating tightening policy rates above neutral,” he added.

“The reimbursement of TLTROs comes first, and we should avoid any unintended incentives to delay repayments by banks,” he said. “Here we could start earlier than 2024, maintaining partial reinvestments but at a gradually reduced pace.”

RBA Ellis: Neutral is not a destination we necessarily reach

RBA Assistant Governor Luci Ellis said in a speech that “don’t think of this as a mechanistic approach of ‘we have to get back to neutral’, or above neutral” interest rate.

“The neutral rate is an important guide rail for thinking about the effect policy might be having. It is not necessarily a prescription for what policy should do,” he said.

“‘Neutral’, then, is not a destination we necessarily reach, but more a pole-star to guide us. And even then, its location is sufficiently uncertain that we are perhaps better served by paying more attention to the ground as it shifts beneath our feet than to that faraway pole-star,” he added.

Looking ahead

UK GDP, production and goods trade balance will be released in European session, with Eurozone industrial production too. Later in the day, US will publish PPI, but main focus will be on tomorrow’s CPI report.

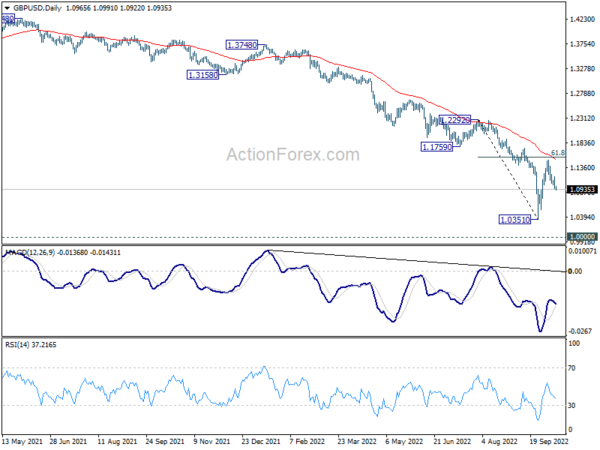

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.0889; (P) 1.1035; (R1) 1.1116; More…

GBP/USD’s fall from 1.1494 resumed after brief recovery. Intraday bias is back on the downside for retesting 1.0351 low. On the upside, above 1.1178 minor resistance will turn intraday bias neutral again. But near term risk will stay on the downside as long as 1.1494 resistance holds, in case of recovery.

In the bigger picture, fall from 1.4248 (2018 high) is resuming long term down trend from 2.1161 (2007 high). Next target is 100% projection of 2.1161 to 1.3503 from 1.7190 at 0.9532. There is no scope of a medium term rebound as long as 1.1759 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Aug | -5.80% | -2.30% | 5.30% | |

| 06:00 | GBP | GDP M/M Aug | 0.10% | 0.20% | ||

| 06:00 | GBP | Index of Services 3/3M Aug | 0.10% | -0.20% | ||

| 06:00 | GBP | Industrial Production M/M Aug | -0.20% | -0.30% | ||

| 06:00 | GBP | Industrial Production Y/Y Aug | 1.10% | |||

| 06:00 | GBP | Manufacturing Production M/M Aug | 0.00% | 0.10% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Aug | 0.70% | 1.10% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Aug | -20.5B | -19.4B | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Aug | 0.50% | -2.30% | ||

| 11:00 | GBP | NIESR GDP Estimate Sep | -0.30% | |||

| 12:30 | USD | PPI M/M Sep | 0.20% | -0.10% | ||

| 12:30 | USD | PPI Y/Y Sep | 8.30% | 8.70% | ||

| 12:30 | USD | PPI Core M/M Sep | 0.30% | 0.40% | ||

| 12:30 | USD | PPI Core Y/Y Sep | 7.30% | 7.30% |