March Quarter CPI Headline CPI 0.0%qtr/1.3%yr Trimmed mean 0.28%qtr/1.6%yr Weighted median 0.10%qtr/1.2%yr

Inflation surprises to the downside – the return of Godot

The March Quarter CPI was flat (0.0%) compared to the market median of 0.2% and Westpac’s forecast for 0.1%. At two decimal places the CPI was also flat (0.0%qt) with the annual rate dropping to 1.3%yr (from 1.8%yr) the slowest annual pace since September 2016. With another subdued print, the six month annualised pace is now just 1.1%yr (using seasonally adjusted data) the slowest pace since June 2016 highlighting that the inflationary pulse continues to remain well under the bottom of the RBA’s target band.

Following the December quarter report we argued that while we may have found a bottom for the disinflationary pulse it was too early to call an emergence of an inflationary pulse. The March quarter report confirms that a lack of widespread inflationary pressure and that the unfolding correction in housing is an ongoing dampener for core inflation.

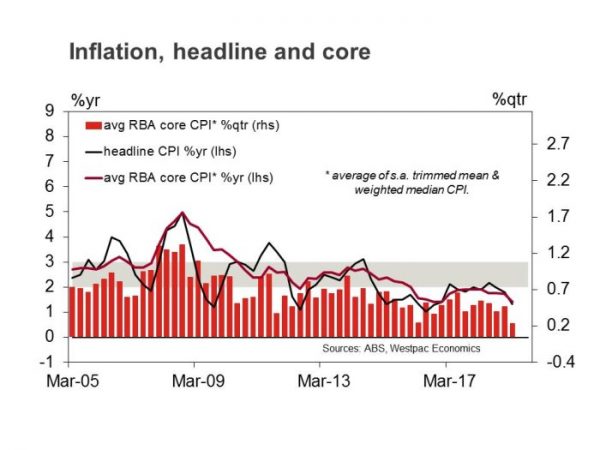

The average of the RBA’s core measures, which are seasonally adjusted and exclude extreme moves, rose 0.2%qtr below market expectations for 0.4% and Westpac’s forecast for 0.3%. In the quarter, the trimmed mean gained 0.28% while the weighted median lifted 0.10%. The annual pace of the average of the core measures printed 1.4%yr the slowest pace of core inflation since December 2016.

Incorporating revisions, the six month annualised growth in core inflation is now just 1.2%yr, well below the bottom of the RBA target band and the slowest pace since December 1997.

Hard to find any upside price pressure

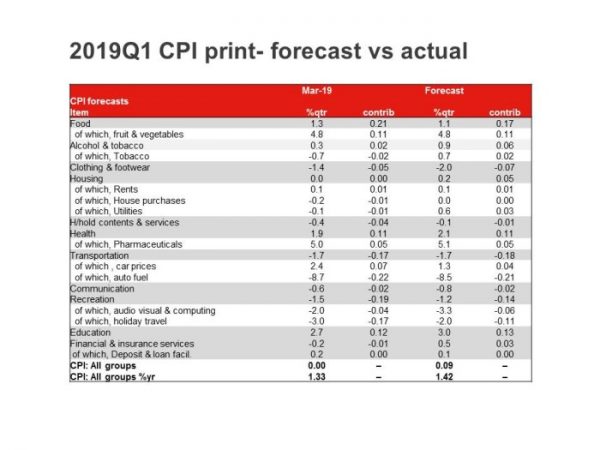

Standouts in the quarter were: on the positive or high side of expectations there was very few:

Food rose 1.3% vs 1.1% expected, with drought and adverse weather conditions continuing to reduce the supply of a selection of fruits and vegetables added to higher input costs placing upward pressure on other food items such as poultry and bread. Clothing & footwear fell 1.4% vs. –2.0% forecast.

Prices that fell or where on the low side of expectations:

Tobacco prices surprised with a 0.7% fall (+0.7% expected), housing was flat (0.2% forecast) on falling house purchases and utilities, household contents fell 0.4% vs. –0.1% forecast, health rose 1.9% vs. 2.1% forecast and recreation fell 1.5% vs. –1.2% forecast due to a larger than expected fall in holiday travel.

The softer than expected housing cost print reflected the fall in dwelling prices (–0.2% vs forecast for a flat print – this reflected a significant fall in Victorian dwelling prices of 1.2%qtr) rents reported a modest 0.1% rise as expected while utilities surprised with a 0.1% fall.

There remains a significant near term negative risk around dwelling purchases prices in NSW. Prices are already falling in Victoria as are rents in NSW. Given that rents and dwelling purchases together are worth around 15% of the CPI, this is a significant risk for headline inflation, and even more so for core where the weight is somewhat higher.

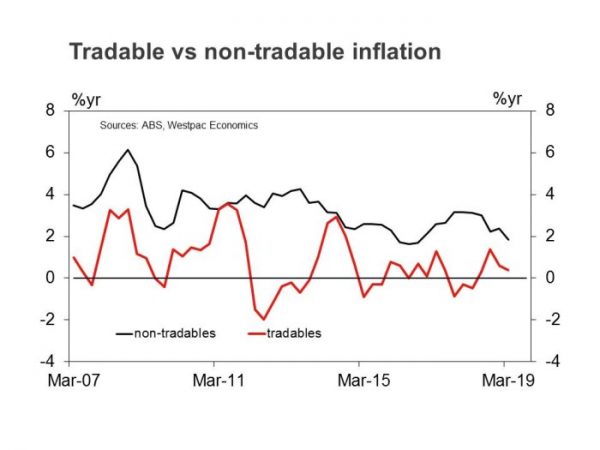

Tradables rose 0.4% in the March quarter. The tradable goods component fell 0.6% due to automotive fuel (-8.7%). The tradable services component fell 2.0% due to international holiday, travel & accommodation (-2.1%). It is worth noting that petrol prices have been rising solidly in recent weeks on the back of surging crude oil prices.

Non-tradables component rose 0.3% in the March quarter. The non-tradable goods component rose 0.4%, due to pharmaceutical products (5.0%). The non-tradable services component rose 0.3% due to secondary education (4.2%).

Inflation is stuck well below the target band with little reason to expect it to return there anytime soon.

It was hard to find even some isolated inflationary pressures; even tobacco prices surprised with a fall in the quarter. Clothing and footwear may not have fallen as much as expected but they are not a galloping inflationary pulse either.

Housing has a significant group weighting in the CPI (22%) so it has a meaningful impact on both inflation and core inflation. With such a modest outlook for housing costs we can find little to suggest any risk of a meaningful acceleration in core inflation from below the bottom of the RBA’s target band.