Thursday August 9: Five things the markets are talking about

The geopolitical tension theme continues to dominate capital markets, now that China has responded to the U.S’s tariff onslaught with additional tariffs of its own.

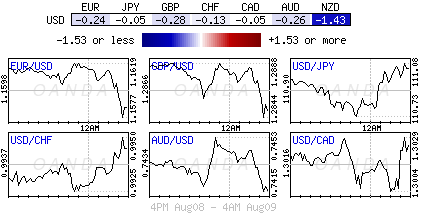

In currencies, the market is again focused on sterling (£1.2852) as it encroaches on its new 12-month low as politics continues to provide the overriding direction for the currency.

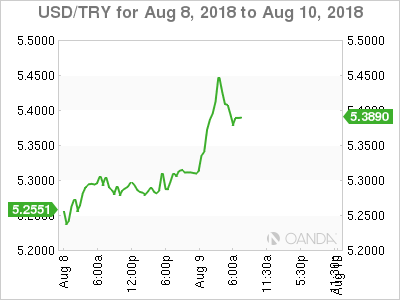

And then there is the Turkish lira ($5.4210) as it makes it way towards record lows on market worries about President Erodgan’s grip on monetary policy and on a deepening dispute with the Trump administration.

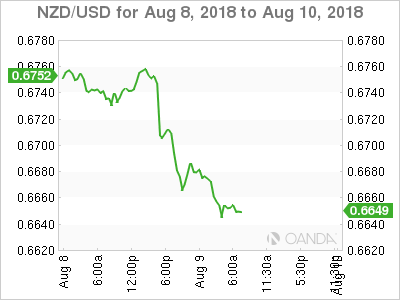

Down-under, the kiwi (NZ$0.6645) has plummeted to a two-year low after the Reserve Bank of New Zealand (RBNZ) pushed out its forecast for a rate increase.

Elsewhere, oil has extended its drop as trade tensions again overshadow a decline in U.S crude stockpiles. Most industrial metals gained, while gold prices ease.

1. Stocks mixed reaction on low volumes

In Japan, the Nikkei edged lower overnight as a stronger yen (¥111.00) impeded investor risk appetite. Not helping was the auto sector, which saw a sell-off on news that certain automakers improperly conducted vehicle inspections in the domestic market. The Nikkei share average dropped -0.2%, while the broader Topix lost -0.3%.

Down-under, Aussie shares rallied overnight on a stronger earnings season. The S&P/ASX 200 index rose +0.5%. In S. Korea, the Kospi stock index produced a small gain, rallying +0.10%.

In Hong Kong and China, shares ended higher as tech firms rally on hopes of China policy boost. The Hang Seng index was up +0.88%, while the Hang Seng China Enterprises index rose +1.09%. In China, the Shanghai Composite index ended +1.9% higher, while China’s blue-chip CSI300 index closed up +2.5%.

In Europe, regional bourses are trading mostly lower in quite trading. U.S stocks are set to open little changed.

Indices: Stoxx600 -0.2% at 388.8, FTSE -0.6% at 7729, DAX 0.0% at 12633, CAC-40 -0.2% at 5492, IBEX-35 0.0% at 9755, FTSE MIB +0.0% at 21801, SMI -0.3% at 9149 S&P 500 Futures 0.1%

2. Oil finds some support after a -3% drop Wednesday, gold steady

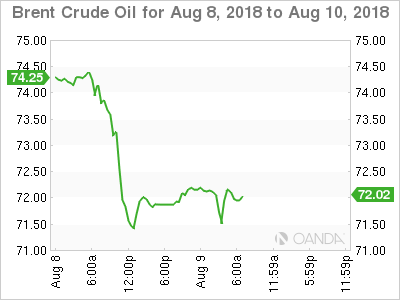

Oil prices are a tad higher after yesterdays steep slide, when the first round of U.S sanctions against Iran came into effect. Not providing much support is investor worries that crude demand will and has been hit by the escalating Sino-U.S trade dispute.

Brent crude futures are up +14c at +$72.42 barrel, after having dropped by more than -3% yesterday. U.S crude futures (WTI) have rallied +8c to +$67.02 a barrel, having closed down -3.2% Wednesday.

With U.S sanctions against Iran, which shipped out +3M bpd of crude in July, officially came into effect on Tuesday and the market is anticipating that supply losses could range from +600K to +1.5M bpd.

Stateside yesterday, the weekly EIA report showed that crude inventories fell -1.4M barrels last week, less than half the -3.3M barrel draw the market had expected and that gas stocks rose by +2.9M barrels, compared with expectations for a drop of -1.7M barrel drop.

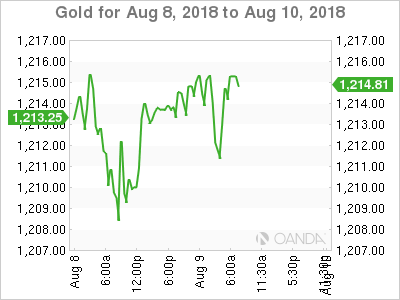

Ahead of the U.S open, gold prices are mostly steady in a range-bound overnight session, as a stronger dollar continues to weigh on upside momentum. Spot gold is up +0.1% at +$1,214.23 an ounce, having gained +0.2% Wednesday.

3. RBNZ Extra Cautious

Reserve Bank of New Zealand (RBNZ) Governor Orr left interest unchanged at +1.75% as expected, while moving the timing of any future increase to Q4 in 2020 from Q1 in the same year.

Assistant Governor McDermott indicated that the chance of a rate cut had increased and wanted the market to understand that they needed to see core-inflation above +2% for any rate hike. The direction of the next move could be “up or down,” he says. The cautious comments saw the NZD ($0.6650) weaken by -0.45% outright.

Elsewhere, the yield on 10-year Treasuries decreased -1 bps to +2.95%. In Germany, the 10-year Bund yield dipped -2 bps to +0.39%, while in the U.K, the 10-year Gilt yield also declined -2 bps to +1.299%.

4. Turkish lira loses another 3% outright

The Turkish lira has hit a new record low this morning as it weakens as much as -3% outright on souring relations with the U.S over the detention of an American pastor. USD/TRY is last up +2.3% at $5.3994, after it hit a record high of $5.4488 earlier.

EUR/USD (€1.1596) is holding below the €1.16 level as the techies continue to watch their significant support level at €1.15. A break opens the door for a possible test to €1.10 handle.

GBP (£1.2890) remains on the softer side on a ‘no-deal’ Brexit worries. The pair tested its 11-month low atop of £1.2850 earlier this morning.

USD/JPY (¥111.14) is a tad higher, but stable ahead of the U.S-Japan trade talks that begin in Washington later today.

RUB ($65.88) is weaker by -1%, testing its two-year low outright following the U.S State Department announcement on Russian sanctions related to a chemical agent being used in a U.K spy attack last March.

5. ECB economic bulletin highlight

According to the ECB in its regular economic bulletin released earlier this morning, the risks to global growth are growing.

“Downside risks to the global economy have intensified amid actions and threats regarding trade tariff increases by the United States and possible retaliation by the affected countries,” the ECB said in an assessment.

The ECB added that if all the threatened measures were to be implemented, the average U.S tariff rate would rise to levels not seen in the last 50-years.

Note: A fortnight ago, the ECB kept policy unchanged, staying on course to end its QE program by the close of the year and to raise rates for the first time since the euro zone debt crisis in the autumn of 2019.