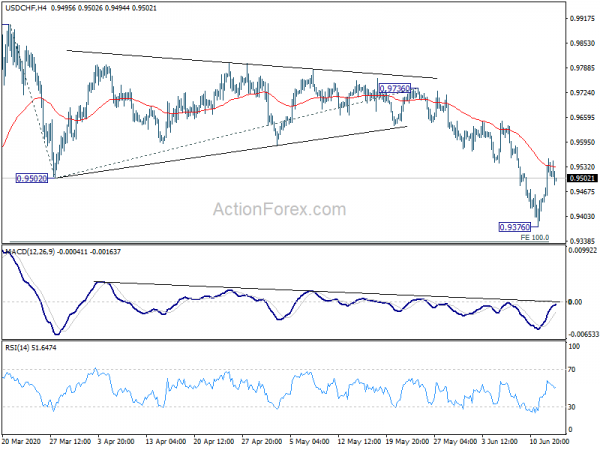

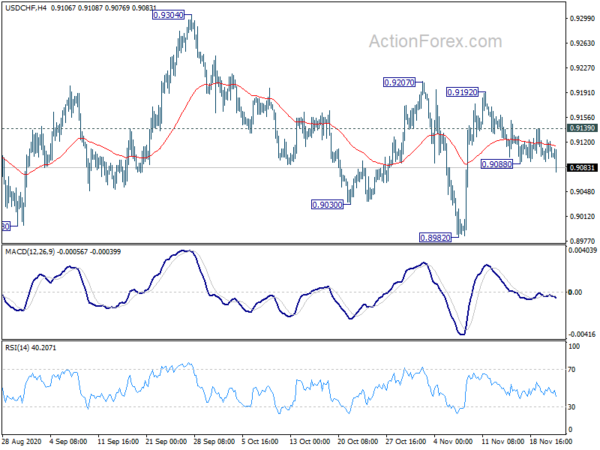

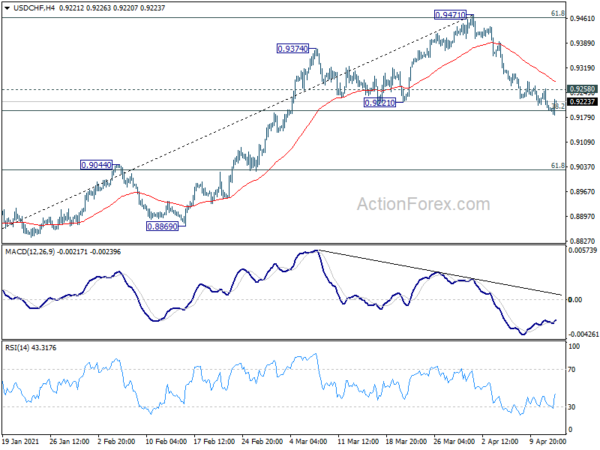

Daily Pivots: (S1) 0.9452; (P) 0.9502; (R1) 0.9571; More…

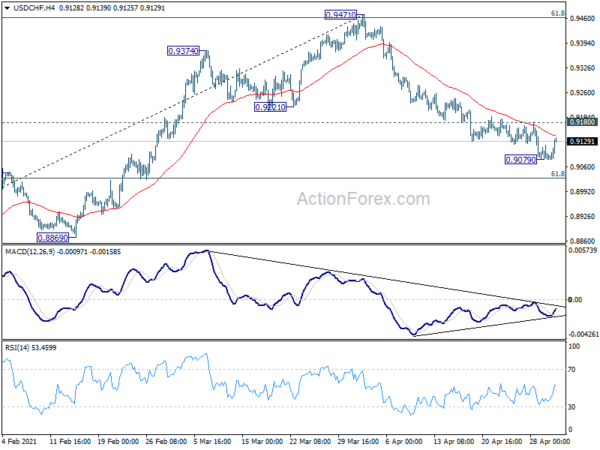

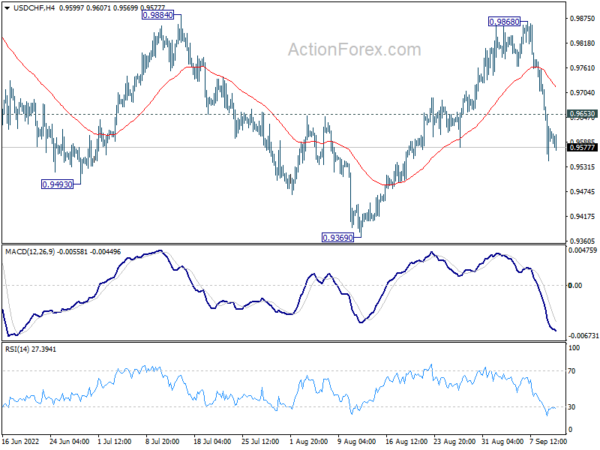

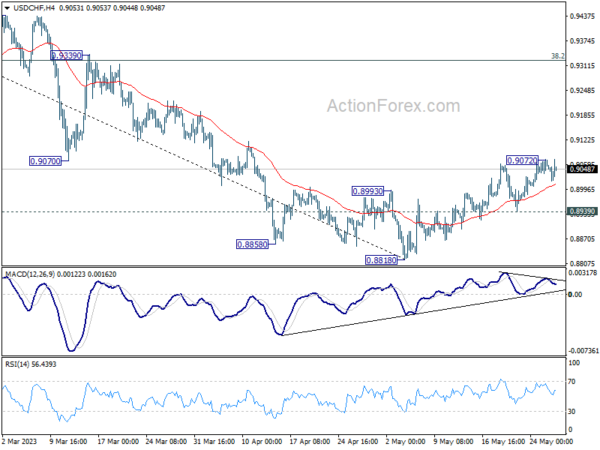

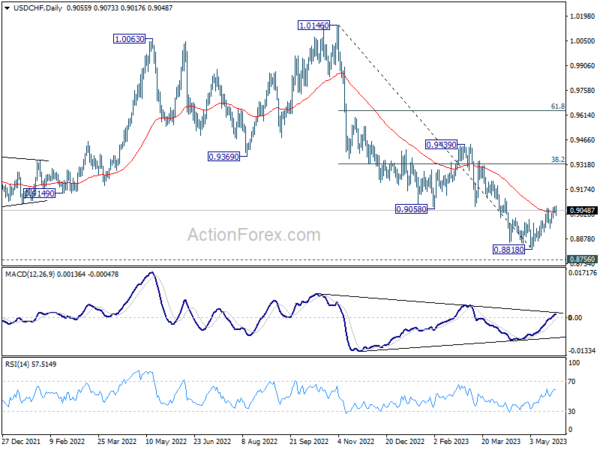

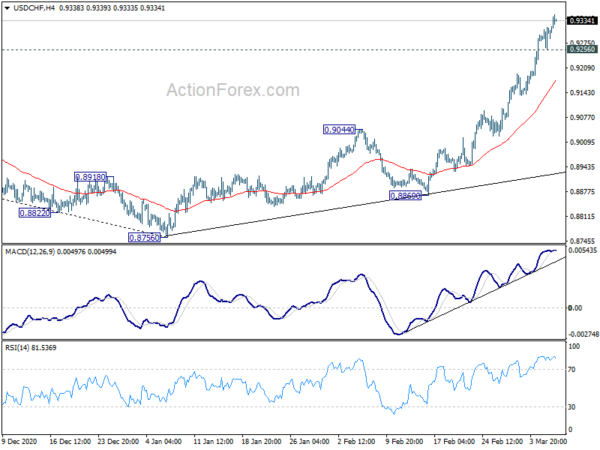

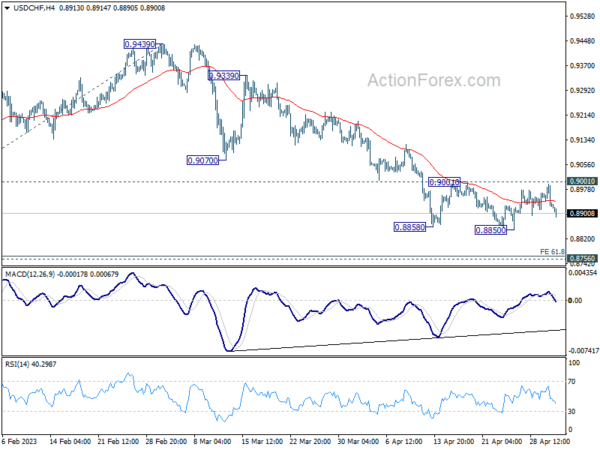

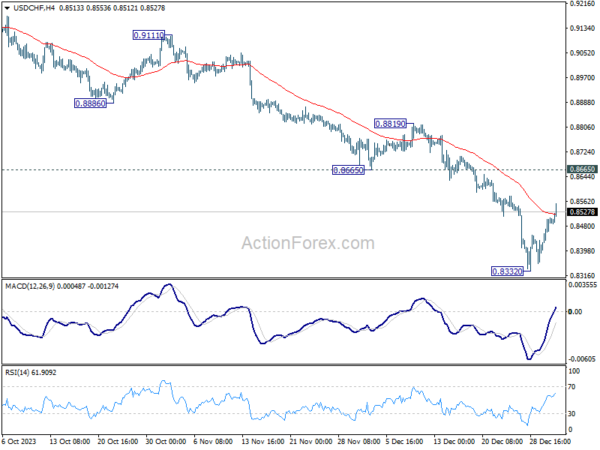

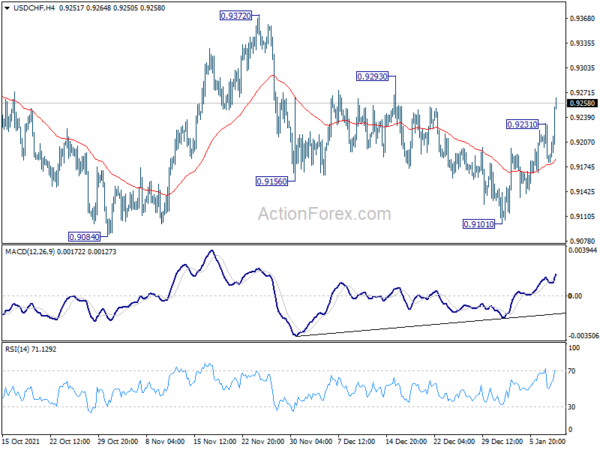

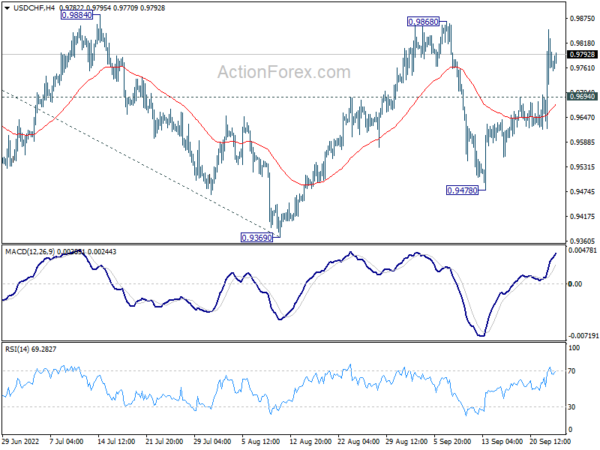

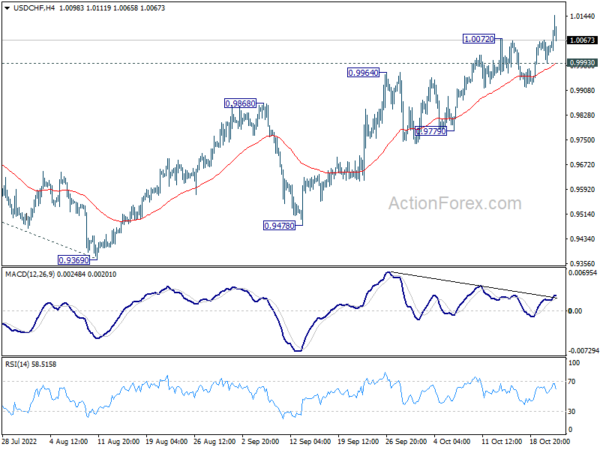

No change in USD/CHF’s outlook and intraday bias stays mildly on the upside. Rebound from 0.9376 is should target 55 day EMA (now at 0.9646). Sustained break there would pave the way to 0.9901 resistance. On the downside, break of 0.9376 will resume the fall from 0.9901 instead.

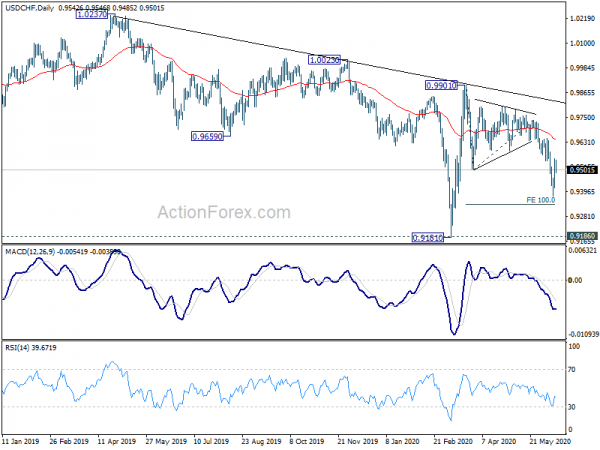

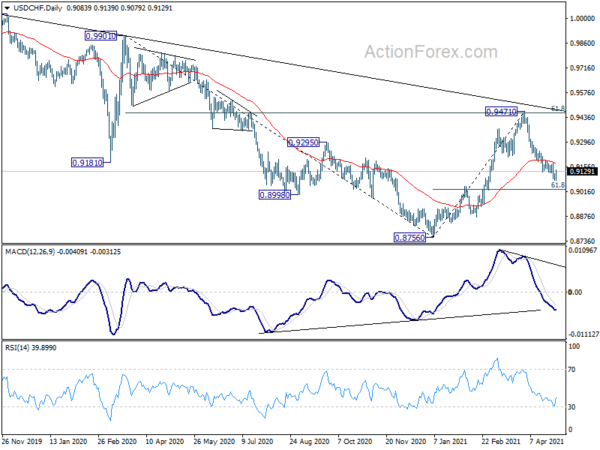

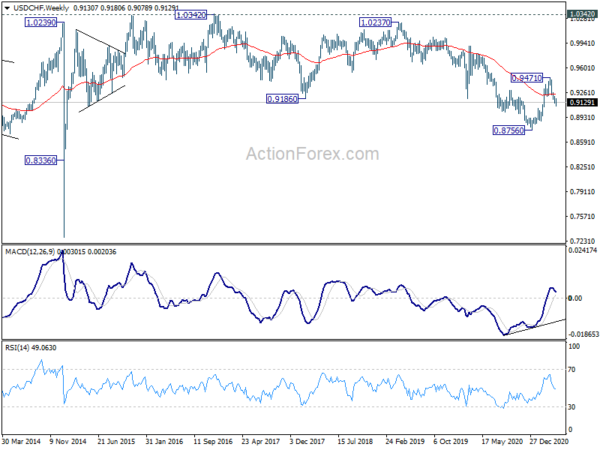

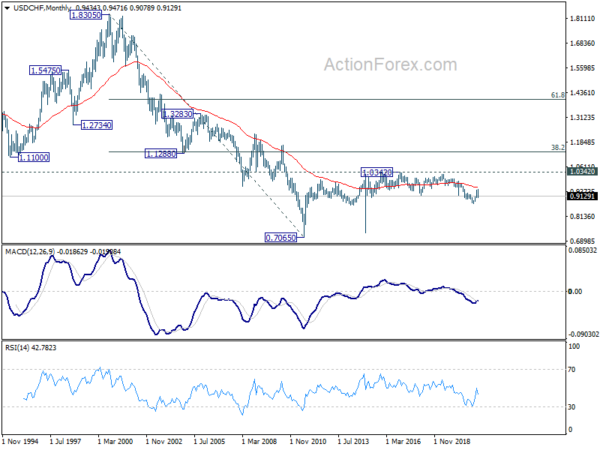

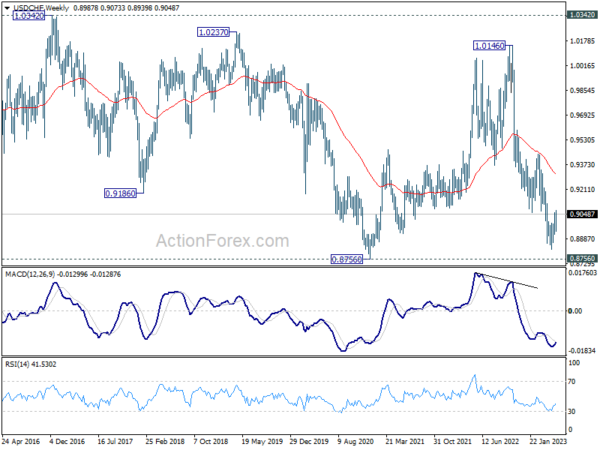

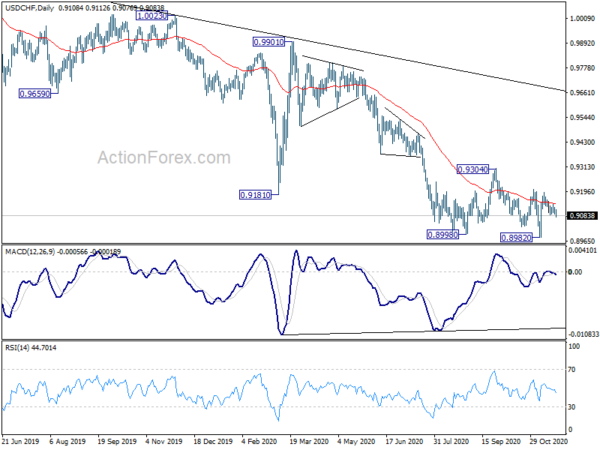

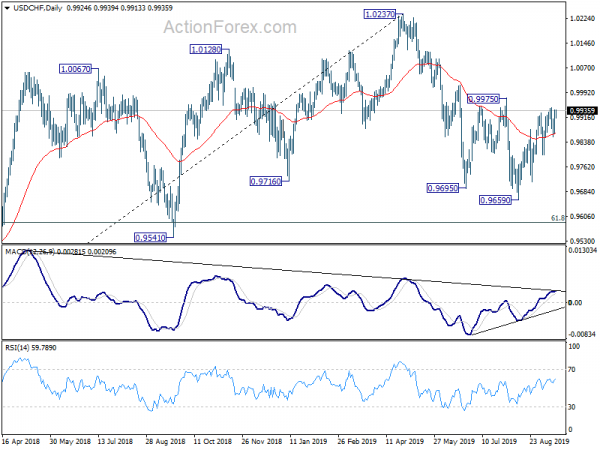

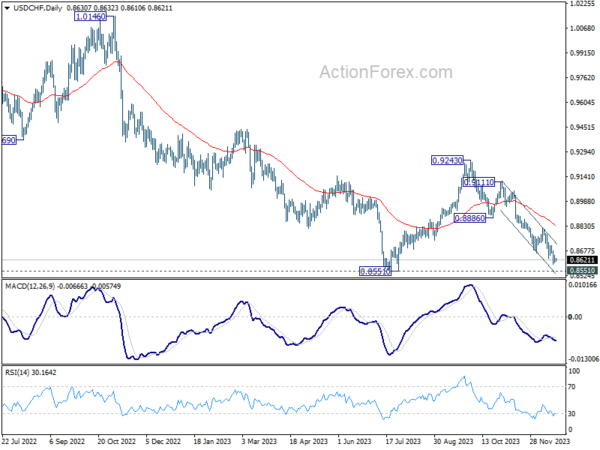

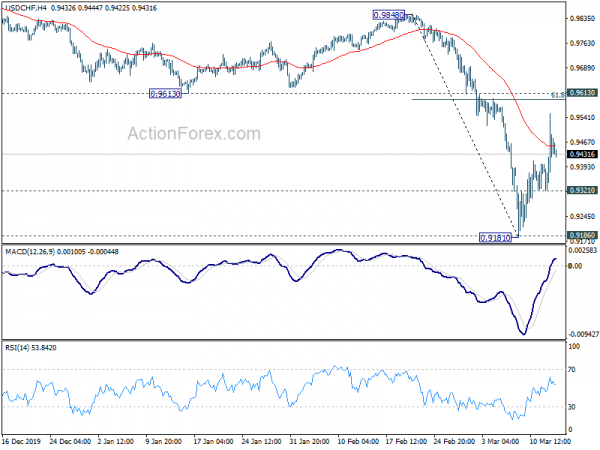

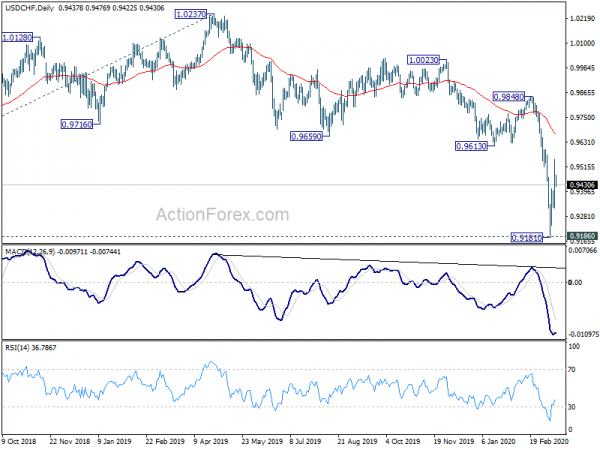

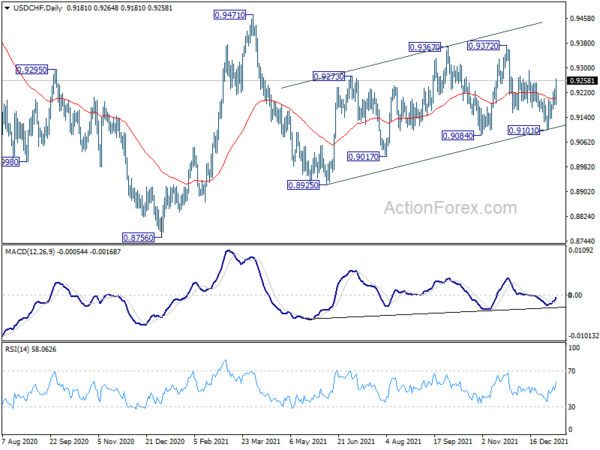

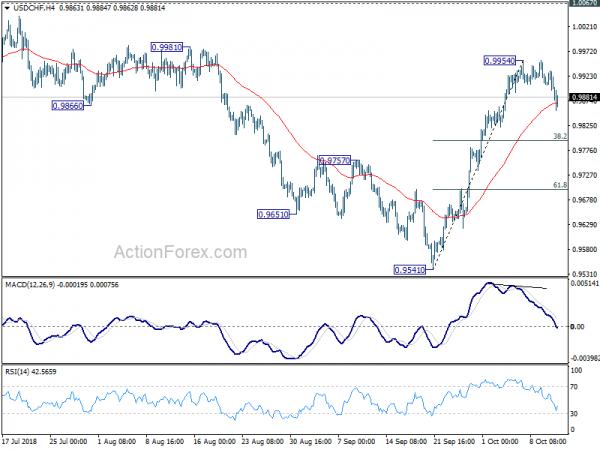

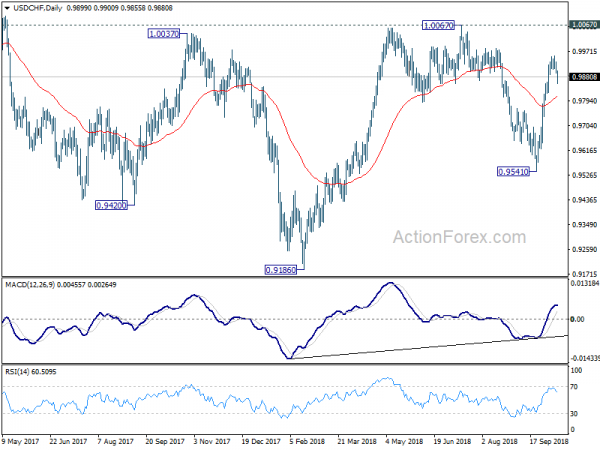

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound form 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.