The set of lower than expected consumer inflation data from the US was music of joy for investors. Stocks surged while treasury yield tumbled, on expectation that Fed is ready to start slowing down tightening pace in December. Risk-on sentiment was broad-based with NASDAQ starting to realign with DOW, despite crypto rout.

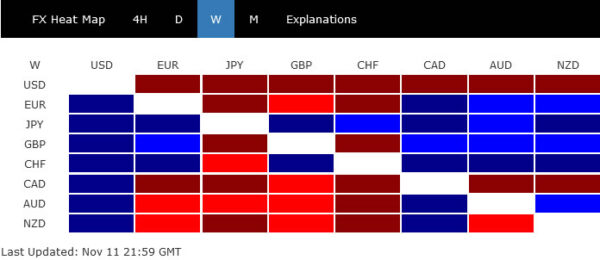

Dollar suffered steep, broad-based selloff as medium term correction is confirmed. While deeper decline is expected, it’s too early to call for reversal. Selling could start to slow in the coming weeks. Yen surged most against others, with help from falling yields and lesser divergence between BoJ and Fed.

Meanwhile, European majors are the next winners, with Swiss Franc outperforming Euro and Sterling. Surprisingly, commodity currencies were just mixed, considering the strong rise in China and Hong Kong markets too. Still, Australian Dollar appeared to be the stronger one, comparing to Kiwi and Loonie.

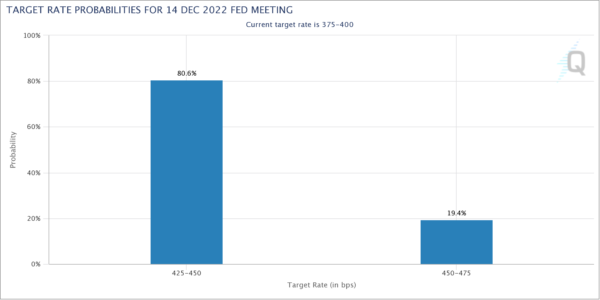

Markets see 80% chance of 50bps Fed hike in Dec

Weaker than expected CPI data from the US gave risk sentiment a strong boost. Traders were also quick to reprice Fed’s policy path. Now, there is more than 80% chance of a 50bps hike at December 14 meeting to 4.25-4.50%.

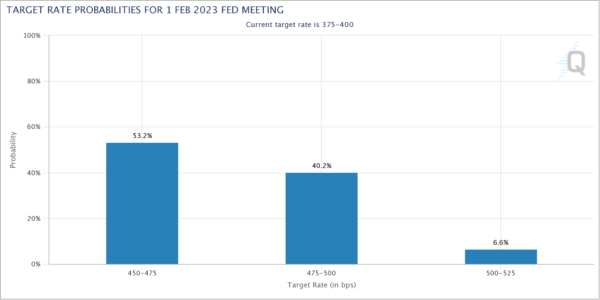

Regarding February meeting, markets are pricing in over 53% chance of a 25bps hike to 4.50-4.75%.

DOW surged, NASDAQ finally re-aligning

DOW had another strong rally last week and the break of the trend line resistance affirms the case that whole corrective fall from 36952.65 has completed with three waves down to 28600.94. It’s still early to determine if rise from 28600.94 is the second leg of a long term consolidation pattern, or the start of an up trend. But in either case, further rally is expected as long as 31727.05 support holds. Break of 34281.36 resistance will pave the way to retest 36952.56 high.

A more important development was, perhaps, that NADAQ also broke through 11230.44 resistance to resume the rebound from 10088.82. The break above 55 day EMA also affirms near term bullishness, at least. Further rise is now in favor to trend line resistance at 12220. Firm break there will re-align the outlook with DOW. That is, whole correction from 16212.22 has completed and further rise would be seen to 13181.08 resistance next.

10-yield yield dived but 3.64 should be the floor

10-year yield dropped sharply to close at 3.813, as correction from 4.333 extended with a third leg. For now, TNX is seen as in correction to the rise from 2.525 only. Strong support is expected around 38.2% retracement of 2.525 to 4.333 at 3.642 to bring rebound, to extend the corrective pattern. Such development will keep the downside in USD/JPY, and other Yen crosses somewhat floored, to keep then in consolidations.

However, in the unlikely case that TNX breaks through 3.483 resistance turned support decisively, that could be a signal that it’s in correction to a larger up trend. That could be accompanied by steep medium term decline in Yen pairs in general.

Dollar in medium term correction, but 103/105 should contain downside

Dollar index dived last week on the back on Fed expectations, falling yields, and rising stocks. The development indicates that it’s already in correction to whole up trend from 89.20. Deeper decline is expected as long as 109.53 support turned resistance holds. Next target is cluster support zone at 104.63/105.00 (38.2% retracement of 89.20 to 114.77 at 105.00).

Such cluster support at 104.63/105.00 could be breached. But DXY will then face another zone between 102.99, 103.82, as well as 55 week EMA (now at 103.80). Hence, downside potential below 104.63 should be very limited, and a bottom should be formed anywhere between 103/105 to bring rebound.

But of course, sustained break of 102.99 will argue that something more substantial is happening and would open up deeper fall back to 55 month EMA at 97.02, which is rather unlikely from current perspective.

Swiss Franc and Aussie have the potential to outperform

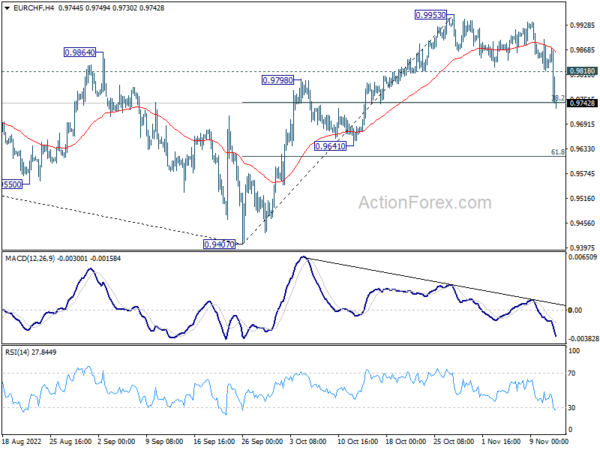

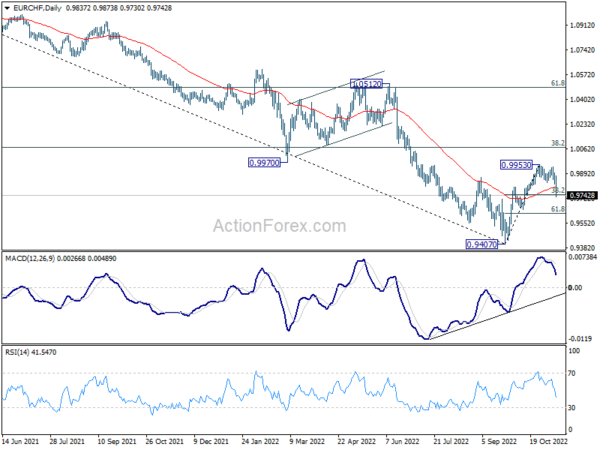

Among European majors, Swiss Franc has the potential to continue to outperform in the near term. GBP/CHF has already completed a head and should top pattern. Meanwhile EUR/CHF has also broken 0.9798 resistance turned support. The development in EUR/CHF indicate that rise from 0.9407 has completed at 0.9953, ahead of 0.9970 support turned resistance. It’s now at least in correction to rise from 0.9407.

Further decline is expected now as long as 0.9818 support turned resistance holds. Sustained trading below 38.2% retracement of 0.8407 to 0.9953 will pave the way to 61.8% retracement a 0.9616, and possibly below.

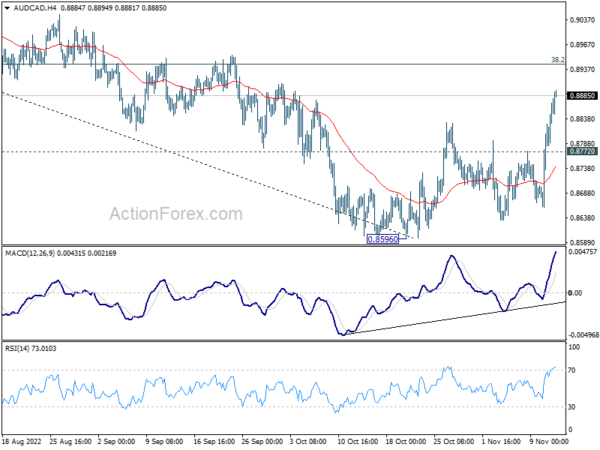

At the same time, AUD/CAD’s strong rally suggests that Aussie has the potential to outperform. 0.8596 is at least a short term bottoming, as supported by medium term channel. Further rally is expected as long as 0.8772 minor support holds, to 38.2% retracement of 0.9514 to 0.8596 at 0.8947. Decisive break there will raise the chance of larger reversal, and target 61.8% retracement at 0.9163, and possibly further to channel resistance at around 0.9260.

USD/JPY Weekly Outlook

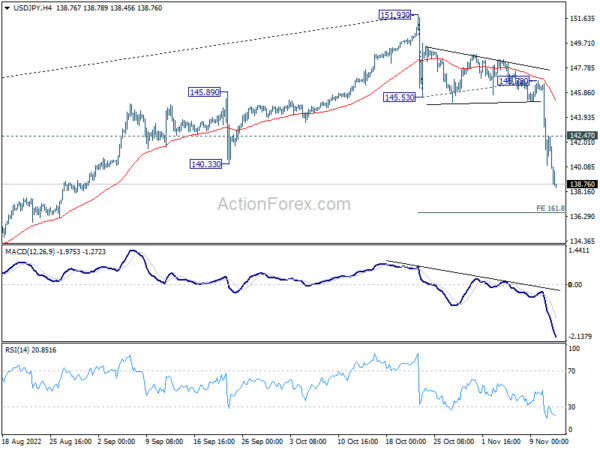

USD/JPY’s decline accelerated to as low as 138.76 last week. The development suggests that it’s already in correction to whole up trend from 102.58. Initial bias stays on the downside this week for 161.8% projection of 151.93 to 145.53 from 146.78 at 136.42. On the upside, above 142.47 minor resistance will turn intraday bias neutral first. But risk will remain on the downside as long as 145.53 support turned resistance holds.

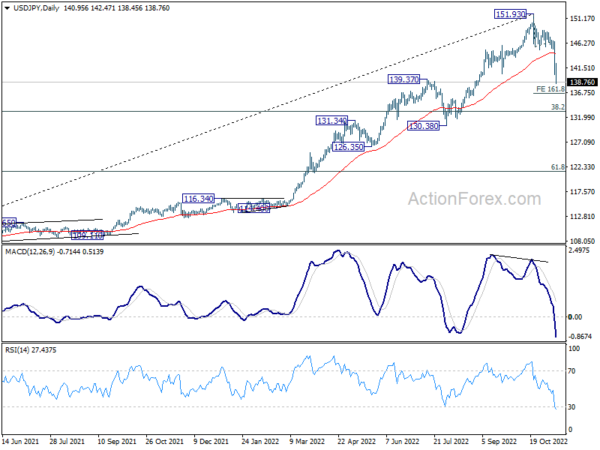

In the bigger picture, a medium term top should be formed at 151.93. Fall from there is correcting larger up trend from 102.58. It’s too early to call for bearish trend reversal. But even as a corrective move, such decline should target 38.2% retracement of 102.58 to 151.93 at 133.07, or further to 55 week EMA (now at 130.73).

In the long term picture, rise from 102.58, as part of the up trend from 75.56 (2011 low) was put to a halt at 151.93, just ahead of 100% projection of 75.56 to 125.85 from 102.58 at 152.87. There is no clear sign of long term reversal yet. Such up trend is expected to resume at a later stage, as long as 125.85 resistance turned support holds.