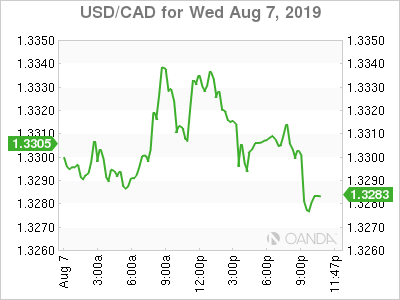

The Canadian dollar rose during the Asian session on Thursday. The loonie had touched seven week lows against the US dollar on Wednesday as risk appetite shrank after days of trade war barbs exchanged by the US and China had investors looking for safe havens.

The USD/CAD is trading at 1.3297 with the loonie gaining some ground as the US rally is losing some steam as both sides in the trade dispute are trying to walk back the effects of their earlier threats.

The central banks of India, Thailand and New Zealand cut their benchmark interest rates on Wednesday as policy makers start walking the dovish walk. The Bank of Canada (BoC) had some breathing room after the Fed cut by 25 basis points at the end of July, but the increased trade tensions could force the central bank to lower rates sooner rather than later.

CAD traders will continue to navigate uncertain waters on Thursday, awaiting domestic employment data on Friday. Trade war headlines will continue to guide markets as global growth estimates keep falling as the two largest economies duke it out with no agreement in sight.

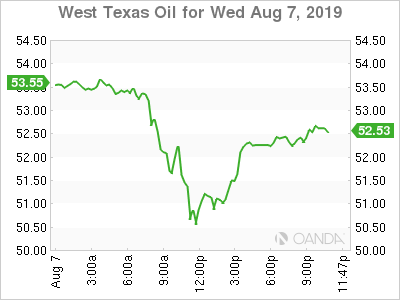

OIL

Oil prices fell on Wednesday after the EIA’s weekly crude inventories showed a surprise buildup of 2.4 million barrels. The streak of seven drawdowns to a close at a bad time for energy prices as oil was already on the back foot as trade tensions escalated after China retaliated against the US in the prolonged trade war between the US and China.

The trade dispute between the two largest economies has been the biggest factor impacting energy demand. Supply and demand fundamentals have taken a back seat as global growth estimates have been downgraded as there is no trade deal in sight for the US and China.

Saudi Arabia was the main architect of the OPEC+ deal, but at the moment appears powerless to stop the downward slide of crude prices. The extension to the production cut agreement has been a stabilizing force, but not enough to offset the escalating trade war.

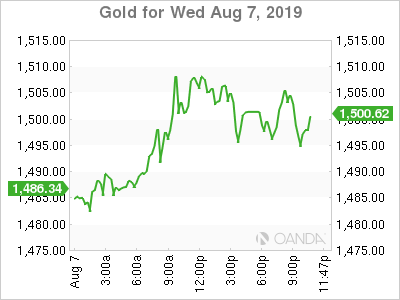

GOLD

Gold broke through the $1,500 price level, but it proved too much for the metal that is now trading at slightly lower at $1,496. Gold reached six year highs as trade war concerns remain high after China continues to be defiant in the face of higher tariffs from the US.

The appeal of gold as a safe haven is driving investors to hold the metal as the outcome of the trade negotiations is uncertain given the aggressive tone from both sides.

Central banks stepped up their efforts to bring rates lower with the Reserve Bank of India, Thailand and the Reserve Bank of New Zealand cutting rates. The RBNZ made an aggressive cut of 50 basis points as policy makers make pro-active moves ahead of a volatile second half of 2019.

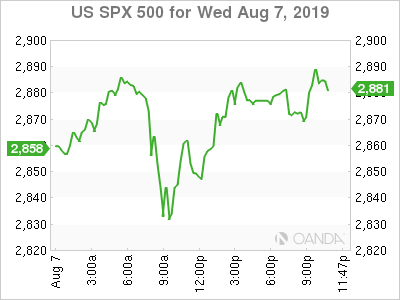

STOCKS

US equities recovered from earlier loses as investors saw buying opportunities after the PBOC boosted the Yuan that had fallen. The intervention from the Chinese central bank brought some confidence back into the market as the US also walked back some of its more aggressive statements. Trade anxiety remains high impacting equities, and investors are flocking to safe haven assets like bonds, the Japanese yen and the swiss franc, and gold.

Central banks around the globe have turn dovish and the moves by three central banks on Wednesday was a reminder of how limited the runway for easing is around the globe. The RBI, RBNZ and the BOT cut rates, with two out of the three cutting by more than was expected.

Lower rates have been a factor in the bull market, but at this point there is not a lot of room to cut from central banks, a fact the Fed is aware of, even as the White House keeps pressuring on a daily basis.