Here are the latest developments in global markets:

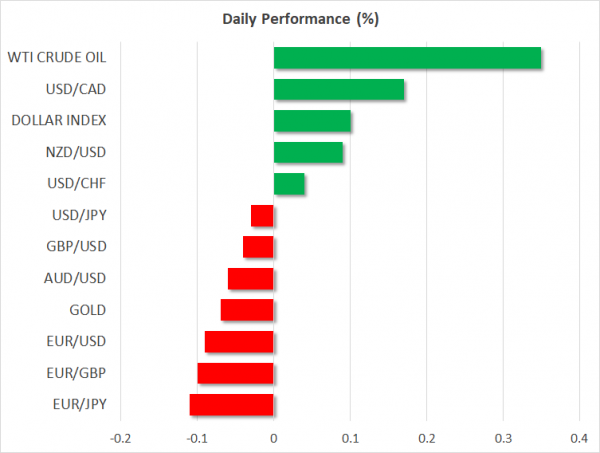

FOREX: The dollar is higher by 0.1% against a basket of six major currencies on Wednesday, after ending the previous session practically unchanged. The British pound regained some poise yesterday, aided by encouraging UK wage figures and reports suggesting the EU is open to extending Britain’s Brexit transition period by another year. Meanwhile, the Japanese yen was the worst performer, as global risk sentiment rebounded, triggering a rotation away from haven assets and into riskier ones.

STOCKS: Wall Street surged on Tuesday, reclaiming some lost ground as solid earnings results from major firms amplified speculation for another quarter of spectacular corporate profits. Robust US data showing that job openings hit another record high in August likely aided the moves. The tech-heavy Nasdaq Composite led the way higher (+2.89%), while the Dow Jones (+2.17%) and the S&P 500 (+2.15%) followed closely in its tracks. The S&P, Dow, and Nasdaq 100 are set to open a little higher today as well, according to futures. The positive sentiment spilled over into Asia on Wednesday. In Japan, both the Nikkei 225 (+1.29%) and the Topix (+1.54%) advanced, alongside South Korea’s Kospi 200 (+1.14%). Europe was a similar story, with futures tracking all the major indices pointing to a notably higher open today.

COMMODITIES: Oil prices ticked higher, buoyed by a drawdown in the API crude inventory data released overnight, with concerns that the US-Saudi Arabia diplomatic rift may escalate still hanging in the background. Although the US administration appears highly unlikely to take any action against the Kingdom, prominent Republican lawmakers have been quite vocal in calling for sanctions against the regime over the disappearance of a journalist. In precious metals, gold is marginally lower on Wednesday (-0.07%) at $1,223 per ounce, extending the modest losses it recorded in the previous session as sentiment shifted back to “risk-on”.

Major movers: Yen underperforms as risk appetite rebounds; sterling advances

Risk appetite firmed again on Tuesday, with the major US stock indices all recovering substantial ground, while haven currencies like the Japanese yen fell across the board as investors unwound some of their defensive bets. The shift in sentiment was likely owed to the earnings season kicking off with strong results from market heavyweights such as UnitedHealth (+4.73%) and Johnson & Johnson (+2.12%), which probably amplified expectations for yet another quarter of blockbuster corporate profits. On a secondary but perhaps more important note, although 10-year US bond yields remain relatively elevated at 3.16%, they have clearly stabilized over the past few sessions, potentially calming the nerves of investors that expected a more aggressive surge in longer-term interest rates.

In Brexit land, the pound advanced on Tuesday, initially drawing strength from upbeat UK wages data, and later from reports suggesting the UK may be allowed to stay in the EU for one extra year beyond the end of the transition period in December 2020. Such an extension would provide more time to reach a comprehensive trade deal, allow businesses a smoother adjustment, and perhaps avoid the need for a special arrangement for Northern Ireland altogether. The EU summit will kick off with a working dinner between leaders tonight. Any formal remarks pointing in the direction of a prolonged transition period, or even better an actual deal being possible within the coming weeks, could spell more good news for sterling.

Meanwhile, it was a relatively quiet session for both the euro and the dollar, with euro/dollar giving back some early gains to close the day almost flat, near 1.1570. The greenback’s rebound was aided by a set of data reaffirming that the world’s largest economy continues to fire on all cylinders, with the JOLTS job openings hitting a new record high in August. Interestingly, the US currency remained indifferent to another round of Fed-criticism from President Trump, who said “my biggest threat is the Fed”, as such remarks from the White House are hardly surprising by now.

Turning to the commodity currencies, the loonie and the kiwi posted meaningful gains yesterday as investors turned their sights back to “riskier” plays. The kiwi seems to have capitalized on New Zealand’s upbeat CPI data as well, though market pricing still points to a small probability for a rate cut by the RBNZ over the coming quarters.

Day ahead: UK CPI and Fed minutes on the agenda

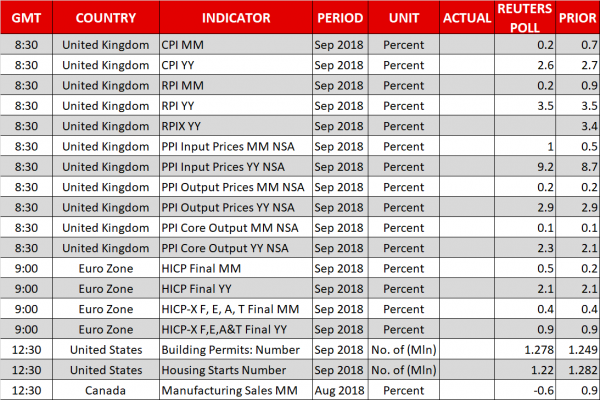

UK inflation data and the Fed minutes relating to the central bank’s latest meeting are the highlights on Wednesday’s calendar.

At 0830 GMT, UK inflation figures as gauged by the consumer price index (CPI) will be hitting the markets. Year-on-year, September’s headline CPI is projected to stand at 2.6%, below August’s 2.7% and reversing the trend of rises from recent months. Core CPI, which excludes volatile food and energy items, is forecast to grow by 2.0% on a yearly basis, from 2.1% in August. For the record, the Bank of England’s target for annual inflation is at 2.0%.

While a data beat may exert pressure on the BoE to hike rates sooner rather than later, more instrumental in freeing the Bank’s hands to do so would be a breakthrough for a Brexit deal during the EU summit commencing today. The Irish border issue remains the main sticking point. Should the parties come to an agreement on this front then sterling is likely to post considerable gains. The opposite holds true of course in the event a no-deal Brexit receives traction.

Elsewhere, the UK will see factory price and retail price inflation numbers at the same time as the CPI figures are made public.

The eurozone Harmonised Index of Consumer Prices (HICP) for September due at 0900 GMT will also attract some attention, though the euro might not react much as the release will pertain to the final readings rather than the initial estimates. Headline HICP is expected to be confirmed at 2.1% y/y, above August’s 2.0%, while core HICP that excludes food, energy, alcohol and tobacco from its calculations is forecast to come in at 0.9% y/y, below the preceding month’s 1.0%.

Out of the US, September’s housing starts will be released at 1230 GMT. They’re anticipated to decline by 4.5% m/m after rising by 9.2% in August. The release is not typically market moving, at least not for FX markets, though it is gathering additional attention lately in light of the rising rate environment; higher interest rates are negative for the real estate market. Building permits for the same month are due at the same time.

But of more importance for the greenback will be the Fed minutes (1800 GMT) pertaining to the September meeting during which the central bank delivered its third 25bps rate increase of the year. The outlook for policy normalization in 2019 might attract most attention out of the record. More optimism for steeper tightening is theoretically dollar-positive.

Canadian manufacturing sales are due at 1230 GMT.

The ECB’s Praet will be giving a speech at 0730 GMT, while Bank of England policymaker Cunliffe’s re-appointment hearing is scheduled to begin at 1315 GMT. Permanent FOMC voting member Brainard will also be making a public appearance at 1410 GMT, though the topic of discussion is unlikely to yield any market-sensitive remarks.

In equities, Alcoa is among corporations releasing quarterly results; the firm’s report will be made public after the closing bell on Wall Street. The Fed minutes may also affect stock market positioning, especially in light of yield angst that has weighed on equities recently.

In energy markets, EIA data on US crude stocks due at 1430 GMT are predicted to show an inventory buildup of around 2.2 million barrels during the week ending October 12, following a rise by roughly 6.0m in the previously tracked week. Tensions between the US and Saudi Arabia over the disappearance of journalist Khashoggi will also be monitored for a potential impact on prices.

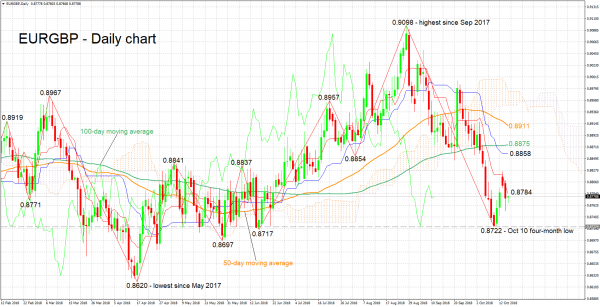

Technical Analysis: EURGBP bearish in short-term though negative bias may be easing

EURGBP is trading roughly 50 pips above last week’s four-month low of 0.8722. The Tenkan-sen is below the Kijun-sen, this being indicative of the bearish bias in the short term. At the moment though, the Kijun-sen has halted its decline which may be an early sign of easing negative momentum.

A breakthrough on the Irish border issue is expected to push the pair lower. Support to losses may come around last Wednesday’s four-month low of 0.8722; the area around this captures a couple of lows from previous months, as well as the 0.87 handle. Lower still, the 0.8620 nadir would come into scope, potentially offering support to steeper losses.

On the upside and in case of an impasse in negotiations, immediate resistance could occur around the Tenkan-sen at 0.8784; notice that the zone around this point was congested from late April to late June. Further above, the Kijun-sen would be eyed, with the region around it capturing a few tops and a bottom from the recent past, as well as the current level of the 100-day moving average line at 0.8875.

UK inflation data can also provide some near-term direction to the pair.