Range bars belong to a type of chart that is independent of time. Unlike the more conventional chart types such as the candlestick and bar charts, with Range bars, only the horizontal price level is plotted. Time is redundant.

Range bars were designed by a Brazilian trader, Vincent Nicolellis in the 1990’s. This unique chart type was conceptualized after Nicolellis spend decades running the Brazilian trading desk. Due to the volatility of the markets at the time, Nicolellis believed that price was the most important aspect when analyzing a security.

Thus, range bars were designed as they removed the equation of time from the charts. As the name suggests, range bars are specifically used to identify ranging price action and trending price action. Although relatively new when compared to the other chart types, range bar based trading strategies and analysis have quickly caught on.

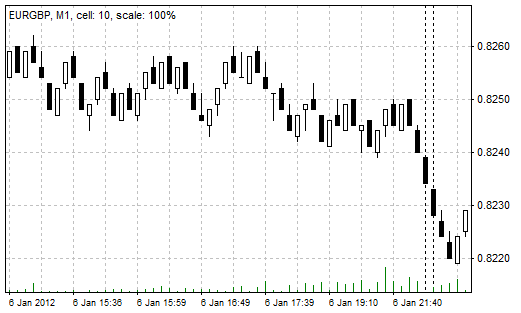

Below is an example of a range bar chart.

Example of a Range bar with 10 pip setting

However, most of the existing trading platforms have not yet incorporated the range bars as one of the default chart types. But there are a lot of workarounds including on the MT4 trading platform.

Traders can make use of one of the many available range bar EA’s in order to build these charts and trade off them.

How do range bars calculate price?

Because range bars consider only price, the main variable when setting up the range bars is the price level. For example, a 10 pip range bar will define that every bar has a range of 10 pips when measured from high to low.

With time not coming into the equation, a range bar can continue to unfold until price breaks above the range.

Range bars follow three simple rules

- Each bar has a high and low that is defined based on the input price level

- A new range bar opens outside the high or the low of the previous bar

- A range bar closes at the high or at the low

The above chart shows a 10 pip EURGBP range bar. The high and low of each bar in this chart is 10 pips. A new range bar opens only when price closes above or below the previous range bar’s high or low.

Trading strategies using the Range bar

On closer observation, one can see that numerous trading strategies that are unique to Range bars can be developed. The simplest of all, however, is based on price action methods such as support and resistance, trend lines and of course the range bar patterns itself.

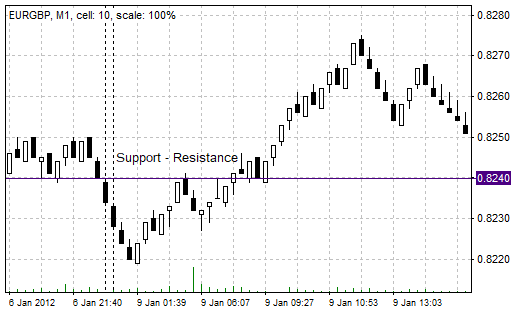

Support/Resistance trading with Range bars

When trading with the range bar, it is important to choose the right pip value, for example when trading the forex markets. Traders should take into account the spread of the instrument. Setting too small a range bar level could result in losses.

The chart above shows a simple support/resistance example using the range bars. As you can see, price action is quite straightforward when trading with range bars, bringing simplicity to the trading methods.

While there is no straightforward way to find the right pip value for the range bar based on the instrument you are trading, you can of course experiment. Most of the forex majors can have a range bar value of 15 – 20 pips and higher. This allows traders to build intraday trading strategies that also take into account the spread of the instrument as well.

In conclusion, range bars can offer traders a unique perspective on the markets. This chart type can be very beneficial for forex intraday traders as it can help traders to understand price action more clearly, eliminating noise but at the same time highlighting volatility.