In today’s Asian trading session, Australian and New Zealand dollars extend their decline from late last week, weakening broadly. Concurrently, Japanese Yen is trailing as the next weakest currency. This picture aligns with the steady risk sentiment across Asia, except for Hong Kong stocks. On the other hand, Dollar, Euro, and Swiss Franc are showing strength, while British Pound and Canadian Dollar display are mixed.

The economic calendar appears light in the beginning but gradually fills with significant events towards the end. Notably, Australia’s CPI, Q1 GDP figures from US and Eurozone, Canada’s monthly GDP, and BoC minutes may induce volatility in their respective currencies.

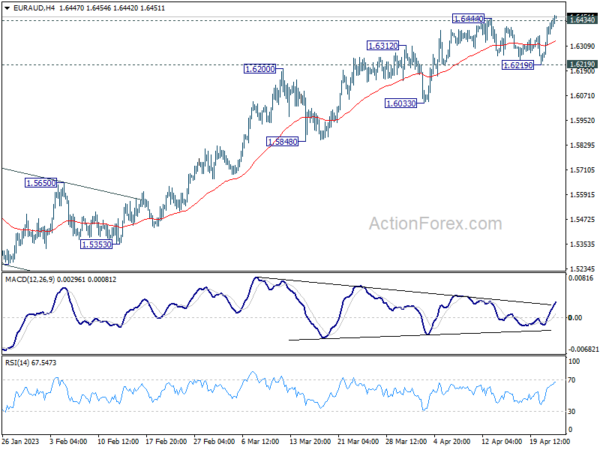

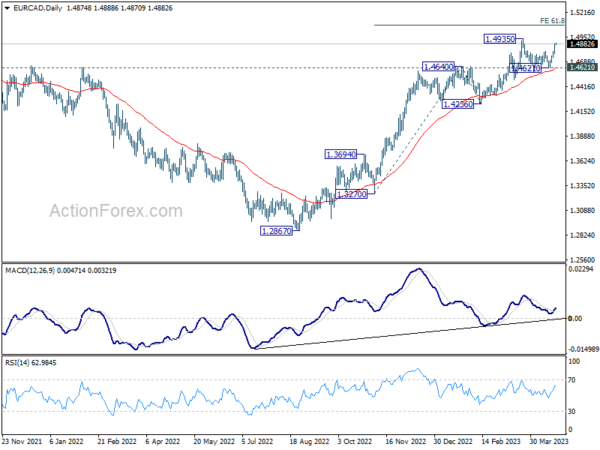

From a technical standpoint, EUR/AUD’s break of 1.6444 resistance suggests resumption of the overall uptrend from 1.4281. Additionally, EUR/CAD is marching towards 1.4935 resistance level. Decisive break there would resume the larger uptrend from 1.2867, with next target at 61.8% projection of 1.3270 to 1.4640 from 1.4236 at 1.5083. A crucial question is whether EUR/USD will follow suit by breaking through 1.1075 resistance.

In Asia, Nikkei closed up 0.10%. Hong Kong HSI is down -1.44%. China Shanghai SSE is down -0.82%. Singapore Strait Times is down -0.15%. Japan 10-year JGB yield is up 0.0061 at 0.468.

In Asia, Nikkei closed up 0.10%. Hong Kong HSI is down -1.44%. China Shanghai SSE is down -0.82%. Singapore Strait Times is down -0.15%. Japan 10-year JGB yield is up 0.0061 at 0.468.

ECB’s Wunsch awaits core inflation and wage growth to come down

In an interview with Financial Times, ECB Governing Council member Pierre Wunsch mentioned that the central bank is waiting for both wage growth and core inflation to decrease in conjunction with headline inflation before considering a pause.

Wunsch stated, “I would not be surprised if we had to go to 4 percent at some point.” He emphasized that ECB aims for a soft landing, and “nobody is going to err on the side of destroying the economy for the sake of destroying the economy.”

“But I have absolutely no indication that what we are doing (on interest rates) is too much,” he added.

Regarding rate hikes, Wunsch clarified, “I’m not a fetishist. I’m not going to hike rates even in a recession just because we have 2.3 percent or 2.1 percent inflation in the two-year forecast. But I’m not seeing inflation numbers going in the right direction yet.”

He also pointed out that if wage agreements persist around a 5 percent growth for an extended period, inflation may not return to 2 percent on a structural basis.

BoJ Ueda highlights importance of strong inflation projections in monetary policy decisions

BoJ Governor Kazuo Ueda emphasized today that the central bank’s inflation forecasts must be “quite strong and close to 2%” within the coming year for the bank to consider adjusting its yield curve control policy.

Speaking to parliament, Ueda said that as “trend inflation is below 2%,” BoJ must maintain its current monetary easing stance. However, he noted that when trend inflation is projected to reach 2% target, the central bank must normalize monetary policy.

When asked about the specifics of how BoJ might phase out YCC, Ueda opted not to provide explicit details, clarifying that such a decision would hinge on a variety of factors, encompassing the economy, inflation pace, and other elements at the time of the verdict.

“At this moment, I cannot provide a definitive answer regarding how this could be executed,” he said, touching upon BoJ’s exit strategy. Nonetheless, Ueda reassured that ” BOJ has actively been conducting numerous evaluations on the potential impact of a monetary policy normalization on its financial situation.”

Bitcoin in tight range as super cycle chat continues

In today’s Asian trading session, Bitcoin was navigating a rather narrow trading range, as it tries to lean on 55 D EMA for support. Just earlier this month, Bitcoin climbed up to 31,011, staging a comeback from last year’s low of 15,452. Yet, the momentum has since waned, as it turned into a pullback. While the overall momentum of bitcoin isn’t too convincing, there are market whispers about the start of a new “super cycle.”

This super cycle conjecture is rooted in the anticipation of the “halving” event, which is predicted to take place around April 2024. The total supply of Bitcoin is capped at 21 million (hardcoded into the protocol by creator Satoshi Nakamoto). The halving event cuts the rate at which new bitcoins emerge and are awarded to miners, approximately every four years or after 210,000 blocks have been mined.

When Bitcoin was first launched in 2009, the block reward was 50 bitcoins. In 2012, the first halving transpired, slashing the reward to 25 bitcoins. Fast forward to 2016, and the reward was reduced once more, this time to 12.5 bitcoins. The latest halving took place in May 2020, leaving the current block reward at a modest 6.25 bitcoins.

Historically, Bitcoin has experienced significant price movements following halving events. In each cycle, the cryptocurrency’s price bottomed out around 12-18 months before the halving, followed by a new record high in the subsequent months.

From a technical perspective, near term outlook of Bitcoin will remain bullish as long as 25242 resistance turned support holds, even in case of deeper pull back. Break of 31011 will resume the rebound from 15452 to 38.2% retracement of 68986 to 15452 at 35902. This is the key hurdle for Bitcoin to overcome if it’s really developing into a “super cycle” up trend.

Meanwhile, decisive break 25242 support will argue that Bitcoin is vulnerable to hit another low below 15452 before building the base for the so-called “super cycle”.

BoJ meeting, BoC minutes and GDP data loom

This week, new BoJ Governor Kazuo Ueda is set to preside over his first monetary policy meeting. It is anticipated that the yield curve control framework will remain unchanged, with short-term interest rate target of -0.1% and 0.5% cap on 10-year JGB yield. Ueda is also expected to uphold the dovish view that inflation will ease later in the year, with wage growth being insufficient to maintain inflation at the target. Recent development in 10-year JGB yield suggests that traders are also not betting on any alterations to the yield cap.

In other central bank activities, BoC will release meeting minutes, which are likely to reaffirm the need for a substantial accumulation of evidence before considering to resume tightening.

Data releases will also play a significant role this week, with Australian CPI potentially being the most impactful. While RBA is expected to resume tightening by implementing one more rate hike on May 2, the decision will depend on the Q1 CPI release and forthcoming economic projections based on the data.

Other noteworthy data releases include Q1 GDP figures from US and Eurozone, as well as monthly GDP data from Canada. Market participants will also be monitoring Germany’s Ifo business climate and US consumer confidence reports.

Here are some highlights for the week:

- Monday: Germany Ifo business climate; Canada new housing price index.

- Tuesday: Swiss trade balance; UK public sector net borrowing; US house price index, consumer confidence, new home sales.

- Wednesday: New Zealand trade balance; Australian CPI; Germany Gfk consumer climate; Swiss Credit Suisse economic expectations; US durable goods orders, goods trade balance, BoC minutes.

- Thursday: Australia ANZ business confidence, Australia import prices; US Q1 GDP advance, jobless claims, pending home sales.

- Friday: BoJ rate decision, Japan industrial production, retail sales unemployment rate, housing starts, Tokyo CPI; Australia PPI, private sector credit; France GDP; Germany import prices, CPI flash, unemployment; Italy GDP; Eurozone GDP; Swiss retail sales, KOF; Canada GDP; US personal income and spending with PCE inflation, Chicago PMI.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6299; (P) 1.6364; (R1) 1.6484; More…

EUR/AUD’s break of 1.6444 resistance suggests that up trend from 1.4281 is resuming. Intraday bias is now back on the upside for 100% projection of 1.4281 to 1.5976 from 1.5254 at 1.6949. For now, near term outlook will remain bullish as long as 1.6219 support holds, in case of retreat. Also, sustained trading above 1.6434/44 resistance will carry larger bullish implications.

In the bigger picture, focus stays on 1.6389/6434 cluster resistance (38.2% retracement of 1.9799 to 1.4281 at 1.6389). Sustained break there should confirm that whole down trend from 1.9799 (2020 high) has completed. Further rally should then be seen to 61.8% retracement at 1.7691. However, rejection by this cluster resistance will make medium term outlook neutral at best.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Germany IFO Business Climate Apr | 94.0 | 93.3 | ||

| 08:00 | EUR | Germany IFO Current Assessment Apr | 96.1 | 95.4 | ||

| 08:00 | EUR | Germany IFO Expectations Apr | 91.6 | 91.2 | ||

| 12:30 | CAD | New Housing Price Index M/M Mar | 0.10% | -0.20% |