New Zealand dollar was the only major currency rose against the US dollar in August, despite speculations over Fed’s tapering and renewed lockdown. We believe policymakers’ proactive reassurance of an October rate hike would likely make the RBNZ the first major central bank to begin rate hike after the most recent round of global monetary easing. This policy divergence has lent strong support to kiwi despite the stringent lockdown of late.

Sentiment weakened in August

The New Zealand government announced on Monday that lockdown in Auckland would be extended for two more weeks. The most populous city of the country will remain in full lockdown at least until mid-September, while restrictions in other parts of the country would be relaxed somewhat. The decision would inevitably affect the third quarter economic data and GDP growth.

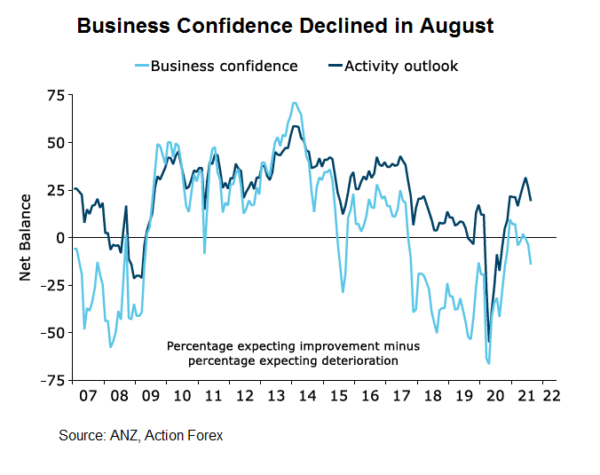

Sentiment indicators released over the past two weeks have sent mixed signals about the growth outlook. ANZ’s business confidence index declined to -14.2 in August from -3.8 a month ago. Deterioration in the sentiment was across difference areas. For instance, the “own activity outlook” index dropped to 19.2 from July’s 26.3, while “employment intention” fell -4.4 points to 17. Pricing intentions also slipped -2.1 points to 59.2 last month. Yet, inflation expectations remained strong, rising to 3.05% from July’s 2.7%.

In light of the renewed lockdown since August 17, the report was divided into pre- and pro-lockdown. Interestingly, the headline business confidence index was weaker before (-14.5) than after the lockdown (-13.4), suggesting that the moderation in sentiment has already existed before the lockdown. Some indices, such as investment intentions, employment intentions, inflation expectations and capacity utilization, worsened after the lockdown was imposed. The survey reveals that the renewed restrictive measures have dampened business sentiment and it is likely that companies would restrain investment and employment plans amidst fear of the economic headwind.

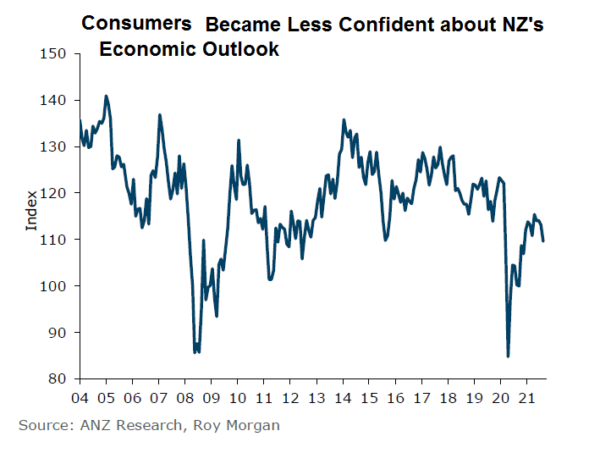

Meanwhile, consumer confidence slipped -3 points to 110 in August, as ANZ-Roy Morgan’s report revealed. A net 13% of consumers surveyed noted that it’s a good time to buy a major household item, down -11 points from July. The reading signals that the August retail sales data could have weakened from a month ago. Perceptions regarding the next year’s economic outlook fell -3 points to -5%, while the five-year outlook dropped -5 points to +7%. CPI inflation expectations, however accelerated to +5.1% from July’s +4.9% to 5.1%. The overwhelming majority of the surveys was down prior to the lockdown, it is reasonable to expect the readings would worse off in the next report.

Auckland’s lockdown will continue at least until mid-September before gradually relaxing. The rest of the country is less stringent but restrictions remain. The measures would inevitably hurt GDP growth in 3Q21 as sentiment indicators have also shown easing consumer and business confidence.

RBNZ Remains Hawkish

Yet, history proves that the growth rebound picks up relatively swiftly after the lockdown. As such, a temporary slowdown should not affect RBNZ’s rate hike schedule. Indeed, after the disappointment at the August meeting, policymakers have reassured that the first rate hike would come very soon, likely in October. For instance, Governor Adrian Orr reaffirmed “October is a live meeting” and “a significant shock to demand” would be needed to change the view. Assistant Governor Christian Hawkesby revealed last week that policied considered to raise the policy rate by +50 bps, but was hard to communicate the case for a hike on the same day the country was locked down in August. Deputy Governor Geoff Bascand echoed the rhetoric of his counterparts, noting that a “six-week delay in a tightening cycle” would not make much difference in the long term.

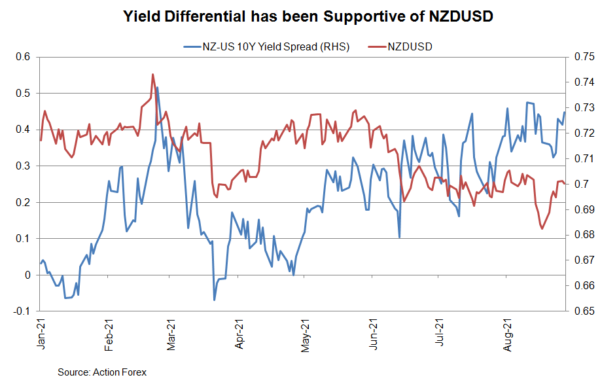

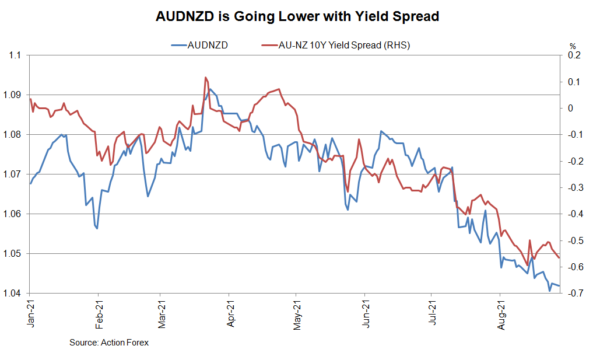

Policy Divergence to Support NZD against USD and AUD

Unless New Zealand’s economy deteriorates rapidly, it is likely that the central bank would go ahead with a rate hike of +25 bps in October, and possibility followed by another +25 bps in November. Policy normalization by the RBNZ would come earlier than the Fed, which is expected to announce QE tapering in November, followed by a first rate hike in 2023. The policy divergence has supported New Zealand dollar over the past week despite the stringent lockdown. The divergence is even wider between the RBNZ and the RBA. It is anticipated that the latter would delay its QE tapering schedule or even resume easing, in light of the latest resurgence of the pandemic. The RBA pledged in mid-August that it would take policy action if the latest country-wide lockdown threatens a deeper economic setback.