Despite Fed Chair Jerome Powell’s firm indications that further monetary tightening is needed, Dollar is struggling find momentum for its near-term rebound. The greenback is yet to break through its weekly high even against the weaker Yen and is primarily bounded within the confines of yesterday’s range, barring its performance against Australian dollar.

Meanwhile, Canadian dollar emerges as the day’s stronger performers so far, buoyed by unexpectedly robust retail sales data. New Zealand Dollar follows closely, aided by a rebound against Australian, while Euro is the third strongest.

On the other end of the spectrum, Aussie languishes as the day’s weakest performer, followed by Yen and British Pound. Despite a short-lived rally following the release of UK CPI data, Sterling’s momentum faded quickly, even as economists are revising their forecasts upwards for BoE’s terminal rate.

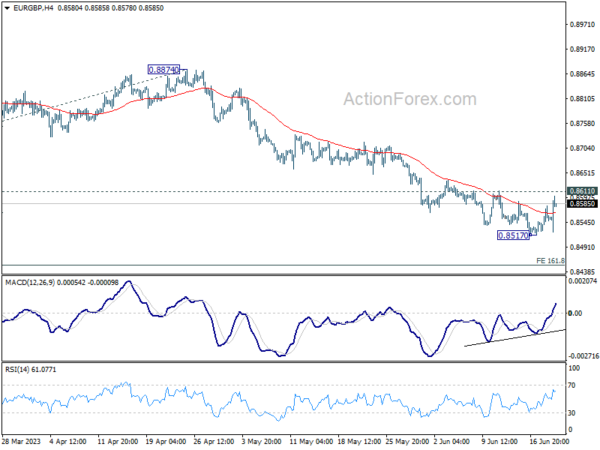

On a technical note, EUR/GBP is worth some attention in lead up to tomorrow’s BoE rate decision. For now, near term outlook will stay bearish as long as 0.8611 resistance holds. Another fall should be seen through 0.8517 to 161.8% projection of 0.8977 to 0.8717 from 0.8874 at 0.8453. However, considering bullish convergence condition in 4H MACD, firm break of 0.8611 will indicate short term bottoming, and bring stronger rise back to 0.8717 support turned resistance.

In Europe, at the time of writing, FTSE is down -0.47%. DAX is down -0.43%. CAC is down -0.58%. Germany 10-year yield is up 0.0254 at 2.431. Earlier in Asia, Nikkei rose 0.56%. Hong Kong HSI fell -1.98%. China Shanghai SSE lost -1.31%. Singapore Strait Times gained 0.11%. Japan 10-year JGB year dropped -0.0162 to 0.374.

Fed Powell: Nearly all FOMC members expect further tightening this year

Fed Chair Jerome Powell indicated that it’s appropriate to continue tightening. But the Committee would like to assess additional information, before making meeting-by-meeting decisions.

In the prepared remarks for the Semiannual testimony to Congress, Powell said, “Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.”

“But at last week’s meeting, considering how far and how fast we have moved, we judged it prudent to hold the target range steady to allow the Committee to assess additional information and its implications for monetary policy,” he added.

In determining future actions, Fed will take into account, “account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”.

“We will continue to make our decisions meeting by meeting, based on the totality of incoming data and their implications for the outlook for economic activity and inflation, as well as the balance of risks,” He said.

Canada retail sales rose 1.1% mom in Apr, well above expectation

Canada retail sales rose 1.1% mom to CAD 65.9B in April, well above expectation of 0.3% mom. Sales increased in eight of nine subsectors and were led by increases at general merchandise retailers (+3.3%) and food and beverage retailers (+1.5%). Ex auto and fuel sales rose 1.5% mom, its fifth consecutive monthly increase. In volume terms retail sales rose 0.3% mom.

Advance estimates suggests that sales rose 0.5% mom in May.

Ifo: German economy to contract -0.4% this year, inflation down slightly to 5.8%

German economy endured a “sharp setback” in the winter half-year, primarily due to soaring inflation and noticeably weakened demand, as per the latest report from Germany’s Ifo Institute.

The country’s GDP is predicted to decline by -0.4% this year, before witnessing a rebound with a 1.5% growth next year. The institute also anticipates a gradual decrease the inflation rate, dropping from 6.9% in 2022, to 5.8% in 2023, and then 2.1% in 2024.

In terms of inflation, the Ifo Institute anticipates a further decrease in inflation rates in the coming months, with producers likely to pass on price reductions for intermediate input costs, particularly energy, to their customers.

Nevertheless, wage growth is likely to accelerate throughout the year due to more inflation bonuses being distributed and the effect of noticeable increases in collectively agreed wages.

UK CPI unchanged at 8.7% yoy in May, core CPI rose to 7.1% yoy

UK annual CPI was unchanged at 8.7% yoy in May, above expectation of 8.5% yoy. Core CPI (excluding energy, food, alcohol and tobacco) accelerated to 7.1% yoy, up from prior month’s 6.8% yoy, and the highest rate since March 1992. CPI goods eased from 10.0% yoy to 9.7% yoy. But CPI services rose from 6.9% yoy to 7.4% yoy. For the month, CPI rose 0.7% mom, slowed from April’s 1.2% mom, but was well above expectation of 0.4% mom.

Also released. RPI ticked down from 11.4% yoy to 11.3% yoy, above expectation of 11.1% yoy. PPI input came in at -1.5% mom, 0.5% yoy, versus expectation of -0.6% mom, 1.2% yoy. PPI output was at -0.5% mom, 2.9% yoy, versus expectation of -0.1% mom, 3.6% yoy. PPI output core was at -0.3% mom, 4.1% yoy, versus expectation of 0.1% mom, 4.7% yoy.

BoJ Ueda: Will patiently maintain easy monetary policy

In his address to the annual trust association’s meeting, BoJ Governor Kazuo Ueda highlighted the central bank’s commitment to maintaining accommodative monetary policy. According to Ueda, BoJ “will patiently maintain an easy monetary policy to stably and sustainably achieve the 2% price target accompanied by wage growth.”

Governor Ueda provided a cautiously optimistic outlook for Japan’s economy, describing it as “picking up” and likely to “recover moderately.” In terms of inflation, he reiterated the expectation of slowdown in Japan’s consumer inflation towards the middle of the current fiscal year.

Ueda also offered reassurances about the stability of Japan’s financial system, noting it was “stable as a whole.” Despite recent failures of several US banks, Ueda claimed the impact on Japan’s financial system was limited.

BoJ Adachi: Appropriate to continue monetary easing with YCC

BoJ board member Seiji Adachi voiced support for continued monetary easing amid a climate of significant uncertainty regarding price outlook. Adachi relayed these views during a discussion with business leaders in Kagoshima.

Adachi said, “My view is that it’s appropriate to continue monetary easing with the yield curve control framework.” He added, “The shape of the yield curve has become smooth overall and there is improvement in market functioning.”

“Amid huge uncertainty over the price outlook, there are upside and downside risks. In the long run, however, the downside risks appear to be larger,” he warned. These risks, according to Adachi, must be carefully considered when deciding on changes to monetary policy.

Adachi also noted an interesting shift in public’s perception of inflation, suggesting that Japan’s long-standing deflationary mindset is starting to change. “We’re seeing some changes in the public’s deflationary mindset, or the perception that prices won’t rise,” he said.

“In a sense, we’re moving closer to achieving our price target. But there’s high uncertainty over our baseline inflation outlook, so it’s premature to tweak monetary policy,” Adachi concluded.

Australia’s Westpac leading index fell to -1.09%, weakness to extend into 2024

Australia Westpac Leading Index growth rate fell from -0.78% to -1.09% in May. This is the lowest read of the growth rate since the pandemic. The tenth consecutive negative print for the index. The negative Index growth rates point to below-trend economic growth.

Westpac expects the weakness to extend through 2023 and into 2024. Westpac recently revised down growth forecast 2023 and 2024, from 1% and 1.5% to 0.6% and 1.0% respectively. This weakness in the economy is centred around consumers but also reflects slowing global economy; downturn in dwelling construction; and progressive weakening in labour market.

Regarding RBA policy, Westpac expects the central bank to raise cash rate by a further 0.25% at July 4 meeting. “As we saw at the June Board meeting, we expect that the July meeting will see these considerations of inflation risks again overriding concerns about the poor growth outlook.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2717; (P) 1.2762; (R1) 1.2810; More…

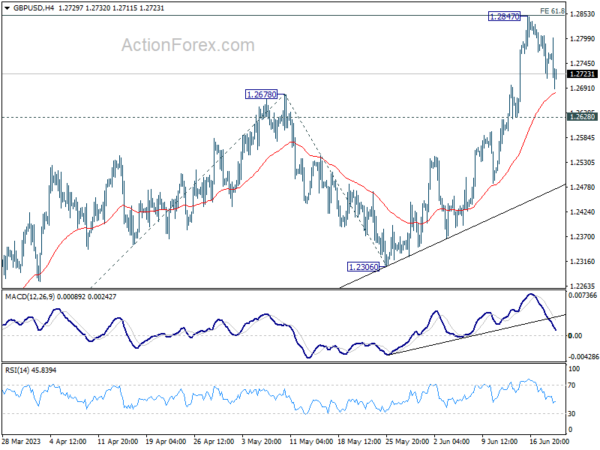

GBP/USD is extending the retreat from 1.2847 but stays above 1.2628 support. Intraday bias remains neutral and further rally is expected. On the upside, firm break of 1.2847 will resume larger up trend and target 100% projection of 1.1801 to 1.2678 from 1.2306 at 1.3183 next. However, firm break of 1.2628 will turn bias to the downside, for deeper fall to 1.2306 support instead.

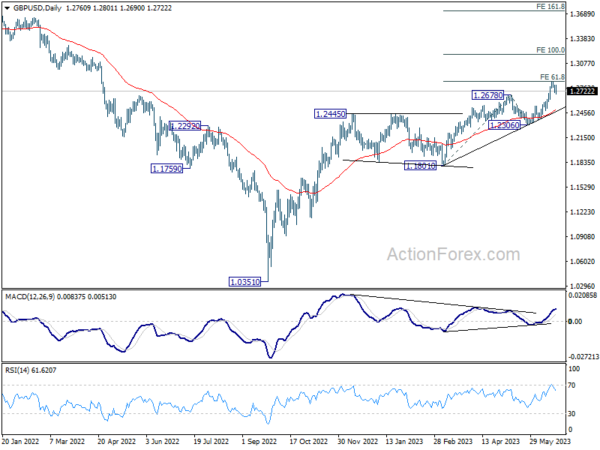

In the bigger picture, the strong support from 55 W EMA (now at 1.2345) is a medium term bullish sign. Outlook will stay bullish as long as 1.2306 support holds. Rise from 1.0351 medium term bottom (2022 low) is expected to extend further to retest 1.4248 key resistance (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | -0.30% | |||

| 00:30 | AUD | Westpac Leading Index M/M May | -0.30% | -0.03% | ||

| 06:00 | GBP | CPI M/M May | 0.70% | 0.40% | 1.20% | |

| 06:00 | GBP | CPI Y/Y May | 8.70% | 8.50% | 8.70% | |

| 06:00 | GBP | Core CPI Y/Y May | 7.10% | 6.80% | 6.80% | |

| 06:00 | GBP | RPI M/M May | 0.70% | 0.50% | 1.50% | |

| 06:00 | GBP | RPI Y/Y May | 11.30% | 11.10% | 11.40% | |

| 06:00 | GBP | PPI Input M/M May | -1.50% | -0.60% | -0.30% | 0.10% |

| 06:00 | GBP | PPI Input Y/Y May | 0.50% | 1.20% | 3.90% | 4.20% |

| 06:00 | GBP | PPI Output M/M May | -0.50% | -0.10% | 0.00% | -0.20% |

| 06:00 | GBP | PPI Output Y/Y May | 2.90% | 3.60% | 5.40% | 5.20% |

| 06:00 | GBP | PPI Core Output M/M May | -0.30% | 0.10% | 0.00% | |

| 06:00 | GBP | PPI Core Output Y/Y May | 4.10% | 4.70% | 6.00% | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) May | 19.2B | 20.3B | 24.7B | |

| 12:30 | CAD | New Housing Price Index M/M May | 0.10% | 0.00% | -0.10% | |

| 12:30 | CAD | Retail Sales M/M Apr | 1.10% | 0.30% | -1.40% | -1.50% |

| 12:30 | CAD | Retail Sales ex Autos M/M Apr | 1.30% | 0.30% | -0.30% | -0.40% |