Dollar falls mildly in early US trading hours, following the release of core PCE inflation data which indicated a slightly sharper than expected slowdown. However, this weakness in Dollar is somewhat counterbalanced by unexpectedly robust growth in consumer spending. Despite these movements, Dollar remains within its established trading range, with a decisive breakout yet to occur.

Euro, initially under pressure, saw a modest uplift following remarks from several ECB officials. They collectively cautioned against premature expectations of rate cuts, lending some support to the currency.

Nevertheless, Euro continues to lag in performance for the week, trailed by Kiwi and Loonie. Swiss Franc and Yen emerge as the strongest currencies, with the Sterling not far behind. Dollar and Australian Dollar are mixed in the middle.

Given that most major currency pairs and crosses are still confined within familiar ranges, there is potential for shifts in their standings during the final trading hours of the week.

In Europe, at the time of writing, FTSE is up 1.43%. DAX is up 0.10%. CAC is up 2.17%. UK 10-year yield is down -0.038 at 3.954. Germany 10-year yield is down -0.010 at 2.285. Earlier in Asia, Nikkei fell -1.34%. Hong Kong HSI fell -1.60%. China Shanghai SSE rose 0.14%. Singapore Strait Times rose 0.38%. Japan 10-year JGB yield fell -0.0294 to 0.720.

US PCE inflation unchanged at 2.6%, core PCE slows to 2.9%

US personal income rose 0.3% mom or USD 60.0B in December, matched expectations. Personal spending rose 0.7% mom or USD 133.9B, above expectation of 0.4% mom.

PCE price index rose 0.2% mom, matched expectations. Core PCE price index (excluding food and energy) rose 0.2% mom, matched expectations. Goods prices fell -0.2% mom while services prices rose 0.3% mom. Food prices rose 0.1% mom and energy prices rose 0.3% mom.

From the same month a year ago, PCE price index was unchanged at 2.6% yoy, matched expectations. Core PCE price index slowed from 3.2% yoy to 2.9% yoy, below expectation of 3.0% yoy. Goods prices increased less than 0.1% yoy while services prices rose 3.9% yoy. Food prices rose 1.5% yoy while energy prices fell -2.2% yoy.

ECB survey shows lowered inflation expectations and GDP growth forecast

In the latest ECB Survey of Professional Forecasters for Q1 2024, inflation expectations have been revised downwards across all horizons. For the immediate years, headline HICP inflation is projected to decrease from 2.4% in 2024 to 2.0% in 2025 and 2026. These revised figures represent a downward adjustment of 0.3 percentage points for 2024 and a slight 0.1 percentage point decrease for 2025.

Similarly, core HICP inflation, which excludes volatile components like energy and food, has also been revised downward for 2024 to 2.6%, with a further reduction to 2.1% expected in 2025. By 2026, core inflation is projected to align with ECB’s target, reaching 2.0%. The revisions for 2024 and 2025, each marked by a 0.3 and 0.1 percentage point decrease respectively, reflect an anticipated easing in the underlying inflationary trends.

On the growth front, expectations for real GDP have been adjusted downward for both 2024 and 2025. The forecasters now anticipate GDP growth of 0.6% in 2024, followed by a modest recovery to 1.3% in 2025 and slightly higher growth of 1.4% in 2026. These projections, revised down by 0.3 and 0.2 percentage points for 2024 and 2025 respectively, indicate a cautious outlook on economic expansion in the near term.

ECB’s Vujcic advocates gradual approach to future rate cuts

ECB Governing Council members Boris Vujcic and Gediminas Simkus have underscored the importance of a cautious approach to future interest rate reductions. In separate interviews occasions, both officials emphasized the need for patience in evaluating economic data before committing to rate cuts.

Boris Vujcic highlighted the necessity of ensuring that inflation is “firmly sustainably on the way” towards ECB’s medium-term target. He emphasized a gradual approach, stressing that ECB should wait for sufficient data to validate a downward trajectory in inflation rates.

Vujcic also expressed a preference for rate cuts in increments of 25 basis points, though he did not exclude the possibility of larger steps if warranted by economic data.

Gediminas Simkus, on the other hand, indicated that a rate cut in March is unlikely. He suggested that the likelihood of rate reductions would increase as 2024 progresses, describing this increase as “exponential, not linear.” This statement implies a growing possibility of monetary easing later in the year, contingent upon evolving economic indicators.

ECB’s Kazaks cautions against hasty rate cuts

ECB Governing Council member Martins Kazaks emphasized a cautious approach to reducing interest rates in an interview with BloombergTV. He acknowledged that while a downward adjustment in rates is anticipated, the ECB should not hasten this process, cautioning against premature actions that could potentially rekindle inflation.

Kazaks drew parallels to historical instances, particularly from the 1970s and 80s, to underline the risks associated with relaxing monetary policy too soon. “There’s the risk that inflation starts to come back and then one would need to raise rates much more,” he added.

Regarding, the timing and magnitude of easing cycles, he indicated that ECB could opt for either smaller steps initiated earlier or larger steps taken at a later stage. But Kazaks emphasized that would be “all data dependent”.

Germany’s Gfk consumer sentiment plummets to -29.7, hopes of recovery dashed

Consumer sentiment in Germany has taken a substantial downturn, reaching its lowest level since March 2023. The Gfk Consumer Sentiment Indicator for February sharply declined from -25.4 to -29.7, faring worse than the anticipated -24.3. This significant drop signals a reversal of the temporary improvement observed last month, which now appears to have been a fleeting pre-Christmas optimism.

Economic expectations in January plummeted to their lowest since December 2022, dropping from -0.4 to -6.6. Income expectations suffered a marked decline from -6.9 to -20.0, the weakest since March 2023. Concurrently, willingness to buy among consumers decreased from -8.8 to -14.8. Willingness to save has shown an increase, rising from 7.3 to 14.0, the highest level since August 2008. This suggests a shift in consumer behavior towards saving rather than spending.

Rolf Bürkl, consumer expert at NIM, remarked that the brief improvement in consumer sentiment witnessed last month was merely a transient spike. The decline in income expectations and willingness to buy, coupled with a growing propensity to save, have contributed to a significant setback in the Consumer Climate at the start of the year.

Japan’s Tokyo CPI slows sharply to 1.6%, raises questions on BoJ’s negative rates exit

Japan’s Tokyo CPI core (ex-food) slowed significantly from 2.1% yoy to 1.6% yoy in January, below expectation of 1.9% yoy. That’s also the lowest rate since March 2022. Additionally, core-core CPI (ex-food and energy) declined from 3.5% yoy to 3.1% yoy, marking a fifth consecutive month of decline. Headline CPI mirrored this trend, falling from 2.4% yoy to 1.6% yoy.

The latest Tokyo CPI data has sparked a debate among economists regarding its influence on BoJ strategy to phase out negative interest rates. While some analysts believe this data won’t significantly impact BoJ’s plan, anticipating the first rate hike since 2007 in April, others are more cautious. They suggest that the surprising drop in Tokyo inflation might lead BoJ to reconsider or delay the decision.

In parallel, December’s corporate services price index remained steady at 2.4% yoy, aligning with the near nine-year high recorded in November.

BoJ’s minutes emphasize importance of discussions on exiting negative rates

The minutes from BoJ’s meeting on December 18-19 highlighted a focus on strategic discussions regarding the future of its monetary policy. The members agreed on the importance to “deepen discussions” about the “timing of the exit” from the current monetary policy framework and determining the “appropriate pace of raising policy interest rates thereafter.” This discussion is closely tied to the evolving dynamics of “wage and price developments.”

A key sentiment echoed by many members was the prerequisite for a sustainable and stable achievement of the price stability target before considering the termination of the negative interest rate policy and the yield curve control framework. The establishment of a “virtuous cycle between wages and prices” was reiterated as a necessary condition for these policy shifts.

Additionally, some members expressed the viewpoint that BoJ is “not in a situation where it would fall behind the curve” if it did not rush to raise policy interest rates. This perspective suggests a cautious approach to monetary tightening, implying that the central bank doesn’t feel pressured to act hastily in adjusting its interest rate policy.

GBP/USD Mid-Day Outlook

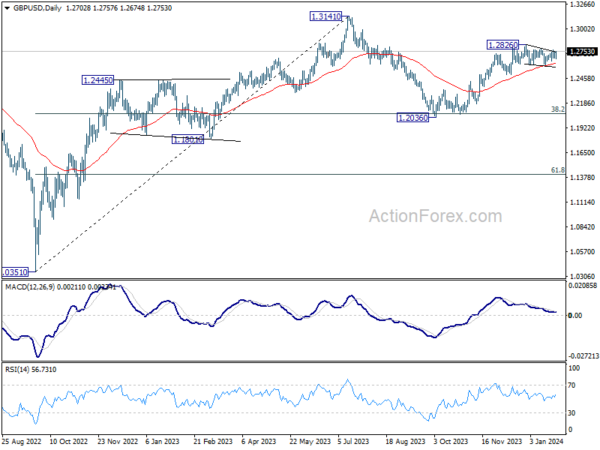

Daily Pivots: (S1) 1.2679; (P) 1.2711; (R1) 1.2740; More…

Intraday bias in GBP/USD stays neutral and outlook is unchanged. On the upside, firm break of 1.2784 resistance will suggest that consolidation pattern has completed. Further rise should be seen through 1.2826 to resume the rise from 1.2036. Next target will be 1.3141 high. On the downside, while another pull back cannot be ruled out, downside should be contained above 1.2499 support to bring rebound.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Jan | 1.60% | 2.40% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Jan | 1.60% | 1.90% | 2.10% | |

| 23:30 | JPY | Tokyo CPI ex Food & Energy Y/Y Jan | 3.10% | 3.50% | ||

| 23:50 | JPY | Corporate Service Price Index Y/Y Dec | 2.40% | 2.40% | 2.30% | 2.40% |

| 23:50 | JPY | BoJ minutes | ||||

| 00:01 | GBP | GfK Consumer Confidence Jan | -19 | -21 | -22 | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Feb | -29.7 | -24.3 | -25.1 | -25.4 |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Dec | 0.10% | -0.70% | -0.90% | |

| 13:30 | USD | Personal Income M/M Dec | 0.30% | 0.30% | 0.40% | |

| 13:30 | USD | Personal Spending Dec | 0.70% | 0.40% | 0.20% | 0.40% |

| 13:30 | USD | PCE Price Index M/M Dec | 0.20% | 0.20% | -0.10% | |

| 13:30 | USD | PCE Price Index Y/Y Dec | 2.60% | 2.60% | 2.60% | |

| 13:30 | USD | Core PCE Price Index M/M Dec | 0.20% | 0.20% | 0.10% | |

| 13:30 | USD | Core PCE Price Index Y/Y Dec | 2.90% | 3.00% | 3.20% | |

| 15:00 | USD | Pending Home Sales M/M Dec | 1.60% | 0.00% |