Today’s markets are characterized by a sense of caution, with most major pairs and crosses gyrating inside Friday’s range. Japanese Yen is an exception as a stronger performer, although it has not yet seen significant follow-through buying. Dollar and the Euro are currently in a consolidation phase, with traders adopting a ‘wait and see’ approach. Australian Dollar, alongside other commodity-linked currencies, exhibits a softer tone. Swiss Franc is also trending on the softer side, while Sterling is mixed.

The upcoming Asian session is set to feature several key economic indicators that are likely to influence market movements. Japan’s Tokyo CPI, China’s Caixin PMI Services, and RBA rate decision are among the key events. RBA is expected to maintain the interest rate at 4.35%. It is anticipated that RBA will refrain from making any significant policy announcements or giving clear forward guidance until Q4 inflation data is thoroughly analyzed. This approach suggests that the upcoming meeting will likely be procedural.

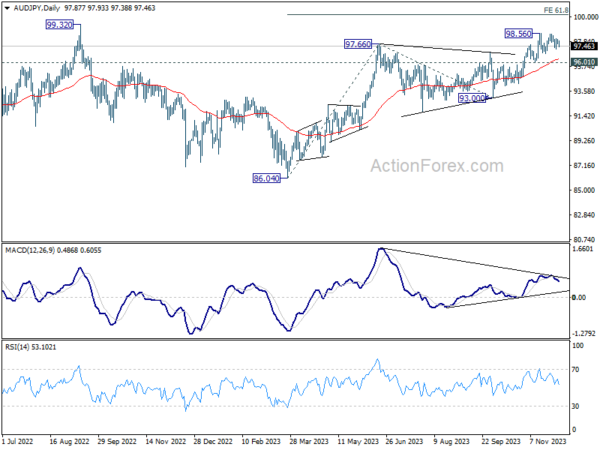

Technically, there is prospect of some volatility in AUD/JPY ahead. The cross turned into sideway consolidation after hitting 98.56 last month. For now, near term outlook will stay bullish as long as 96.01 support holds. Firm break of 98.56 will resume the rise from 86.04 to 61.8% projection of 86.04 to 97.66 from 93.00 at 100.18. Let’s see if the upside breakout would happen this week.

In Europe, at the time of writing, FTSE is down -0.48%. DAX is up 0.10%. CAC is down -0.29%. Germany 10-year yield is down -0.004 at 2.356. Earlier in Asia, Nikkei fell -0.60%. Hong Kong HSI fell -1.09%. China Shanghai SSE fell -0.29%. Singapore Strait Times fell -0.20%. Japan 10-year JGB yield fell -0.0095 to 0.691.

ECB’s de Guindos warns against early celebration of inflation slowdown

ECB Vice-President Luis de Guindos acknowledged the recent slowdown in CPI, which eased to 2.4% last month, describing it as “a positive surprise.” However, he cautioned that it was “too early to declare victory.”

De Guindos emphasized the influence of factors on slowing inflation like “base effect” and warned the potential inflationary impact of withdrawing government measures.

Additionally, he mentioned that “Unit labor costs are increasing in Europe and that is one of the concerns regarding the future evolution of inflation.”

Addressing market expectations, de Guindos observed the anticipation of a soft landing and a prolonged disinflation process in Eurozone. However, he warned, “Such an assumption may not be confirmed in reality due to high uncertainty.”

Eurozone Sentix rose to -16.8, cautious optimism amid inflation outlook

Eurozone Sentix Investor Confidence Index’s latest update offers a mixed but cautiously optimistic view of the region’s economic outlook. In December, the index rose from -18.6 to -16.8, slightly below the expected -16 but marking its highest level since May. Current Situation Index improved from -26.8 to -23.5. More notably, the Expectations Index inched higher from -10.0 to -9.8, reaching its peak since February.

The consecutive rise in the Expectations Index for the third month is a signal that some economists might interpret as the beginning of a trend reversal. However, Sentix cautions against over-optimism, noting “The still weak overall momentum and the lack of a certain amount of international support speak against this.”

Despite these reservations, Sentix identifies potential for significant improvement at the start of the new year, largely due to positive shifts in the inflation outlook. The Sentix inflation barometer, which tracks expectations about inflation, has shown improvement for the fifth consecutive time, reaching 16.25.

Sentix elaborated on this, stating, “From this positive view of inflation, investors not only deduce an end to the central banks’ prolonged cycle of interest rate hikes, but now also expect positive support from monetary policy.” The corresponding theme barometer, reflecting this optimism, has ascended to 14.25, the highest since April 2021.

Swiss CPI slows to 1.4%, import prices turn negative

Swiss CPI fell -0.2 mom in November, below expectation of -0.1% mom. Core CPI (excluding fresh and seasonal products, energy and fuel), was flat at 0.0% mom. Domestic products prices was flat at 0.0% mom. Imported product prices fell -1.1% mom.

Annually, CPI slowed from 1.7% yoy to 1.4% yoy, below expectation of 1.6% yoy. Core CPI slowed from 1.5% yoy to 1.4% yoy. Domestic products prices slowed from 2.2% yoy to 2.1% yoy. Imported product prices turned negative from 0.4% yoy to -0.6% yoy.

BoJ’s Noguchi: Just only beginning to envision inflation target achievement

BoJ board member Asahi Noguchi emphasized the need for continuing ultra-loose monetary policy in Japan.

Noguchi acknowledged on Saturday the impact of global inflation on Japan, stating, “It’s true the impact of elevated global inflation is reaching Japan’s economy with consumer inflation exceeding the BOJ’s 2% target since the spring of 2022.”

However, Noguchi differentiated the nature of Japan’s inflation from that of the West, pointing out that, “the rise is mostly due to cost-push factors amid higher import prices,” contrasting with the wage-driven price increases in US and Europe. This distinction is crucial in understanding BoJ’s monetary policy approach.

To effectively meet the BoJ’s inflation target, Noguchi emphasized “we must see price rises backed by sustained wage increases.”

Despite significant wage hikes in this year’s spring wage negotiations, Noguchi believes that Japan is only at the beginning of its journey to reach its inflation target, stating, “we’ve only just reached a stage where the possibility of achieving our target has come into sight.”

USD/CHF Mid-Day Outlook

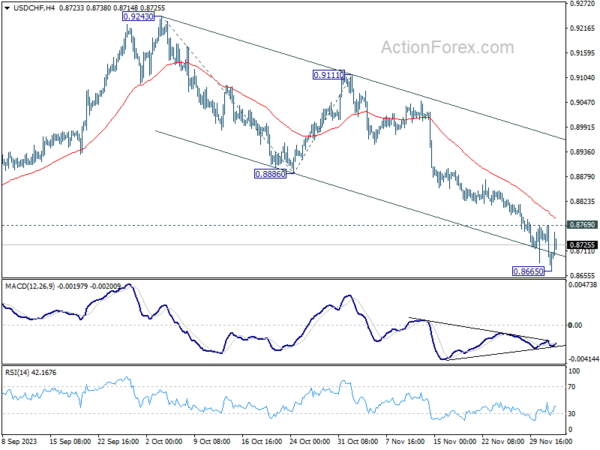

Daily Pivots: (S1) 0.8657; (P) 0.8713; (R1) 0.8746; More….

Intraday bias in USD/CHF remains neutral for the moment. Another fall is in favor as long as 0.8769 minor resistance holds. Below 0.8665 will resume the decline from 0.9243 to 161.8% projection of 0.9243 to 0.8886 from 0.9111 at 0.8533, which is close to 0.8551 low. However, break of 0.8769 minor resistance should indicate short term bottoming, and turn bias back to the upside for stronger recovery.

In the bigger picture, price actions from 0.8551 are currently seen as part of a corrective pattern to the decline from 1.0146 (2022 high). Fall from 0.9243 is seen as the second leg for now. Deeper decline could be seen to 0.8551 low but strong support should be seen there to bring rebound. For now, this will remain the favored case as long as 0.8886 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q3 | -0.60% | -2.10% | 0.40% | 0.30% |

| 23:50 | JPY | Monetary Base Y/Y Nov | 8.90% | 9.50% | 9.00% | |

| 00:00 | AUD | TD Securities Inflation M/M Nov | 0.30% | -0.10% | ||

| 07:00 | EUR | Germany Trade Balance (EUR) Oct | 17.8B | 17.0B | 16.5B | 16.7B |

| 07:30 | CHF | CPI M/M Nov | -0.20% | -0.10% | 0.10% | |

| 07:30 | CHF | CPI Y/Y Nov | 1.40% | 1.60% | 1.70% | |

| 09:30 | EUR | Eurozone Sentix Investor Confidence Dec | -16.8 | -16 | -18.6 | |

| 15:00 | USD | Factory Orders M/M Oct | -2.50% | 2.80% |