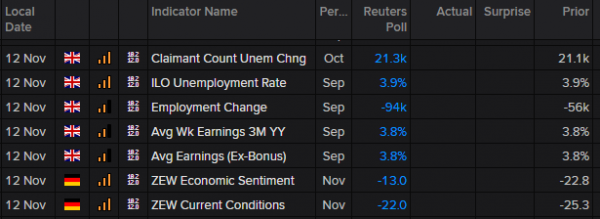

Employment a risk to near-term BoE cut expectations

After last night’s rally in GBPUSD off the back of election headlines and not UK GDP, GBPUSD faces more sensitivity around UK jobs report due out at 9.30am LT. While the large focus will be on unemployment claims and the unemployment rate, we don’t discount the contribution made by average weekly earnings and employment change. Expectations are for most figures to remain broadly in line with the prior month. Hence, should there be any evidence of a slowdown in earnings growth, don’t be surprised by some GBPUSD selling back into 1.28 as risks around a near-term rate cut increase.

German ZEW Sentiment to show better times ahead?

Half an hour after UK jobs, markets catch German ZEW Economic Sentiment and Current Conditions at 10.00am LT. The leading sentiment measure which informs how businesses are feeling about future economic activity is forecast to print -13, a moderate improvement on the prior month, as polled by Reuter economists. Given EURUSD has stayed awfully quiet over the prior three sessions, trading in a by-in-large 20pip range, we do expect a slight uptick in EURUSD volatility around the announcement. A sharp improvement in the measure could see EURUSD edge back towards 1.105 levels, the next intra-week resistance level to the upside.

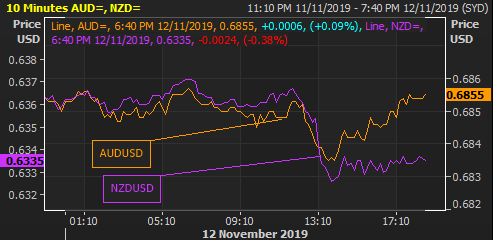

Antipodeans draw attention

A drop in NZ inflation expectations during early Asia saw RBNZ rate cut expectations aggressively reprice higher with some major Australian banks now calling for a 25bps rate cut. We preview the close rate call ahead for NZDUSD traders in our SPECIAL REPORT: RBNZ November Preview piece.

New Zealand’s neighbour in AUDUSD bucked the trend, retracing its initial sell-off (from uninspiring Business Confidence), closing back above 0.685 likely driven by the late 2.5% gain in iron ore futures. Elsewhere, though it’s been relatively quiet on the US-China trade front we remain mindful of the broader risk-on/risk-off impacts in our SPECIAL REPORT: The US-China Art Of War.