Euro is back under broad based selling pressure after an ex-IMF official accepted the mandate to form an interim government. While traders were relieved that the anti-establishment eurosceptic coalition government couldn’t be formed, they’re now facing uncertainty of a new election. EUR/USD has already broken last week’s low at 1.1643 to resume recent downside. 1.16 handle will likely be broken soon. EUR/JPY also followed and broke 127.14 temporary low.

Elsewhere in the currency markets, Canadian Dollar follows Euro and Swiss Franc as the weakest one. WTI crude oil is extending recent fall and hits as low as 65.80 so far today. New Zealand Dollar, Australian Dollar and Sterling are the better performing ones as no news is good news.

German-Italian yield spread widens again as ex-IMF official takes mandate to form interim government

Euro’s rebound today was rather short lived. It’s based on relief that the anti-establish, eurosceptic coalition government of the 5 Start Movement and the League couldn’t be formed. But then the common currency is back under pressure as investors remember that Italy will now likely head to another election. That sentiment is also clearly reflected in widening of German-Italy yield spread again. German 10 year yield bund once jumped to 0.463 earlier today but it’s down at 0.358, down -0.048. Italy 10 year government bond yield dropped to 2.35 earlier today but it’s now at 2.664, up 0.112.

In swift arrangements, former IMF Director of the Fiscal Affairs Carlo Cottarelli accepted Italian President Sergio Mattarella’s appointment to form an interim government. That came after Giuseppe Conte abandoned the effort to form a new coalition government of the 5-Star Movement and the League, following Mattarella’s veto of eurosceptic Paolo Savona as the as economy minister.

The Prime Minister designate Cottarelli said that “I’ll present myself to parliament with a program which – if it wins the backing of parliament – would include the approval of the 2019 budget. Then parliament would be dissolved with elections at the beginning of 2019.” Or, “in the absence of (parliament’s) confidence, the government would resign immediately and its main function would be the management of ordinary affairs until elections are held after the month of August.”

Based on responses from political parties, the next elections will likely be held in August.

South Korean Moon: Meeting with Kim Jong-un was easy like a casual meeting

South Korean President Moon Jae-in said in a meeting with senior secretaries that the meeting with North Korean leader Kim Jong-un on Saturday was “just like a casual meeting” and that’s “more important than anything”. He added that “leaders easily got in contact, easily made an appointment and easily met to discuss urgent matters, without complicated procedures and formalities, just like a casual meeting.”

Moon also noted that the Saturday meeting was organized on short notice after Kim’s request. And that could be a model for further contact between the two Koreas. He noted “if we could hold working-level, back-to-back talks on both sides of Panmunjom if urgently necessary in addition to formal summits, it would expedite faster advancement of inter-Korean relations.”

After Moon’s effort to revive the Kim-Trump summit, US officials are now in North Korea for the details. It’s reported that Sung Kim, the former US ambassador to South Korea, was leading the American delegation to meet North Korean officials. Sung Kim was hailed by a former senior South Korean official as ” capable, level-headed, cautious, and has solid grasp of the issues and knows North Koreans well.” At the same time, Sung Kim has “healthy scepticism”.

Abe to tell Trump Japanese carmakers made huge contributions to the US economy

Japan Prime Minister Shinzo Abe was asked in the parliament today about Trump intention to impose tariffs on car imports using national security as excuse. Abe said he would seek to convince Trump that Japan carmakers are important in boosting the US economy.

He noted that Japan auto makers have “created jobs and made huge contributions to the U.S. economy.” And he added that the number of cars Japanese automakers produce in the US is double the number it exports to the country.

And he emphasized that “as a country that prioritizes a rule-based, multilateral trade system, Japan believes that any steps taken on trade must be in line with World Trade Organization rules.”

Separately, he added that “Japan has explained to the United States its stance that TPP is the best format for both countries. We will continue to talk with the United States based on this view.”

EUR/JPY Mid-Day Outlook

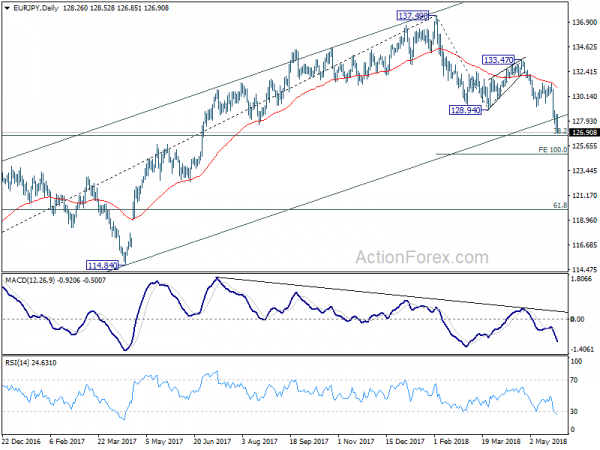

Daily Pivots: (S1) 126.86; (P) 127.70; (R1) 128.25; More….

EUR/JPY’s decline resumed after brief recovery and intraday bias is back on the downside. Current fall should now target 126.61 medium term fibonacci level. Based on current momentum, EUR/JPY will likely dive through this level to 100% projection of 137.49 to 128.94 from 133.47 at 124.92. On the upside, above 128.52 minor resistance will turn intraday bias neutral again. But after all, near term outlook will remain bearish as long as 129.22 support turned resistance holds and further fall is expected ahead.

In the bigger picture, bearish divergence in daily MACD and current strong downside momentum is raising the chance of medium term trend reversal. Sustained break of 38.2% retracement of 109.03 to 137.49 at 126.61 will argue that whole up trend from 109.03 has completed at 137.49 already. And, deeper decline would be seen to 61.8% retracement at 119.90 and below. Though, strong support from 126.61 and rebound from there would revive medium term bullish for another high above 137.49.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Apr | 0.90% | 0.50% | 0.50% |