Despite policy tightening from ECB and Fed’s hawkish hold last week, global markets largely shrugged off the central banks’ actions. Investors’ sentiment remained buoyant, propelling many global markets to impressive rallies. Germany’s DAX index even recorded a new all-time high.

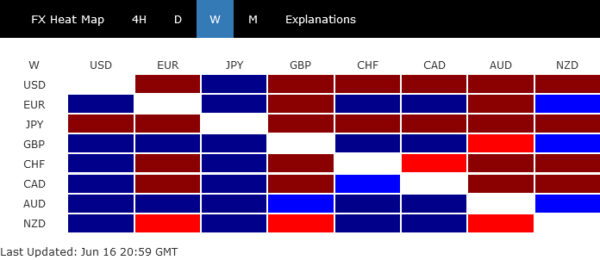

In the forex market, Yen took a significant hit and emerged as the week’s worst performer by a mile. Policy divergence between BoJ and other central banks was a dominant factor led to the Yen’s underperformance. Dollar wasn’t far behind, sliding further as the correlation with risk sentiment seemed to invert once again. Swiss Franc, another traditional safe-haven currency, was the third weakest performer, further underscoring the prevailing risk-on environment.

Contrastingly, Australian Dollar outperformed, buoyed by robust domestic job data and expectations of further monetary tightening. Commodity prices also got a boost following China’s decision to cut rates, providing an additional lift to the Aussie. British Pound secured the second strongest position, propelled by expectations of more rate hikes from BoE and significant buying against European majors. Euro, despite ECB’s rate hike, lagged behind, only ended as the third strongest for the week.

US stocks extended rally, bullish investors skeptical on Fed’s rate projections

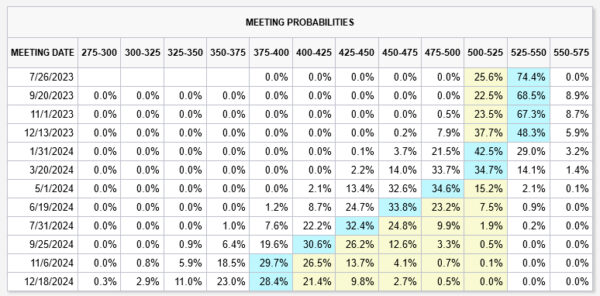

Fed maintained interest rates at 5.00-5.25% during last week’s FOMC meeting, an outcome that was in line with market expectations. However, it made a surprising upward adjustment in the median economic projections for the year, indicating that federal funds rate could peak at 5.60% instead of previously forecast 5.10%. This suggests two more 25bps rate hikes this year.

According to the new dot plot, twelve Fed members are now expecting rates to reach 5.50-5.75% or higher within the year. Also, the central bank foresees interest rates falling at a slower pace, dropping to 4.6% in 2024 (as opposed to the earlier forecast of 4.3%), and then to 3.4% in 2025 (versus t 3.1%).

However, these hawkish projections appear not to have convinced the markets. Fed fund futures show a 74.4% likelihood of another 25bps hike in July, bringing rates to 5.25-5.50%. Yet, the probability of an additional hike for the remainder of the year stands at less than 10%. Though, expectations for the first rate cut are now pushed forward to January, with odds around 68%.

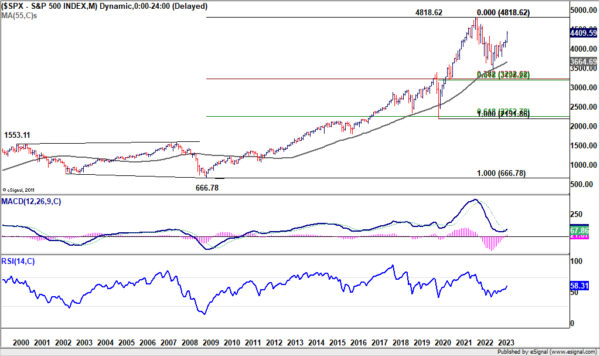

Interestingly, US stocks largely shrugged off Fed’s more aggressive rate projections. The three major indexes ended the week on a higher note. S&P 500 convincingly surpassed key structural and cluster resistance at 4325.28 (61.8% retracement of 4818.62 to 3491.58 at 4311.69), to close at 4409.50.

This development should confirm that corrective fall from 4818.62 has concluded at 3491.58, after drawing support from 55 M EMA.

Whether the rise from 3491.58 marks the second leg of the corrective pattern from 4818.62 or signifies a resumption of the long-term uptrend remains to be seen. Regardless, as long as 4261.07 support holds, near-term outlook will remain bullish. Retest of 4818.62 high should be seen next.

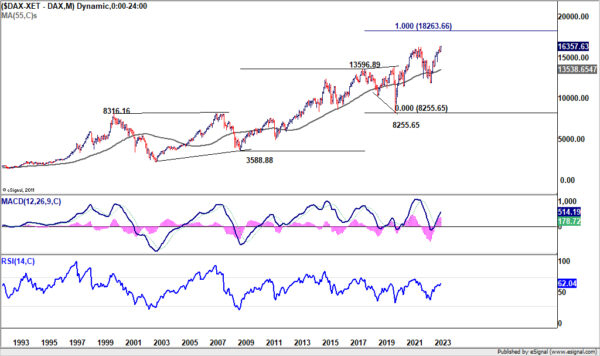

DAX hit new record despite ECB hike and hawkish stance

ECB delivered on expectations by hiking interest rates by 25bps, elevating the main refinancing and deposit rates to 4.00% and 3.50% respectively. The decision came alongside a notable upward revision the core inflation forecast for 2023 and 2024, with a slight bump in 2025 projection. Concurrently, growth estimates were slightly reduced for 2023 and 2024.

In her post-meeting press conference, ECB President Christine Lagarde unequivocally underscored the hawkish stance. Lagarde emphasized that the central bank is not finished with its policy adjustments, stating, “Are we done? Have we finished the journey? No. We’re not at our destination. Do we still have ground to cover? Yes, we still have ground to cover.”

Lagarde explicitly indicated continued tightening trajectory in the near term, adding, “Barring a material change to our baseline, it is very likely that we will continue to increase rates at our next policy meeting in July.” Thereafter, the central bank will continue to follow a “data-dependent approach”.

Yet European stock investors were not bothered by hawkish ECB. DAX has indeed extended its medium term up trend to close at new record high at 16357.53. For the near term, outlook will stay bullish as long as 55 D EMA holds (now at 15851.59). Next target is 61.8% projection of 11862.84 to 15658.56 from 14458.39 at 16804.14.

Depending on sustainability of buying momentum, there is prospect for DAX to target 61.8% projection of 3588.88 to 13596.89 from 8255.65 at 18263.66 in the medium term.

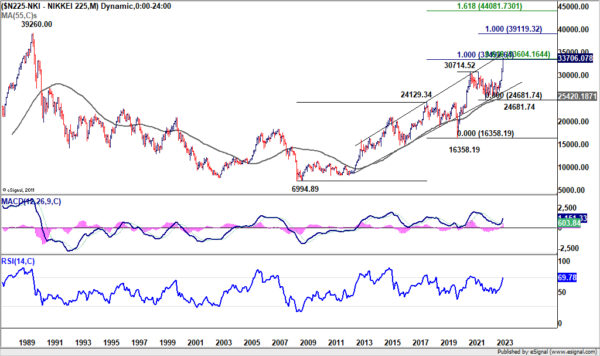

Nikkei surged as BoJ refrained from policy normalization, ready for record high?

The story in Japan was slightly different. BoJ continued to refrain from ending the ultra-loose monetary policy, stood pat last week. Governor Kazuo Ueda indicated clearly that inflation could fall below target ahead, and “that’s why we are not normalizing monetary policy”.

Nikkei surged earlier in the week and kept almost all of its gains after BoJ, closing at 33706.07, another three-decade high. Indeed, Nikkei has closed above a key cluster projection level at around 33500, including 61.8% projection of 16358.19 to 30714.52 from 24681.74 at 33533.95. and 100% projection of 6994.89 to 24129.34 from 16458.19 at 33492.64.

Near term outlook would stay bullish as long as 31383.05 support holds. Next target is 100% projection of 16358.16 to 30714.52 from 24681.74 at 39119.32, which is close to 1990 record high at 39260.00.

Meanwhile, it should be noted that Nikkei’s momentum could depend on whether Japan would allow Yen to continue depreciation at the current pace.

Dollar index might be ready to break through 100

Dollar ended as the second worst in spite of hawkish Fed rate projections. Strong rally in global stock markets appeared to be the reason. But it’s still certain if the inverse relationship between the greenback and risk sentiment is totally back.

In any case, Dollar index’s rebound from 100.78 should have completed at 104.69. It’s likely that the consolidation pattern from 100.82 has finished in a three-wave structure too. Risk will now be heavily on the downside as long as 55 D EMA (now at 103.05) holds. Retest of 100.78/82 support zone should be seen next. Decisive break there will confirm resumption of whole down trend from 114.77.

From a long term picture, ideally, 97/98 handle should provide strong enough support to DXY. The level represents 55 M EMA (now at 97.87) and 38.2% retracement of 70.69 to 114.77 at 97.93. Strong rebound from that level could complete the whole fall from 114.77, as the first leg of a long term corrective pattern. However, sustained break of 97 would pave the way to the second line of defense in channel support at around 93.00.

AUD/JPY’s upside acceleration suggests up trend ready to resume

Yen was clearly even worse than Dollar, with AUD/JPY, GBP/JPY, EUR/JPY and NZD/JPY gaining more than 3.4% last week. AUD/JPY’s upside acceleration, as seen is the strong break of near term channel resistance and D MACD, suggests that it’s probably resuming the whole up trend from 59.85. In any case, outlook will stay bullish as long as 94.58 support holds. Retest of 99.32 should be seen next.

The question now is whether AUD/JPY would head to after breaking 99.32. The long term trend line resistance (now at around 100.34), could be a tough one to overcome. However, sustained trading above there could clear the way through 105.42 (2013 high) and even 107.88 (2007 high). In this case, next medium to long term target will be 61.8% projection of 59.85 to 99.32 from 86.04 at 110.43.

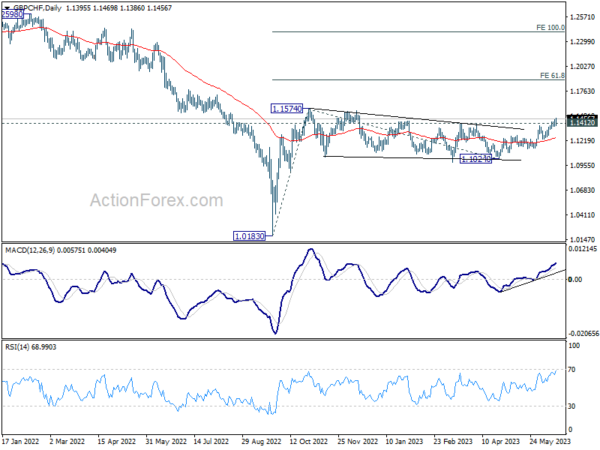

GBP/CHF heading for retesting 1.1574 resistance ahead of BoE and SNB

Looking ahead, GBP/CHF would be a pair to watch too with BoE and SNB rate decisions featured in the coming days. Last week’s break of 1.1412 resistance argues that whole consolidation pattern from 1.1574 has completed at 1.1025. More importantly, rise from 1.0183 is ready to resume.

Sustained trading above 1.1412 this week will bring retest of 1.1574 first. Firm break there will confirm this bullish case and target 61.8% projection of 1.0183 to 1.1574 from 1.1024 at 1.1884.

From a long term point of view, it’s too early to tell if trend reversal is underway. But bullish convergence condition in M MACD is a positive sign. A test on 55 M EMA (now at 1.2155) is possible if 1.1574 can be taken out decisively.

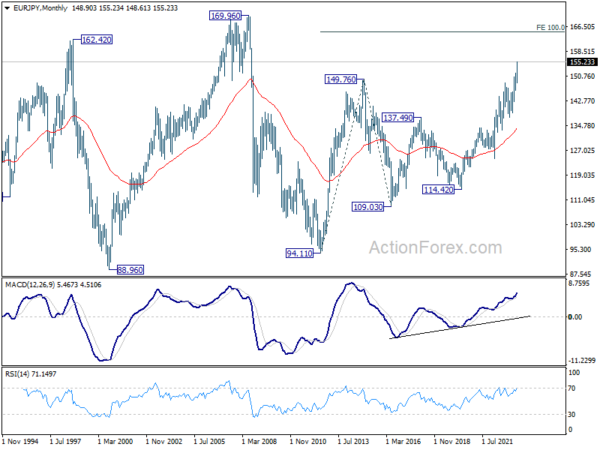

EUR/JPY Weekly Outlook

EUR/JPY’s up trend resumed last week and surged to as high as 155.23. Initial bias stays on the upside this week for 100% projection of 139.05 to 151.60 from 146.12 at 158.67 next. On the downside, below 153.08 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, rise from 114.42 (2020 low) is in progress. Next target is 100% projection of 124.37 to 148.38 from 138.81 at 162.82. For now, medium term outlook will remain bullish as long as 148.38 resistance turned support holds, even in case of deep pull back.

In the long term picture, rise from 109.03 (2016 low) is seen as the third leg of the whole up trend from 94.11 (2012 low). Next target is 100% projection of 94.11 to 149.76 from 109.03 at 164.68, and possibly further to 169.96 (2008 high).