Relentless geopolitics has continued to haunt global markets since the turn of the year, and last week offered little respite. What has changed, however, is not the scale of the headlines but the market’s tolerance for them. Investors appear increasingly fatigued by policy uncertainty and abrupt reversals from the US, where confidence has become harder to rebuild with each successive shock.

That fatigue showed clearer signs of expression last week. The resurgence of “Sell America” trade appeared to gain genuine traction, first manifesting through a sharp rise in U.S. Treasury yields. The 10-year yield briefly pushed above the 4.3% mark, a move that initially looked technical but increasingly resembled a broader repricing of U.S. risk rather than a shift in growth or inflation expectations.

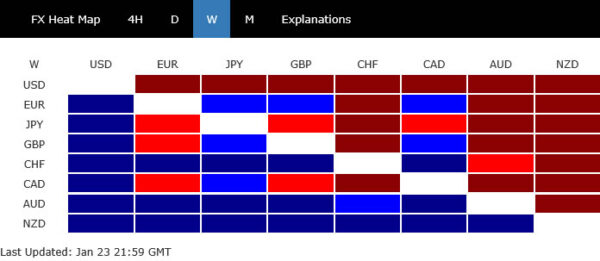

As the week progressed, pressure began to migrate. While yields stabilized and equity markets avoided outright breakdowns, Dollar became the release valve. By the end of the week, the greenback had posted its worst performance in months, falling decisively against every major currency bloc. This was not a targeted or thematic move—it was broad, indiscriminate, and persistent.

The scale of Dollar’s underperformance stood out. Losses exceeded 3% against both Aussie and Kiwi, approached 3% versus Swiss Franc, and neared 2% against Euro and Sterling. This was weakness against risk currencies, European majors, and safe havens alike, suggesting something deeper than tactical positioning was unfolding.

What makes the move more unsettling is what it was not driven by. Economic data remained broadly supportive, Fed rate expectations barely moved, and U.S. equity indices finished the week largely confined within prior ranges. The absence of traditional catalysts points instead to a growing policy risk premium being priced directly into U.S. assets—starting with the currency.

Elsewhere in FX, relative winners and losers offered further clues. Kiwi and Aussie topped the performance table, buoyed by domestic data that has revived speculation of rate hikes later this year. Swiss Franc followed closely, hinting that risk aversion has not entirely faded, particularly in Europe. At the other end, Dollar finished last, with Yen not far behind, despite a sharp rebound linked to suspected Japanese intervention.

As markets move into the final days of January, the question is where volatility will express itself next. Whether this marks the early stages of a sustained rotation out of U.S. assets, or merely a sharp warning shot, remains unresolved. What is clear is that confidence has been shaken, and the weeks ahead may determine whether this shift hardens into a defining theme for 2026.

Policy Volatility, Not the Fed, Drives the Move

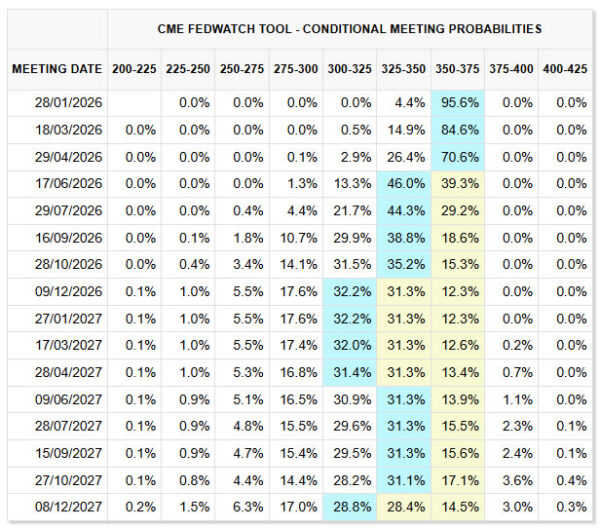

The most important point about last week’s Dollar selloff is what it was not about. It was not driven by U.S. economic data, which remained broadly resilient. Nor was it about a sudden repricing of Fed policy. In fact, rate expectations were remarkably stable throughout the week, even as the Dollar slid sharply across the board.

Fed funds futures barely budged. Markets remain fully priced for a hold at the upcoming meeting, followed by another likely pause in March (at 85% chance), with June still seen as the first realistic window for a cut, at around 60% chance. That profile has changed little in recent days. If anything, it reinforces the idea that Dollar’s weakness was decoupled from monetary policy expectations.

Equity markets tell a similar story. Despite intraweek volatility, all three major U.S. indexes ended the week within the prior week’s ranges. There was no disorderly risk-off move, no equity panic, and no sign of forced deleveraging. This was not a classic risk event. Instead, it looked like a rotation within portfolios, not a rush for the exits.

That leaves one dominant explanation: policy volatility itself is being repriced. Investors are increasingly uneasy with a U.S. policy environment that feels erratic, unpredictable, and prone to sudden escalation. In that context, Dollar has become the most efficient release valve for U.S.-specific risk premia.

The Greenland episode captured this dynamic perfectly. Markets were first rattled by the threat of tariffs against NATO allies over a national security dispute, only to be whipsawed days later when those threats were abruptly withdrawn following talks in Davos. While the immediate risk of a transatlantic trade war faded, the credibility damage was already done.

What unsettled investors was not the content of the policy shift, but the manner in which it unfolded. Each episode appears to expand the perceived range of U.S. policy options, normalizing ideas that were previously considered unthinkable. Tariffs against allies, national security leverage, and transactional diplomacy are no longer tail risks—they are part of the active policy set.

That expansion of the policy envelope carries consequences. Even when tensions ease, markets are left with a higher baseline of uncertainty. The Greenland pivot did not restore confidence; it merely removed the immediate catalyst. The underlying concern—that U.S. policy can reverse suddenly and without warning—remains firmly in place.

This helps explain why relief rallies were shallow and short-lived. Rather than chasing risk higher, investors appeared content to reduce exposure quietly, particularly in currencies. Dollar absorbed the adjustment while equities remained relatively insulated, at least for now.

In that sense, Dollar’s role has subtly shifted. It is no longer just a reflection of relative growth or yield differentials, not to mention safe haven. Increasingly, it is acting as a barometer of trust—or the lack thereof—in the stability of U.S. policymaking.

Cuba and Canada Enter the Crosshairs

Just as markets began to digest the Greenland episode, reports late in the week suggested the Trump administration is considering a total blockade on oil imports to Cuba, raising the prospect of another sudden escalation with in another region.

If implemented, such a move would mark a sharp intensification of pressure on Havana. Cuba’s energy system is already fragile, with fuel shortages threatening electricity supply and economic stability. A full oil blockade would risk tipping the system into crisis, amplifying humanitarian and political fallout across the Caribbean.

The timing is notable. Earlier this month, the administration had already vowed to block oil and financial flows from Venezuela to Cuba following the operation that led to the capture of Venezuelan President Nicolás Maduro. A direct move against Cuba would reinforce the perception that Washington is prepared to use economic force aggressively to reshape regional alignments further.

Canada, meanwhile, has found itself unexpectedly drawn into this widening orbit. Over the weekend, Trump warned that Canada would face 100% tariffs if it follows through on a newly announced trade deal with China. The message was explicit: alignment choices will carry immediate economic consequences.

The rhetoric marked a sharp turn in tone toward one of America’s closest allies. Trump accused China of using Canada as a conduit to bypass U.S. tariffs and suggested that Ottawa’s engagement with Beijing would be treated as a direct challenge to U.S. trade policy. The threat added new of strain to an already tense relationship.

These warnings came against the backdrop of deteriorating U.S.-Canada relations, particularly after Canadian Prime Minister Mark Carney criticized Washington’s approach to Greenland. What might once have been dismissed as rhetorical posturing now carries greater weight, given the administration’s demonstrated willingness to act.

For markets, the significance lies not in the immediate probability of action, but in the breadth of potential targets. With Europe, Cuba, and Canada all entering the frame, investors are increasingly forced to consider whether U.S. policy risk is becoming systemic rather than episodic—a shift that could carry lasting implications for asset allocation decisions.

Dollar at a Crossroads: Long Term Channel Back in Radar

Beyond daily headlines, last week’s price action fits into a much larger narrative: global diversification out of U.S. assets. For over a decade, global portfolios have been heavily skewed toward the US, driven by superior growth, deep capital markets, and policy credibility. That imbalance is being questioned since early last week and the challenge has resurfaced just now, which is reinforced by the technical picture

For the near term, Dollar Index’s outlook remains bearish with 38.2% retracement of 1101.7 to 96.21 at 101.54 intact. Recent price actions from 96.21 are seen as a corrective pattern.

The break of of 97.74 support last week confirms resumption of the fall from 100.39. Immediate focus is now on 100% projection of 100.39 to 97.74 from 99.49 at 96.84. Strong rebound from 96.84 will keep the fall from 100.39 as the second leg of the pattern from 96.21 only. Thus, another rising leg would still be seen. However, strong break of 96.84 could prompt downside acceleration through 96.21 to resume the larger down trend decisively.

In the bigger picture, firstly, the rejection below falling 55 W EMA (now at 100.06) is keeping medium term outlook bearish too. More importantly, the next fall would push Dollar Index through the channel support that defines the whole up trend from 70.69 (2008 low). That would confirms that Dollar Index is already reversing the long term up trend. Selling should then persistent for months and target 90 psychological and even below to 61.8% retracement of 60.69 to 114.77 at 87.52.

Yen’s Potential to Accelerate the Sell America Trade

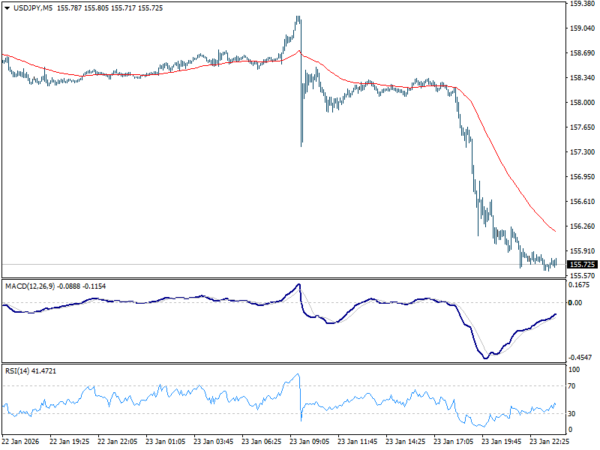

Among all major currencies, Yen stands out as the most complex variable in the current environment. Two sharp intraday spikes in Yen on Friday sparked speculation that Japanese authorities had conducted rate checks, often seen as a precursor to direct intervention.

The first move came shortly after BoJ Governor Kazuo Ueda’s press conference. Yen was initially sold offer due to lack of indication of imminent rate hike, and hope for an April increase was dashed. But USD/JPY then suddenly dived to close to 157, but then quickly recovered

The second run came during US afternoon that pushed USD/JPY further lower to 155.70. That was admittedly partly due to Dollar’s broad selloff. But the steep decline in EUR/JPY and GBP/JPY suggests that Yen was also strong too.

While officials declined to confirm any action, the market response suggested that a line has been explicitly drawn at USD/JPY 160. At least, that is what’s perceived by the markets.

For Yen’s rally to persist and develop to a rising trend however, investors have to join the move. The critical question, therefore, is whether market participants are willing to lean into Yen strength. That willingness would likely depend on what happens in Japanese equities.

If Yen appreciation begins to pressure the Nikkei meaningfully in the coming days, a feedback loop could emerge. Falling equities would reinforce Yen demand, which in turn would tighten financial conditions further and exacerbate equity weakness. Such are powerful when they appear.

Technically, the immediate focus in the next few days is whether Yen’s rebound would at the same time trigger a deep selloff in Nikkei, which then starts a vicious cycle of falling stocks and rising Yen.

For Nikkei, break of 52,194.81 support will extend the fall from 54,487.32. Sustained trading below 55 D EMA (now at 50,756.38) will argue that a medium term was formed, likely with bearish divergence condition in D MACD.

In this bearish case, Nikkei should fall towards 38.2% retracement of 30,792.74 to 54,486.32 at 45,435.99, as a correction to the whole up trend from 30,792.74.

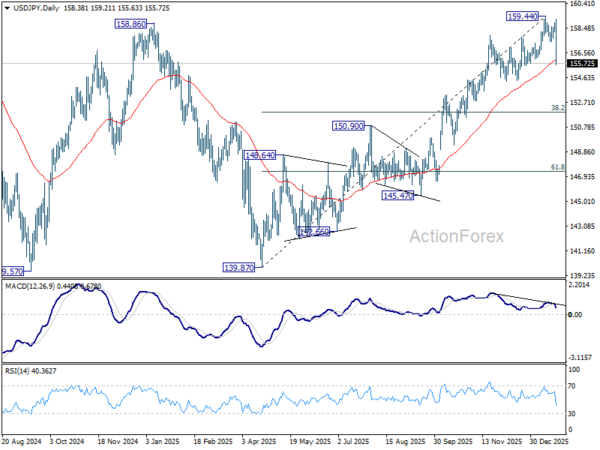

That would likely be accompanied by a fall in USD/JPY to 38.2% retracement of 139.87 to 159.44 at 151.96 That would then add to Dollar Index’s extended decline through 96.21 low mentioned above.

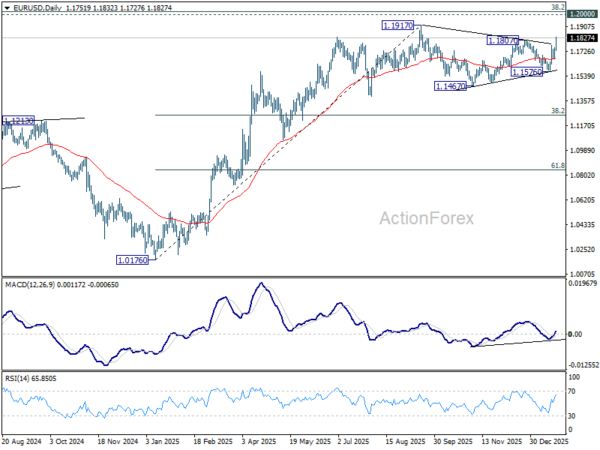

EUR/USD Weekly Outlook

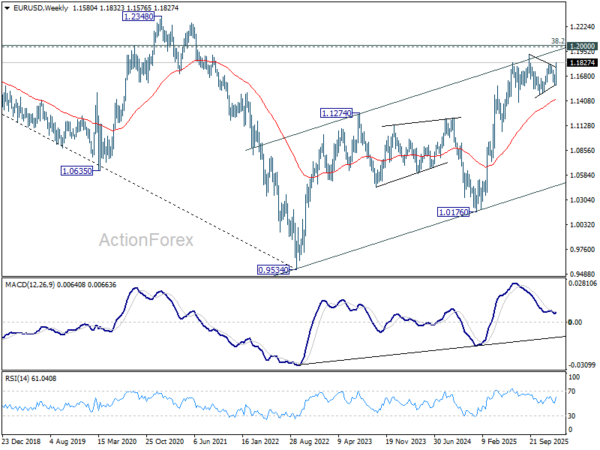

EUR/USD’s strong rally and break of 1.1807 confirms that rise from 1.1467 is resuming. Also, corrective pattern from 1.197 could have completed with three waves to 1.1576. Initial bias stays on the upside this week for retesting 1.1917. Firm break there will resume larger up trend. On the downside, below 1.1727 minor support will mix up the outlook and turn intraday bias neutral again.

In the bigger picture, as long as 55 W EMA (now at 1.1428) holds, up trend from 0.9534 (2022 low) is still in favor to continue. Decisive break of 1.2 key psychological level will carry larger bullish implication. However, sustained trading below 55 W EMA will argue that rise from 0.9534 has completed as a three wave corrective bounce, and keep long term outlook bearish.

In the long term picture, 38.2% retracement of 1.6039 to 0.9534 at 1.2019, which is close to 1.2000 psychological level is the key for the outlook. Rejection by this level will keep the multi decade down trend from 1.6039 (2008 high) intact, and keep outlook neutral at best. However, decisive break of 1.2000/19, will suggest long term bullish trend reversal, and target 61.8% retracement at 1.3554.