Australian Dollar rises broadly today, as lifted by stronger than expected headline employment data. But the details are less impressive, as the vast majority of job growth were part-time, while hours worked decline. That’s nonetheless welcome news for RBA, as the job markets while starting to cool, appeared to have absorb prior rate hikes well. Meanwhile, it’s still too early to judge if RBA would deliver one more final hike in the cycle, until getting more Q3 data as a whole.

Euro is currently mixed as trader eagerly await ECB rate decisions. Opinions are still split of whether the central bank would hike or pause. At the same time, any guidance on rates, together with new growth and inflation projections are able to send Euro for a wide ride.

As for the week, Dollar is currently the worst performer, but held above last week’s lows against all but Canadian. Swiss Franc and Sterling are the next weakest. Australian Dollar is the strongest one, followed by Canadian and New Zealand Dollar. Euro and Yen are mixed in the middle.

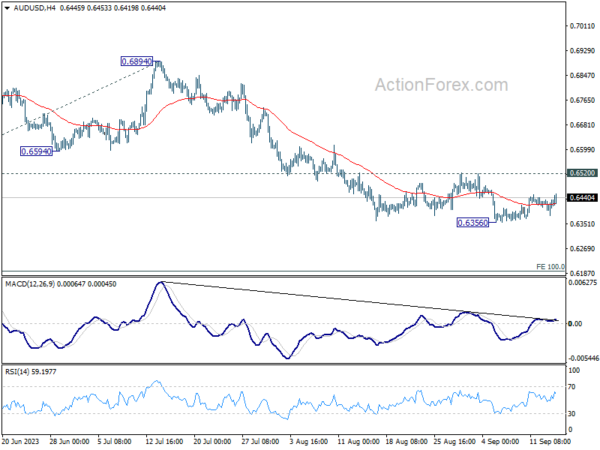

On the technical front, AUD/USD’s recovery today is rather weak and doesn’t alter the corrective structure of the rise from 0.6356. Also, even though further upside cannot be ruled out, outlook will stay bearish as long a s0.6520 resistance holds. Break of 0.6356 support will signal resumption of the fall from 0.6894, towards 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195.

In Asia, at the time of writing, Nikkei is up 1.40%. Hong Kong HSI is down -0.22%. China Shanghai SSE is up 0.04%. Singapore Strait Times is up 0.52%. Japan 10-year JGB yield is down -0.0024 at 0.708. Overnight, DOW dropped -0.20%. S&P 500 rose 0.12%. NASDAQ rose 0.29%. 10-year yield dropped -0.015 to 4.249.

Markets in suspense ahead of ECB; Could EUR/USD bounce from here?

As the global financial market eagerly anticipates today’s pivotal ECB rate decision, the pendulum of market expectations has been swinging vigorously, making it the most uncertain ECB meeting in recent times. Initial market sentiment leaned towards a pause; however, a recent Reuters report ignited speculation about a potential rate hike.

The mentioned report suggested that ECB could revise its 2024 inflation forecast upwards, well pass the 3% mark, thereby strengthening the case for a rate increase. Consequently, odds for a 25bps hike escalated to nearly 70%, a significant rise from around 40% noted on Monday. If this materializes, we could see the main refinancing rate and deposit rate shift to 4.50% and 4.00% respectively.

Adding a layer of complexity to the anticipations is Vice President Luis de Guindos’ earlier assertion, dating back to August 31, where he said that the impending inflation forecasts are “similar to what we had in June”, steering away from the prospect of an excessive upward revision. Moreover, European Commission had marginally adjusted Eurozone inflation rate from 5.8% to 5.6% for 2023 and increased the 2024 forecast from 2.8% to 2.9%. That casts further doubts on the aggressive inflation predictions noted in the Reuters report.

The market is not just hinging on the rate verdict. A myriad of factors stand as potential catalysts in steering the financial markets post the announcement. The ECB is expected to maintain its stance of basing future verdicts on evolving data dynamics. However, there might be subtle indications given on whether interest rates have reached its peak, whether it hikes or not today.

Furthermore, growth projections are on the verge of being revised to possibly match European Commission’s grim outlook. The Commission had notably scaled down the growth forecasts for 2023 and 2024 to 0.8% and 1.3% respectively, a decrement from the previous estimates of 1.1% and 1.6%.

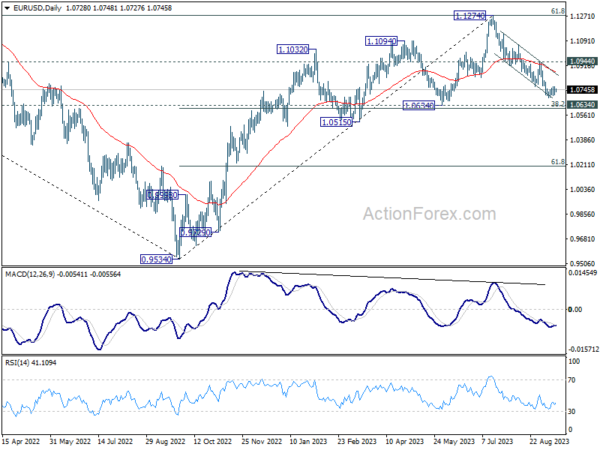

As for EUR/USD it’s now standing close to an important cluster support zone at 1.0634, (38.2% retracement of 0.9534 to 1.1274 at 1.0609). There is prospect of a near term bullish reversal from current level, to finish off the whole decline from 1.1274. But decisive break of 1.0944 resistance is needed to confirm this case, or risk will stay on the downside. On the other hand, sustained break of 1.0609/0634 will raise the chance of medium term term bearish trend reversal, and target 61.8% retracement at 1.0199.

UK RICS house price balance fell to 14-year low, deepening slump

In the latest sign of mounting pressures in the UK property market, RICS house price balance deteriorated notably, plummeting to -68 in August, down from -55 in the previous month. This development has surpassed the grim expectation set at -56 and marks the most unfavorable reading since February 2009.

Dissecting the UK reveals that almost every region is grappling with “relatively steep fall in house prices,” as noted by RICS.

Looking ahead, surveyors anticipate that the upcoming months will not bring any reprieve. Short-term projections illustrate a more pronounced dip, with net balance drifting deeper into negative terrain at -67%, a decline from prior figure of -60%.

Furthermore, long-term outlook remains relatively unchanged but still under a cloud, with expectations cementing around a net balance of -48%, mirroring the sentiment recorded in both June and July.

Elsewhere

Swiss PPI will be released in European session. US will publish retail sales, PPI and jobless claims later in the day.

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9576; (P) 0.9585; (R1) 0.9599; More…

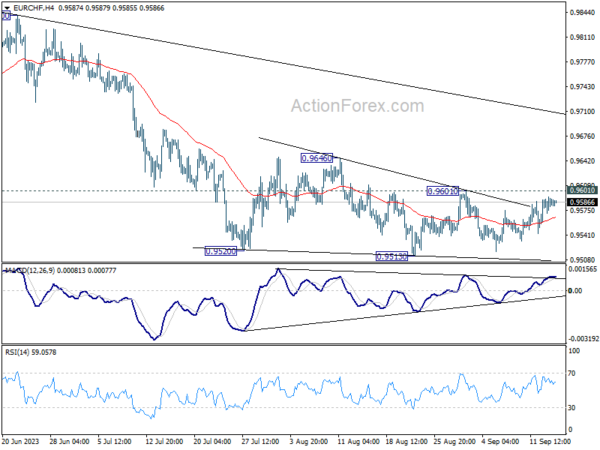

EUR/CHF is still bounded in range below 0.9601 resistance and intraday bias stays neutral for the moment. Outlook stays bearish with 0.9601 resistance intact. On the downside, decisive break of 0.9513 will resume the decline from 1.0095, towards 0.9407 low. However, break of 0.9601 resistance will turn bias back to the upside for stronger rebound to 0.9646 resistance and above.

In the bigger picture, medium term outlook is staying bearish as the cross is capped well below falling 55 W EMA (now at 0.9818). Down trend from 1.2004 (2018 high) is in favor to continue. Sustained break of 0.9407 will target 61.8% projection of 1.1149 to 0.9407 from 1.0095 at 0.9018. For now, this will remain the favored case as long as 0.9670 support turned resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Jul | -1.10% | -0.70% | 2.70% | |

| 01:00 | AUD | Consumer Inflation Expectations Sep | 4.60% | 4.90% | ||

| 01:30 | AUD | Employment Change Aug | 64.9K | 24.3K | -14.6K | |

| 01:30 | AUD | Unemployment Rate Aug | 3.70% | 3.70% | 3.70% | |

| 04:30 | JPY | Industrial Production M/M Jul F | -1.80% | -2.00% | -2.00% | |

| 06:30 | CHF | Producer and Import Prices M/M Aug | 0.10% | -0.10% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Aug | -0.60% | |||

| 12:15 | EUR | ECB Main Refinancing Rate | 4.25% | 4.25% | ||

| 12:30 | CAD | Wholesale Sales M/M Jul | -2.00% | -2.80% | ||

| 12:30 | USD | Retail Sales M/M Aug | 0.20% | 0.70% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Aug | 0.40% | 1.00% | ||

| 12:30 | USD | PPI M/M Aug | 0.40% | 0.30% | ||

| 12:30 | USD | PPI Y/Y Aug | 1.20% | 0.80% | ||

| 12:30 | USD | PPI Core M/M Aug | 0.20% | 0.30% | ||

| 12:30 | USD | PPI Core Y/Y Aug | 2.20% | 2.40% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 8) | 229K | 216K | ||

| 12:45 | EUR | ECB Press Conference | ||||

| 14:00 | USD | Business Inventories Jul | 0.10% | 0.00% | ||

| 14:30 | USD | Natural Gas Storage | 51B | 33B |