- Sterling crumbles as no-deal Brexit risk returns

- Aussie gets a lift from politics, but outlook still grim

- Dollar continues to reign supreme as other currencies lack appeal

Pound dives as May’s grasp on power weakens

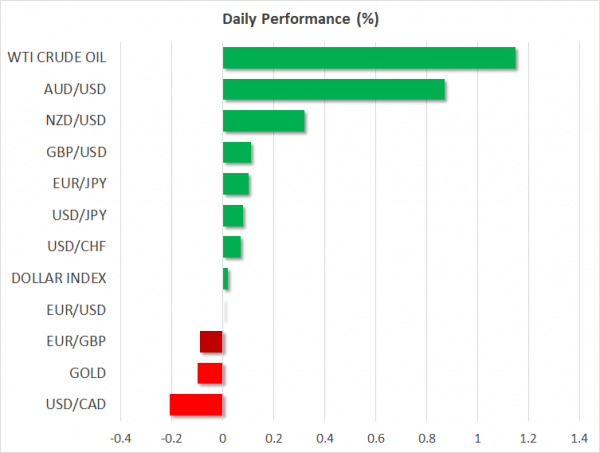

Sterling took yet another hit on Friday, with Cable falling to its lowest level since January as the British political landscape darkened. Cross-party talks between Theresa May’s Conservatives and the opposition Labour party collapsed, dashing hopes for a bipartisan compromise to break the Brexit deadlock.

More importantly, May’s grasp on power seems to be weakening by the day, with many seeing her as a ‘lame duck’ Prime Minister now that she has all but confirmed she will step down come summer. The real question now is who will replace her, and whether her successor will be a ‘hawk’ that wants to deliver Brexit in October no matter what. This seems like a disaster in the making for the pound, as a no-deal Brexit is slowly becoming a realistic scenario again.

This week, the biggest risk for sterling are the EU Parliament elections on Thursday. Opinion polls suggest the Conservatives will get crushed, with many of their voters defecting to the new Brexit Party. Such a poor showing could add even more pressure on the Tories to rebrand their image by replacing May with a more ‘Leave friendly’ leader, like Boris Johnson, consequently keeping the pound under pressure.

Politics lift the aussie, but risks still loom

The Australian currency is recovering ground on Monday, after the nation’s federal election produced an upset victory for incumbent PM Scott Morrison, defying opinion polls that had predicted a win for the opposition. Morrison has promised a fiscal boost for the economy, mainly via tax cuts, which is probably what has lifted the aussie today.

Alas, this doesn’t change much in the near term. Any tax package is months away at best, and the risks that have pushed the aussie lower lately haven’t abated. US-China trade tensions are still heightened, and may even escalate further in the summer as Trump threatens to impose more tariffs. Meanwhile, markets appear convinced that the RBA will ease soon, with a rate cut being fully priced in by July. Hence, the risks surrounding the aussie still seem tilted to the downside, and this relief rally may prove relatively short lived.

‘King dollar’ continues to reign supreme

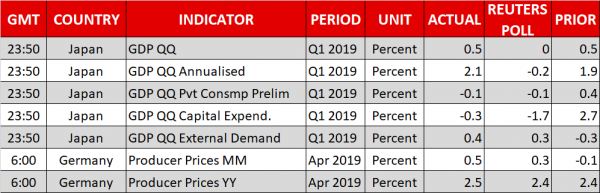

The lack of appeal in most major currencies continues to translate into broad dollar strength. The euro is plagued by growth concerns, the pound by Brexit uncertainty, and trade tensions have taken the shine off of commodity currencies like the aussie and kiwi. The yen is the only real contender to the dollar at this point given the risk aversion of recent weeks, and the prospect for that to continue. Of note, Japan’s GDP growth for Q1 smashed estimates overnight, but the yen did not react.

What is particularly striking is that the dollar has continued to outperform even in an environment of growing Fed rate-cut bets. A quarter-point rate cut by December is now fully priced in, which seems quite pessimistic considering that the US economy is still in good shape. Therefore, anything that alters this gloomy narrative going forward – for instance a sanguine tone in the upcoming Fed minutes on Wednesday – could benefit the dollar further as some rate cut bets are unwound.