For the 24 hours to 23:00 GMT, the EUR declined 0.27% against the USD and closed at 1.1306.

In economic news, data indicated that Germany’s final consumer price index (CPI) advanced 1.5% on an annual basis in February, less than market consensus and preliminary reading for a rise of 1.6%. In the previous month, the CPI had climbed 1.4%.

In the US, data showed that the US new home sales unexpectedly tumbled 6.9% on a monthly basis, to a level of 607.0K in January, defying market expectations for a rise to a level of 622.0K. New home sales had recorded a revised reading of 652.0K in the previous month. Moreover, the number of applicants filing for fresh unemployment benefits rose to a level of 229.0K in the week ended 09 March 2019, more than market anticipations for a rise to a level of 225.0K. In the prior week, initial jobless claims had recorded a reading of 223.0K.

In the Asian session, at GMT0400, the pair is trading at 1.1318, with the EUR trading 0.11% higher against the USD from yesterday’s close.

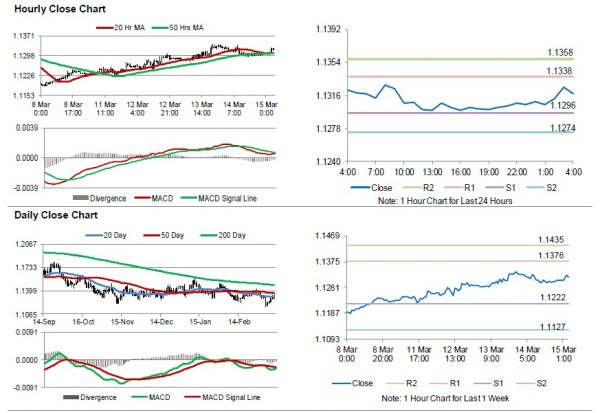

The pair is expected to find support at 1.1296, and a fall through could take it to the next support level of 1.1274. The pair is expected to find its first resistance at 1.1338, and a rise through could take it to the next resistance level of 1.1358.

Moving ahead, investors would await the Euro-zone’s consumer price index for February, scheduled to release in a few hours. Later in the day, the US NY Empire State manufacturing index and the Michigan consumer sentiment index, both for March as well as industrial production and manufacturing production, both for February, will keep traders on their toes. Additionally, the US JOLTS job openings for January,.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.