The forex markets are still engaging in corrective trading in Asian session today. Despite stronger than expected job data, Aussie trades lower following mild risk-off sentiment. Kiwi, Loonie and Sterling are are softer. On the other hand, Dollar, Yen and Swiss Franc are the firmer ones, while Euro is mixed. For now, the selling in Dollar should have been exhausted, and consolidation would likely extend for a while. The question is how much the greenback could recover during this phase.

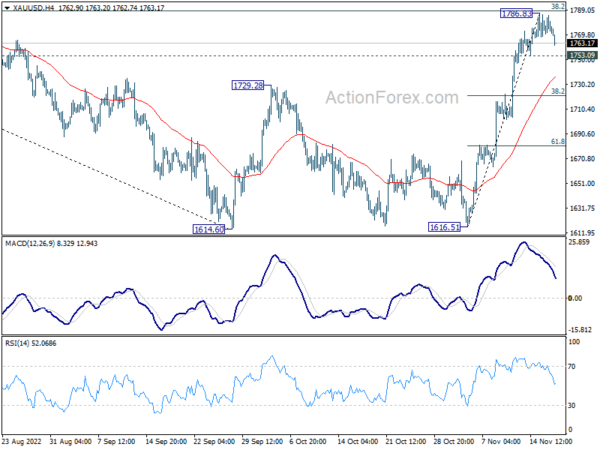

Technically, Gold’s development is so far in line with expectation. 1768.83 looks increasing likely a short term top, just ahead of 38.2% retracement of 2070.06 to 1614.60 at 1788.58. Break of 1753.09 minor support will bring deeper fall to 4 hour 55 EMA (now at 1734.49). The key line of defense will be at 38.2% retracement of 1616.51 to 1786.83 at 1721.76. As long as this fibonacci support holds, another rise is still in favor, and that will suggests that recovery in Dollar would be limited.

In Asia, at the time of writing, Nikkei is down -0.31%. Hong Kong HSI is down -2.21%. China Shanghai SSE is down-0.68%. Singapore Strait Times is up 0.53%. Japan 10-year JGB yield is up 0.0004 at 0.246. Overnight, DOW dropped -0.12%. S&P 500 dropped -0.83%. NASDAQ dropped -1.54%. 10-year yield drooped -0.0107 to 3.692.

Fed Waller more comfortable to hike 50bps in Dec, but no judgement before more data

Fed Governor Christopher Waller said in a speech that while the slowdown in CPI in October was “welcome news”, “we must be cautious about reading too much into one inflation report”

“I don’t know how sustained this deceleration in consumer prices will be,” he said. And, it’s “way too early to conclude that inflation is headed sustainably down”

Despite raising interest rates from near 0% to 3.75-4.00% in nine months, “policy is barely in restrictive territory today, so more interest rate hikes are needed to get inflation down,” he said.

“The Committee will reach the terminal rate well before inflation reaches 2 percent because of the abundance of evidence that it takes months, and perhaps even longer, for the full effects of a rate increase to work through the economy.”

“Looking toward the FOMC’s December meeting, the data of the past few weeks have made me more comfortable considering stepping down to a 50-basis-point hike. But I won’t be making a judgement about that until I see more data, including the next PCE inflation report and the next jobs report.”

BoJ Kuroda: May take a long time to achieve price stability with wage hikes

BoJ Governor Haruhiko Kuroda told the parliament that it may “take a long time” to achieve the “price stability target, involving wage hikes”. He reiterated that the central bank needs to continue with its monetary easing to support a fragile recovery.

At the same session, Executive Director Shinichi Uchida said it was too early to discuss exit from monetary stimulus. “When exiting, the point will be adjusting long-term and short-term policy rates and the BoJ’s balance sheet,” Uchida said. “The order and mixture of those factors would differ depending on economy, prices and financial situations at the time.”

Japan trade deficit hit another record as import surged

Japan’s exports rose 25.3% yoy to JPY 9.00T in October, after shipments of cars and electronics components increased. Imports rose 53.5% yoy to JPY 11.16T, hitting a historical high, as led by crude oil, liquefied natural gas and coal.

Trade deficit came in at JPY -2.16T, a record for the month. Also, Japan has seen as record trade deficit for each month in the past six months, on rising energy and raw material costs, as well as weak Yen exchange rates.

US-bound exports rose 36.5% yoy to JPY 1.78T while imports rose 47.1% yoy to JPY 1.06T. Exports to China rose 7.7% yoy to JPY 1.72T while imports rose 39.3% yoy to JPY 2.39T.

In seasonally adjusted term, exports rose 2.2% mom to JPY 8.91T. Imports rose 4.2% mom to JPY 11.21T. Trade deficit came in at JPY -2.30T.

Australia employment grew 32.3k in Oct, unemployment rate dropped to 3.4%

Australia employment rose 32.2k in October, above expectation of 15.0k. Unemployment rate dropped from 3.5% to 3.4%, below expectation of 3.5%. Participation rate was unchanged at 66.5%. Monthly hours worked in all jobs rose 2.3% mom.

“Although employment in seasonally adjusted terms rose 0.2 per cent in October 2022, the underlying trend estimate was monthly growth of around 0.12 per cent. This was below the average for the 20 years prior to the pandemic of 0.16 per cent,” Bjorn Jarvis, head of labour statistics at the ABS said.

“This indicates that while employment has continued to grow, the rate of growth has slowed to below the longer-term average. It has been below this average for the past 5 months.”

Looking ahead

Swiss trade balance, Italy trade balance, and Eurozone CPI final will be released in European session. Later in the day, US will release building permits and housing starts, jobless claims, and Philly Fed survey.

AUD/USD Daily Report

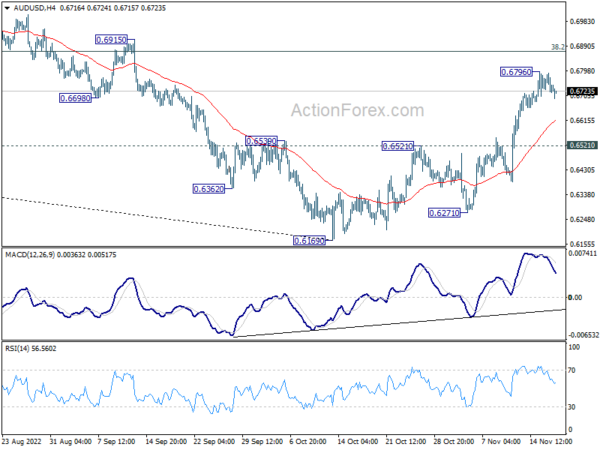

Daily Pivots: (S1) 0.6711; (P) 0.6752; (R1) 0.6784; More…

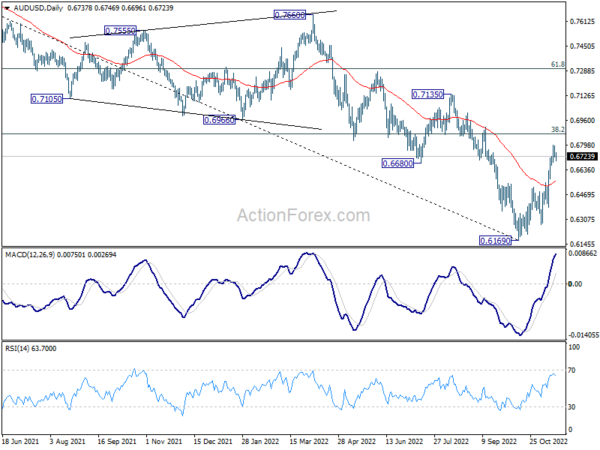

A temporary top is in place at 0.6796 with current retreat. Intraday bias in AUD/USD is turned neutral for consolidations. Further rally is expected as long as 0.6521 resistance turned support holds. Above 0.6796 will resume the rise from 0.6169 to 0.6871 fibonacci level.

In the bigger picture, the break of 0.6680 support turned resistance confirms medium term bottoming at 0.6169. It’s too early to call for trend reversal. But even as a corrective move, rise from 0.6169 should target 38.2% retracement of 0.8006 to 0.6169 at 0.6871. Sustained trading above 55 week EMA (now at 0.6934) will raise the chance of the start of a bullish up trend. This week now remain the favored case as long as 0.6521 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q3 | 0.80% | 2.60% | 3.10% | |

| 21:45 | NZD | PPI Output Q/Q Q3 | 1.60% | 2.10% | 2.40% | |

| 23:50 | JPY | Trade Balance (JPY) Oct | -2.30T | -2.23T | -2.01T | -2.04T |

| 00:30 | AUD | Employment Change Oct | 32.2K | 15.0K | 0.9K | -3.8K |

| 00:30 | AUD | Unemployment Rate Oct | 3.40% | 3.50% | 3.50% | |

| 07:00 | CHF | Trade Balance (CHF) Oct | 3.70B | 4.0B | ||

| 09:00 | EUR | Italy Trade Balance (EUR) Sep | -4.05B | -9.57B | ||

| 10:00 | EUR | Eurozone CPI Y/Y Oct F | 10.70% | 10.70% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct F | 5.00% | 5.00% | ||

| 13:30 | USD | Building Permits Oct | 1.52M | 1.56M | ||

| 13:30 | USD | Housing Starts Oct | 1.42M | 1.44M | ||

| 13:30 | USD | Initial Jobless Claims (Nov 11) | 220K | 225K | ||

| 13:30 | USD | Philadelphia Fed Survey Nov | -6 | -8.7 | ||

| 15:30 | USD | Natural Gas Storage | 66B | 79B |