Yen declined notably during the European session and stays weak as markets enter into US session. The selloff comes in the wake of rebound in European and US benchmark yields. Despite positive news from Japan, where large corporations have committed to significant wage increases for the first time in decades, the Yen struggled to find support. BoJ Governor Kazuo Ueda’s remarks to the parliament underscored the importance of this year’s wage negotiations, stating, “we hope to reach an appropriate decision (at next week’s meeting) looking comprehensively at these results,” along with other economic data.

Overall for the day, Yen is the weakest current, with Swiss Franc and the Dollar also underperforming. On the flip side, Euro led the strength chart, followed by Australian Dollar and New Zealand Dollar. Pound and Canadian Dollar are mixed in the middle. In particular, Sterling showed indifference to GDP data that aligned with expectations and hinted at the UK’s exit from last year’s recession.

Technically, Copper surges sharply higher today, and the break of 3.9346 resistance confirms resumption of whole rebound from 3.5021. Further rise is now in favor as long as 3.8422 support holds, for 100% projection of 3.5021 to 3.9346 from 3.6324 at 4.0649. Decisive break there with strong momentum will raise the chance that it’s resuming the rise from 3.1314 too, and target 4.3556 resistance next. Meanwhile, rejection by 4.0649 will keep the rebound corrective, and suggest that consolidation from 4.3556 is still on-going. Also, firm break of 4.0649 in Copper could give Aussie a lift.

In Europe, at the time of writing, FTSE is up 0.10%. DAX is up 0.02%. CAC is up 0.55%. UK 10-year yield is up 0.0397 at 4.086. Germany 10-year yield is up 0.0107 at 2.343. Earlier in Asia,Nikkei fell -0.26%. Hong Kong HSI fell -0.07%. China Shanghai SSE fell -0.40%. Singapore Strait Times rose 0.61%. Japan 10-year JGB yield fell -0.0074 to 0.761.

Eurozone industrial production falls -3.2% mom in Jan, EU down -2.1% mom

Eurozone industrial production fell -3.2% mom in January, much worse than expectation of -1.0% mom. Production increased by 2.6% for intermediate goods, increased by 0.5% for energy, decreased by -14.5% for capital goods, decreased by -1.2% for durable consumer goods, decreased by -0.3% for non-durable consumer goods.

EU industrial production fell -2.1% mom. Among Member States for which data are available, the largest monthly decreases were recorded in Ireland (-29.0%), Malta (-9.4%) and Estonia (-6.6%). The highest increases were observed in Poland (+13.3%), Slovenia (+10.6%) and Lithuania (+7.2%).

ECB’s Kazaks: Inflation dragon nearly defeated, rate cuts on horizon

ECB Governing Council member Martins Kazaks likened the fight against inflation to battling a dragon, stating in a blog post, “The dragon of inflation is pinned to the ground, a little more and it will be defeated.” This vivid metaphor reflects a growing confidence within ECB that the persistent inflationary pressures which have challenged Eurozone economy are finally coming under control.

Kazaks further suggested that “if the economy roughly follows” the bank’s forecasts, “then the decision to start reducing interest rates could be made within the next few meetings.”

Kazaks also acknowledged the delicate balance the ECB has had to maintain: the risk of premature rate cuts that could reignite inflation versus the risk of delaying rate reductions too long. However, he noted that these risks are now beginning to “level out,” there is “no need to delay the rate reduction too much”

Complementing Kazaks’s insights, ECB Governing Council member Francois Villeroy de Galhau told France Info radio, “We will probably cut rates in spring, and spring in Europe is from April to June 21.”

“It’s perhaps more probable in June — we are very pragmatic and will see depending on the data,” Villeroy added.

UK GDP grows 0.2% mom in Jan, matches expectations

UK GDP expanded by 0.2% mom in January, matched expectations. Services was up 0.2% mom, and was the largest contributor to growth. Production fell -0.2% mom while construction grew 1.1% mom.

In the three months to January, GDP has fallen by -0.1% 3mo3m. Services was flat. Production fell -0.2% 3mo3m. Construction fell -0.9% 3mo3m.

NIESR forecasts 0.3% UK GDP growth in Q1

NIESR forecast UK GDP to grow by 0.3% in Q1, aligns with a pattern of “low, but stable economic growth,” suggesting a potential “turning point” for the nation after slipping into a technical recession in the latter half of 2023.

The forecast comes with a critical analysis of UK’s economic stagnation, emphasizing the necessity for “structural changes” to break free from the so-called low-growth trap. The institute’s recommendation underscores the importance of bolstering public investment, particularly in pivotal areas such as infrastructure, education, and health.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 146.85; (P) 147.44; (R1) 148.27; More…

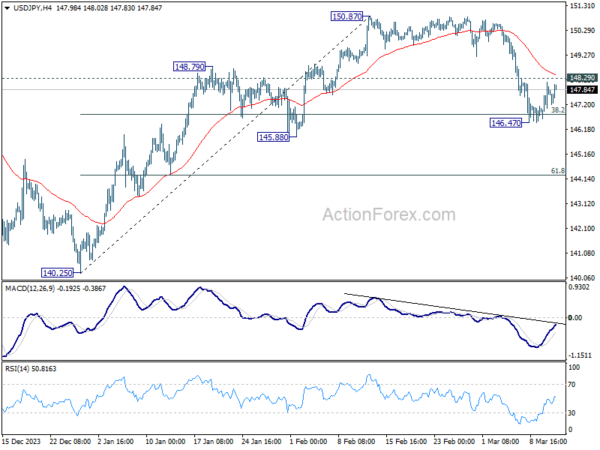

USD/JPY is staying in range between 146.47 and 148.29 and intraday bias remains neutral. On the downside, sustained break of 38.2% retracement of 140.25 to 150.87 at 146.81 will argue that fall from 150.87 is reversing the whole rally from 140.25. In this case, deeper decline would be seen to 61.8% retracement at 144.30 and below. Nevertheless, strong support from 146.81, followed by break of 148.29 minor resistance resistance, will argue that fall from 150.87 is merely a correction, which has completed already. Retest of 150.87 should be seen next.

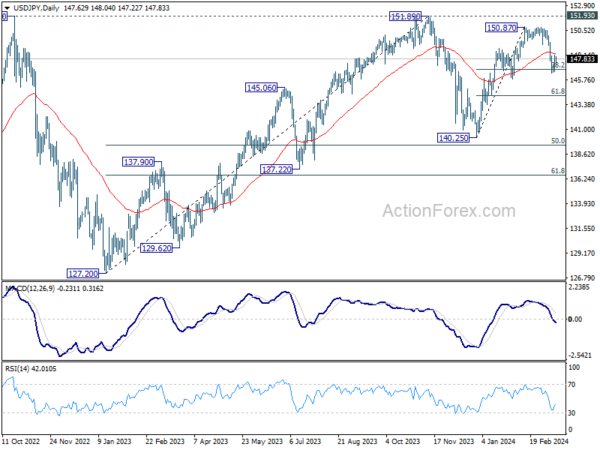

In the bigger picture, no change in the view that price action from 151.89 (2023 high) are correction to up trend from 127.20 (2023 low). The question is whether this correction has completed at 140.25, or extending with fall from 150.87 as the third leg. Sustained break of above mentioned 146.81 fibonacci level will favor the latter case. But even so, downside should be contained by 50% retracement of 127.20 to 151.89 at 139.54.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | GBP | GDP M/M Jan | 0.20% | 0.20% | -0.10% | |

| 07:00 | GBP | Manufacturing Production M/M Jan | 0.00% | 0.00% | 0.80% | |

| 07:00 | GBP | Manufacturing Production Y/Y Jan | 2.00% | 2.00% | 2.30% | |

| 07:00 | GBP | Industrial Production M/M Jan | -0.20% | 0.00% | 0.60% | |

| 07:00 | GBP | Industrial Production Y/Y Jan | 0.50% | 0.70% | 0.60% | |

| 07:00 | GBP | Goods Trade Balance (GBP) Jan | -14.5B | -15.0B | -14.0B | |

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | -3.20% | -1.00% | 2.60% | 1.60% |

| 13:00 | GBP | NIESR GDP Estimate (3M) Feb | 0.00% | -0.10% | ||

| 14:30 | USD | Crude Oil Inventories | 0.9M | 1.4M |