Dollar and Japanese Yen saw a modest bounce back in today’s Asian session, making up for some of their steep losses from last week. However, the buying momentum for both currencies remains relatively weak. Due to a light economic calendar today, coupled with public holiday in the US, trading could be relatively quiet. But, the rest of the week is likely to bring considerable volatility, with BoE and SNB rate decisions, Fed Chair Jerome Powell’s testimony, and a barrage of crucial economic data.

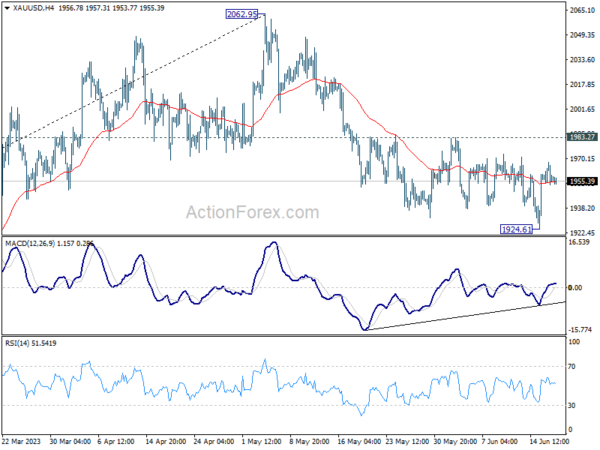

From a technical standpoint, movement in Gold will be observed for signs of an re-escalating selloff in Dollar. Bullish convergence condition in 4H MACD suggests that corrective decline from 2026.95 might have concluded at 1924.61. Solid break above 1983.27 resistance would confirm this scenario, potentially triggering a stronger rally back towards 2062.95 high. On the other hand, if Gold price is rejected by 1983.27, fall from 2062.95 could resume through 1924.61 support. If this scenario materializes, it might be accompanied by a more sustainable rebound in Dollar.

In Asia, at the time of writing, Nikkei is down -0.97%. Hong Kong HSI is down -1.17%. China Shanghai SSE is down -0.49%. Singapore Strait Times is down -0.60%. 10-year JGB yield is down -0.0064 at 0.398, back below 0.4% handle.

NZ BNZ services jumped back to 53.3, economy still on a broader slowing trajectory

New Zealand’s BusinessNZ Performance of Services Index climbed from 50.1 in April to 53.3 in May, revealing a slight uptick in the services sector. However, it’s worth noting that this figure remains marginally under long-term average of 53.6. A closer look at the numbers shows activity/sales leaping from 45.4 to 52.0, employment increasing from 50.5 to 52.6, and new orders/business ascending from 50.1 to 55.4. Stocks inventories slightly declined from 57.1 to 56.8, while supplier deliveries edged up from 50.6 to 51.1.

BusinessNZ’s Chief Executive Kirk Hope shared his insights, stating, “The lift in expansion for May also saw a pickup in the proportion of positive comments, which rose from 39.8% in April to 50.6% for the current month.” He further added that while there weren’t any defining themes, the overall positive comments were “either industry-specific or very general around increased activity.”

Nonetheless, the economy appears to be on a deceleration trajectory, which, according to BNZ Senior Economist Craig Ebert, is necessary to deflate the inflationary pressures.

“The bounce back in the PSI in May arguably helped calm a lot of nerves – after it sagged to 50.1 in April, and after the services component of Q1 GDP declined 0.6%. Still, this doesn’t deny the economy is on a broadly slowing trajectory, which is what’s required to take the inflationary heat out of it,” Ebert explained.

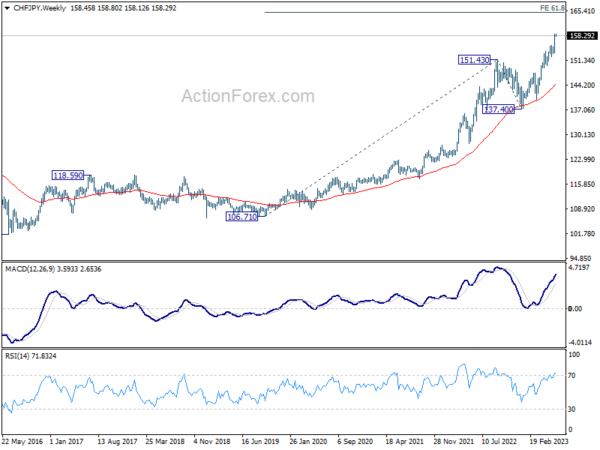

CHF/JPY extending up trend, ready for 160, and then 165

While Swiss Franc hasn’t been a strong currency recently, it did manage to extend up trend against Yen. It now ready to take out prior high of 158.45 set in 1979, (barring the spike after SNB suddenly removed the cap of Franc in 2015).

Monetary policy divergence between SNB and BoJ continues to be the driving factor for the move. SNB is set to raise interest rate again this week and any hawkish comments or economic projections could propel CHF/JPY further higher.

From a near term point of view, CHF/JPY passed through 161.8% projection of 137.40 to 147.58 from 140.21 at 156.58 last week. There is no sign of topping yet. Near term outlook will stay bullish as long as 155.53 resistance turned support holds. Next target is 200% projection at 160.57.

From a medium term point of view, the up trend from 106.71 is in progress, and will remain on healthy track as long as 151.43 resistance turned support holds. Next target is 61.8% projection of 106.71 to 151.43 from 137.40 at 165.03.

BoE and SNB to hike again; Fed Powell to testify; Lots of data

BoE is widely expected raise interest rate by 25bps to 4.75% this week. That would be its 13th straight rate rise as inflation remained stubbornly high despite some cooling. Hawkish bias would be maintained with some analysts expecting at least another 25bps hike in August of September. Yet, markets are indeed pricing in a peak rate of 5.75%. While May CPI data to be released on Wednesday would likely trigger some volatility in Sterling, it’s unlikely to alter BoE’s decision this time.

SNB is also widely expected to continue tightening this week. But opinions are divided on whether a 25bps or a 50bps hike would be delivered to the current 1.50%. Chairman Thomas Jordan was clear about two things in recent interview. Switzerland’s neutral rate might be “slightly lower” than the norm of 2-3%. Additionally, “if inflation is higher than the target, monetary policy must be restrictive.” Judging from there, raising interest rate to above 2% should be a natural expectation. The question is only when that will be reached.

In terms of central bank activity, Fed Chair Jerome Powell will testify before Congress this week. He’s expected to be scrutinized further regarding Fed’s median projection of two more 25bps hike, as well as the timing of rate cuts. RBA minutes of June meeting and BoJ minutes of April meeting (not last week’s) will also be published.

On the data front, in addition to the UK, Japan will also publish CPI data. Meanwhile, PMI data from Australia, Japan, Eurozone, UK, and US will also be closely watched.

Here are some highlights for the week:

- Monday: New Zealand BNZ services; Canada IPPI, RMPI; US NAHB housing index.

- Tuesday: RBA minutes; Swiss trade balance; Germany PPI; Eurozone current account; US building permits and housing starts.

- Wednesday: BoJ minutes; Australia leading index; UK CPI, PPI; Canada retail sales, new housing price index.

- Thursday: New Zealand trade balance; SNB rate decision; BoE rate decision; US jobless claims, current account, existing home sales.

- Friday: Australia PMIs; Japan CPI, PMI manufacturing; UK retail sales, PMIs; Eurozone PMIs; US PMIs.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6854; (P) 0.6877; (R1) 0.6899; More…

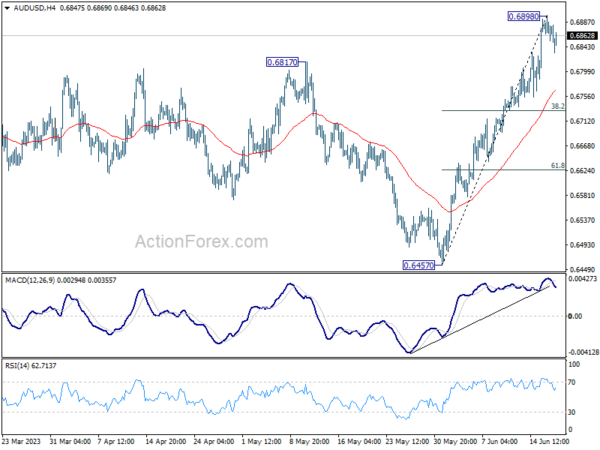

Intraday bias in AUD/USD is turned neutral with current retreat, and with 4H MACD crossed below signal line. Some consolidations could be seen first. But downside of retreat should be contained by 38.2% retracement of 0.6457 to 0.6898 at 0.6730 to bring another rally. As noted before, whole corrective decline from 0.7156 could have completed with three waves down to 0.6457 already. Above 0.6898 will resume the rally from 0.6457 to retest 0.7156 high next.

In the bigger picture, fall from 0.7156 could have completed in a three wave corrective structure at 0.6457. The development argues that rise from 0.6169 (2022 low) is still in progress. Firm break of 0.7156 will also add to the case that whole down trend from 0.8006 (2021 high) has finished and turn medium term outlook bullish. For now this will be the favored case as long as 55 D EMA (now at 0.6694) holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI May | 53.3 | 49.8 | 50.1 | |

| 12:30 | CAD | Industrial Product Price M/M May | 0.20% | -0.20% | ||

| 12:30 | CAD | Raw Material Price Index M/M May | 2.40% | 2.90% | ||

| 14:00 | USD | NAHB Housing Market Index Jun | 50 | 50 |