Dollar traded broadly lower while stocks struggled in tight range as markets are dissatisfied with the lack of clarity on economic policies at president-elect Donald Trump’s first post election press conference. DJIA gained 98.75 pts, or 0.50%, to close at 19954.28, still lacks buying to push through 20000 handle. S&P 500 rose 6.42 pts, or 0.28%, to close at 2275.32, kept below recent high at 2282.10. Dollar index had a volatile day yesterday, jumping to as high as 102.95 but then reversed and dipped to as low as 101.28, now back at 101.50. Gold rode on Dollar weakness and extended recent rebound, set to take on 1200 handle today. WTI crude oil also rebounded and is trading above 52 for the moment. In the currency markets, Yen is clearly strengthening on falling yield but is overwhelmed by the strength in Aussie. Sterling and Dollar remain the two weakest major currency for the week.

In UK, BoE governor Mark Carney hinted that the central bank could raise economic forecast in the quarter inflation report to be published next month. He noted that "recent data would be consistent with some further upgrade of the forecast but that process has not yet started." Regarding the risk of Brexit to financial stability, Carney noted that "there are greater financial stability risks on the continent in the short term, for the transition, than there are for the UK." And he urged that financial institutions in EU countries to "think very carefully about the transition from where you are today to where the new equilibrium will be."

Meanwhile, ECB president Mario Draghi urged oversight of UK’s clearing activities even after Brexit. Draghi noted that "It will be important to find solutions that at least preserve, or ideally enhance, the current level of supervision and oversight." ECB spokes man Rolf Benders said that "the location of clearing houses for euro payment and settlement services after the U.K. leaves the European Union will depend on details of the exit agreement."

On the data front, Japan current account surplus narrowed to JPY 1.80T in November. Eurozone industrial production and ECB monetary policy meeting accounts are the main features in European session. US will release jobless claims and import price index later today. Canada will release new housing price index.

USD/JPY Daily Outlook

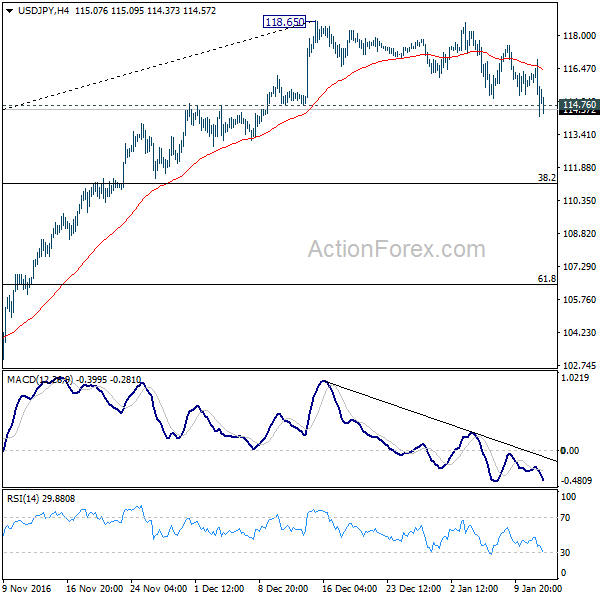

Daily Pivots: (S1) 114.12; (P) 115.50; (R1) 116.76; More…

USD/JPY’s fall and break of 114.76 support indicates short term topping at 118.65. Intraday bias is back on the downside for 55 day EMA (now at 113.10) and below. At this point, we’d expect strong support from 38.2% retracement of 98.97 to 118.65 at 111.13 to contain downside and bring rally resumption. Above 118.65 will target at test on 125.85 key resistance next. However, sustained break of 111.13 will argue that whole rise from 98.97 has completed and bring deeper fall to 61.8% retracement at 106.48 and below.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Rejection from 125.85 and below will extend the consolidation with another falling leg before up trend resumption.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) Nov | 1.80T | 1.48T | 1.93T | |

| 5:00 | JPY | Eco Watchers Survey: Current Dec | 49.3 | 48.6 | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Nov | 0.50% | -0.10% | ||

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | CAD | New Housing Price Index M/M Nov | 0.30% | 0.40% | ||

| 13:30 | USD | Initial Jobless Claims (JAN 7) | 255k | 235k | ||

| 13:30 | USD | Import Price Index M/M Dec | 0.70% | -0.30% | ||

| 15:30 | USD | Natural Gas Storage | -49B |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box