U.S. Review

Fed Keeps Rates on Hold as GDP Growth Remains Sturdy

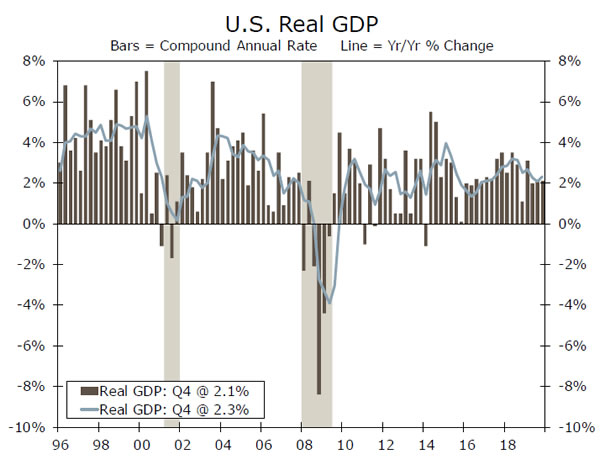

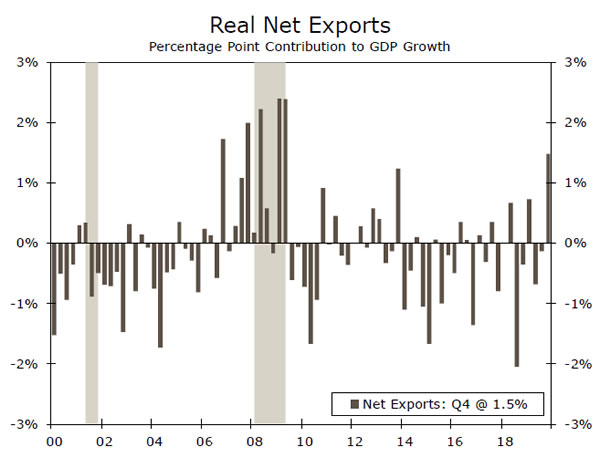

- Real GDP grew 2.1% on an annualized basis in Q4, in part due to a boost from net exports. Year-to-year, real GDP is up 2.3%.

- The Fed left the target range for the federal funds rate unchanged, but slightly lifted the interest rate paid on excess reserves by 5 bps.

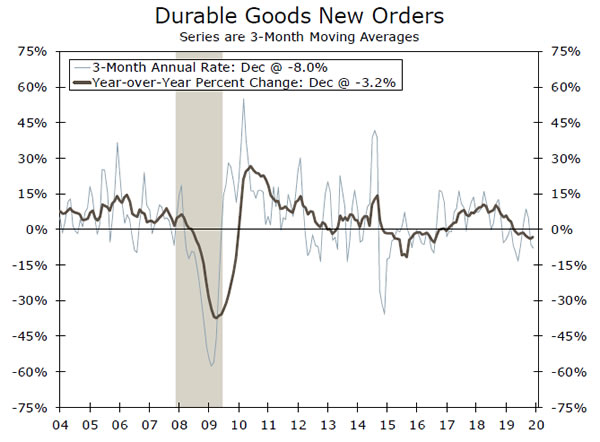

- Durable goods orders jumped 2.4% in December thanks to a surge in defense orders. Excluding defense, orders fell 2.5%.

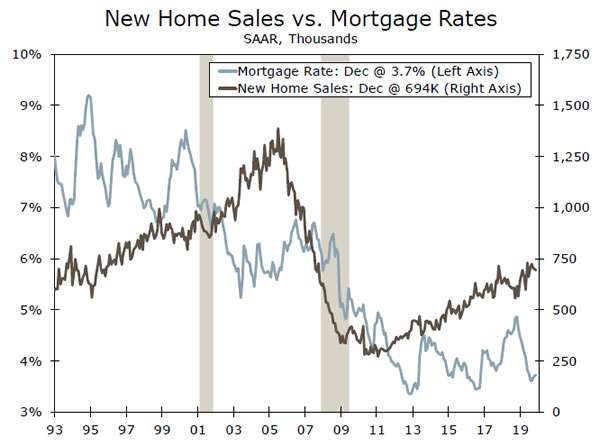

- New home sales slipped 0.4% in December, but ended the year up 10.3% compared to 2018 thanks to lower mortgage rates.

- Personal income grew 0.2% during December, while personal spending advanced 0.3%.

Fed Keeps Rates on Hold as GDP Growth Remains Sturdy

The first week of the Chinese Lunar New Year started off with coronavirus fears sending financial markets into a tailspin over the potential impacts of the worldwide spread of the virus on already weak global growth (see Topic of the Week on page 7.)

However, through the noise of the day-to-day market volatility, economic growth in the U.S. continues to hold up fairly well. Real GDP grew 2.1% on a quarterly annualized basis during Q4—a solid outcome—which is roughly in line with the pace averaged over the past decade.

Looking under the hood, growth in Q4 was boosted by a sizable 1.5 percentage point contribution from net exports, as a modest increase in exports was offset by a steep decline in imports. The threat of additional tariffs in December likely led many importers to pull purchases forward into earlier in the year, which helps explain the dramatic decline. That noted, business fixed investment continued to be a drag, owed to the combined forces of the trade war, the Boeing 737 MAX sidelining, and a pullback in the energy sector. However, consumer spending remained firmly in positive territory, and an upturn in government purchases provided some additional support. Furthermore, lower mortgage rates spurred the second straight quarterly rise in residential investment.

Residential construction and new and existing home sales have reversed course and are now on a positive trajectory. New home sales slipped 0.4% in December, but ended the year up 10.3% compared to 2018. The widespread improvement in the housing data can also be seen in the homeownership rate, which climbed to 65.1% during Q4, the highest since 2013.

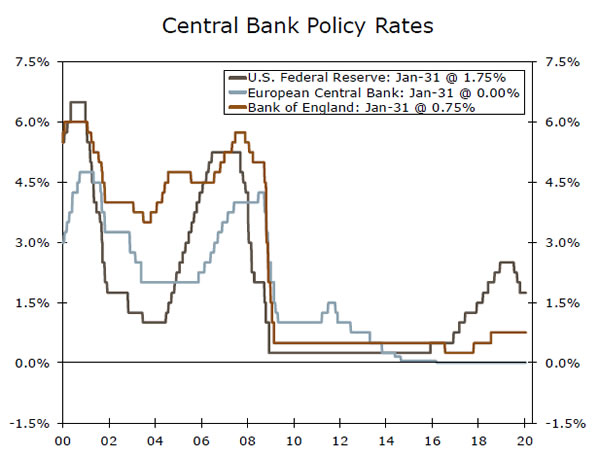

Both housing and the broader economy should continue to be supported by lower interest rates moving forward. The first FOMC meeting of 2020 yielded no change to the federal funds rate, with officials choosing to maintain the current 1.50%-1.75% target range. Given the effective federal funds rate has been trading closer to the bottom of that range, Fed officials lifted the interest rate paid on excess reserves by 5 bps in order to incentivize commercial banks to keep more reserves parked at the Fed and help keep the effective rate closer to the middle of the target range.

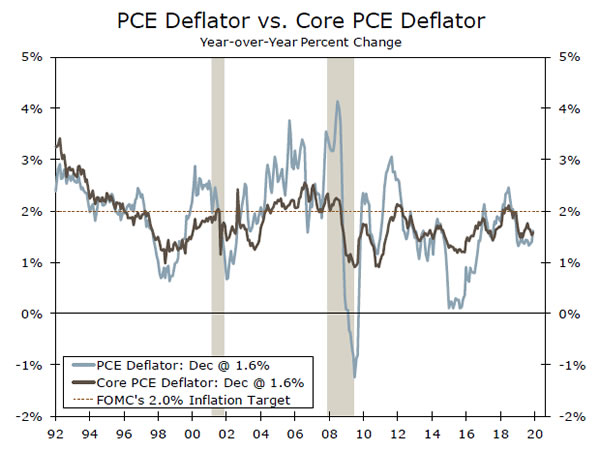

We expect the Fed to hold-off on any adjustments to the federal funds rate this year. While business spending remains weak (durable goods orders jumped 2.4% in December, but excluding defense, fell 2.5%), we expect better days ahead as the fog of trade uncertainty begins to dissipate. After it passed through both the House and Senate, President Trump signed the USMCA trade agreement on Wednesday, which should help along those lines. In addition, consumer spending should continue to be solid. In the final month of the year, personal spending rose a solid 0.3%. Meanwhile, inflation continues to gradually move towards the Fed’s 2.0% target. The PCE deflator, the Fed’s preferred inflation measure, rose 1.6% year-to-year during December. With sturdy GDP growth and modest inflation pressures, the Fed will likely be content on keeping rates on hold for the remainder of 2020.

U.S. Outlook

ISM Manufacturing • Monday

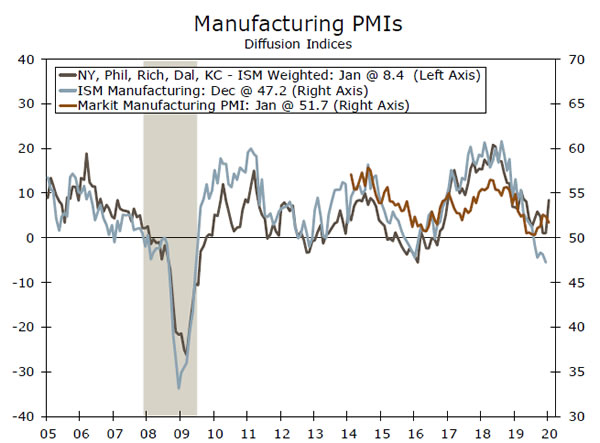

In December, the ISM manufacturing index sank to its lowest level since the recession and marked its fifth straight month in contraction territory. We expect to see a turnaround in January’s figures, however. For starters, regional Fed manufacturing surveys showed a net pickup in January, while the preliminary reading of the Markit index suggests activity continues to expand. The ISM index has undershot other PMIs by a wide margin in recent months, suggesting some catch up is due.

January brought with it a number of events that will likely trigger such a catch up. The United States and China reached a Phase I deal on trade, while the USMCA deal moved through Congress and was signed into law this week. Both should alleviate some uncertainty surrounding trade policy and, along with some stabilization in global manufacturing activity, help push the ISM up to 48.8.

Previous: 47.2 Wells Fargo: 48.8 Consensus: 48.5

ISM Non-Manufacturing • Wednesday

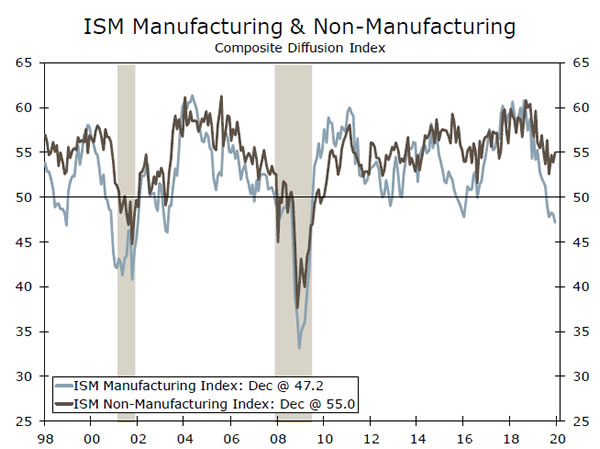

Although the ISM manufacturing index garners more attention among the media and markets, we view the ISM non-manufacturing index as a more telling barometer of the strength of the U.S. economy. In recent months, the gap between the manufacturing sector and all other industries has widened to the biggest gulf since 2015. The ISM non-manufacturing index has remained comfortably in expansion territory and indicates that spillovers from a weaker factory sector to other industries have been limited.

We expect the ISM non-manufacturing will be little changed in January, and will continue to point to activity across the broader U.S. expanding at a decent rate. The preliminary Markit services PMI ticked up in January, while regional Fed readings on the service sector show activity has continued to firm since the summer.

Previous: 54.9 Wells Fargo: 54.9 Consensus: 55.0

Employment • Friday

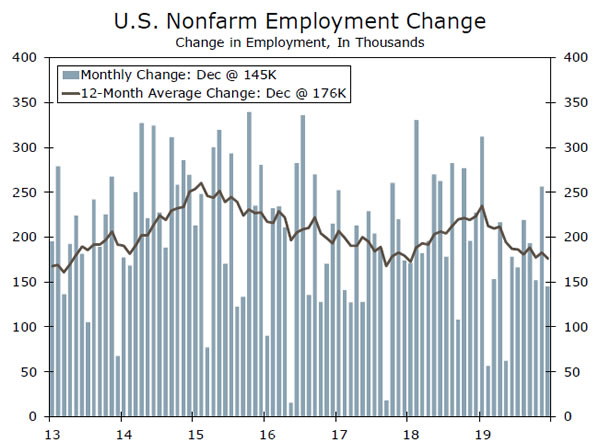

Job growth likely improved in January, coming in at a more trendlike 170K gain after employers added 145K jobs in December. Jobless claims have settled down in recent weeks, while sub-indices of regional purchasing managers’ surveys indicate hiring firming. The kick-off of the Census year may give payrolls an additional small lift.

The January release will include the annual benchmark revisions to payrolls. The preliminary estimates showed that there were 501K fewer jobs in March 2019 than is currently published—the largest revision since 2009. More recent data will not be affected by the benchmark process, but the weaker momentum of 2018-early 2019 could influence expectations for payroll growth going forward.

The unemployment rate will likely remain unchanged at 3.5%. It is a close call on average hourly earnings growth, but we expect a 0.3% gain for January and for the year-ago change to tick back up to 3.0%.

Previous: 145K Wells Fargo: 170K Consensus: 156K

Global Review

Central Banks on Hold; Mexico’s Economy Struggling

- This week, both the Bank of England and Chilean Central Bank opted to keep policy rates unchanged. Political developments have weighed on both economies, with Brexit complications creating mixed sentiment towards the UK, while social unrest is hurting economic activity in Chile. As of now, we expect both central banks to stay on hold, but acknowledge the dovish language from each set of policymakers.

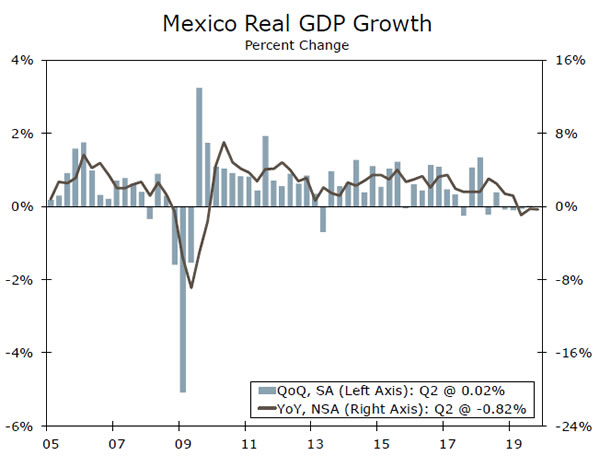

- Mexico’s economy has slowed notably over the last year, with the economy contracting again in Q4, indicating a full-year contraction for 2019. Growth prospects for 2020 remain dim as political uncertainty weighs on the country’s outlook.

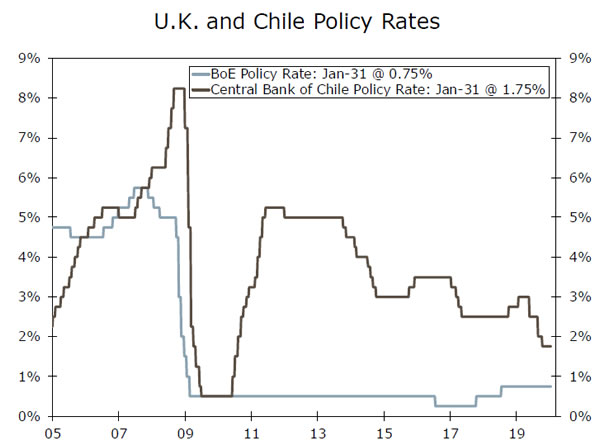

BoE Holds but Suggests Rates Could Move Lower

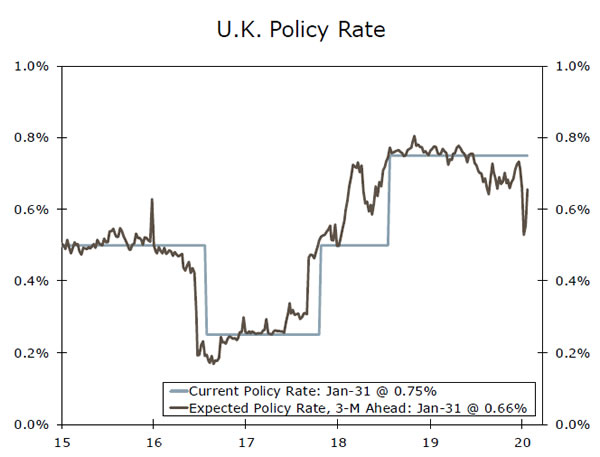

On Thursday, the Bank of England (BoE) convened to assess monetary policy, with market participants split on whether the central bank would cut policy rates or keep them steady. The BoE ultimately opted to keep rates on hold at 0.75%; however, in our view, BoE policymakers were relatively dovish. BoE governor Mark Carney commented that UK economic data were “good enough,” but noted that the UK monetary policy committee needs to see more evidence of a pickup in activity in order to avoid an interest rate cut in the future. In addition, there was dissent among BoE policymakers, with seven members voting for no rate change, and two members voting for a cut. The BoE also released updated GDP and inflation forecasts, which were also a bit dovish in nature, indicating that BoE policymakers expect growth to slow to below 0.50%, while inflation is forecasted to tick up only modestly.

Chilean Central Bank Stays Steady as Protests Calm

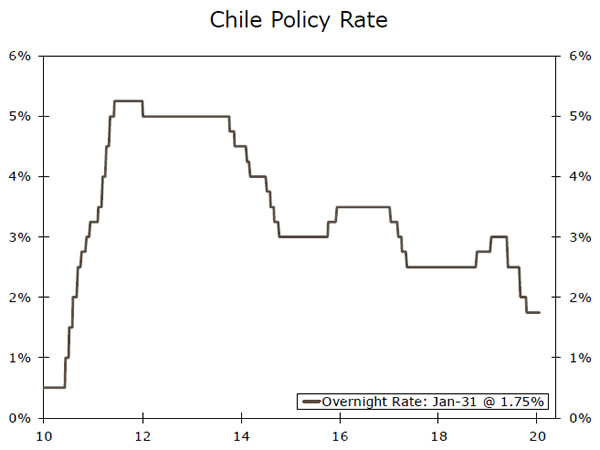

The Central Bank of Chile also opted to keep policy rates on hold at 1.75% this week. While this was expected by market participants, the decision still resulted in a sharp selloff of the Chilean peso later in the week. The Chilean central bank has been in a tough place for months now as social protests erupted in the second half of last year. Immediately following the protests, economic activity in Chile contracted sharply, sparking fear that Chile could enter technical recession in Q1-2020. The slowdown in Chile’s economy provides an incentive for Chile’s central bank to cut policy rates; however, given the selloff in the currency and how sensitive the peso is to political unrest, the central bank has been cautious to adjust interest rates. More recently, protests have calmed as the administration has agreed to rewrite the country’s constitution in an effort to address policies that likely contributed to large wealth disparity in the country. The constitutional rewrite process will begin in April, which we expect to be a bit contentious given the complexities that are involved and how violent the protests originally were. As far as monetary policy, it is possible the central bank could lower rates if the rewrite process sparks renewed protests and continues to weigh on economic activity.

Mexican Economy Contracts Again

The Mexican economy has been under duress for a while now, with this week’s Q4 GDP print also underwhelming. Recent data indicate the Mexican economy contracted 0.2% quarter-over-over in Q4, the third quarterly contraction in Mexico in 2019. This follows revised data in Q3 indicating the Mexican economy fell into technical recession in the first half of the year, while also indicating the economy contracted for the entire year. We can point to multiple explanations for the sharp slowdown in Mexico, high interest rates being one of them. However, we point to elevated political risks as the primary reason for the deceleration. Following president AMLO’s decision to cancel the construction of a major airport in Mexico City, corporations and investors alike have been extremely cautious to deploy money into Mexico. AMLO’s decision to halt auctions of Mexican oil fields and lower oil production have also contributed, while austerity measures have limited government spending which could spur GDP growth.

Global Outlook

Turkey Inflation • Monday

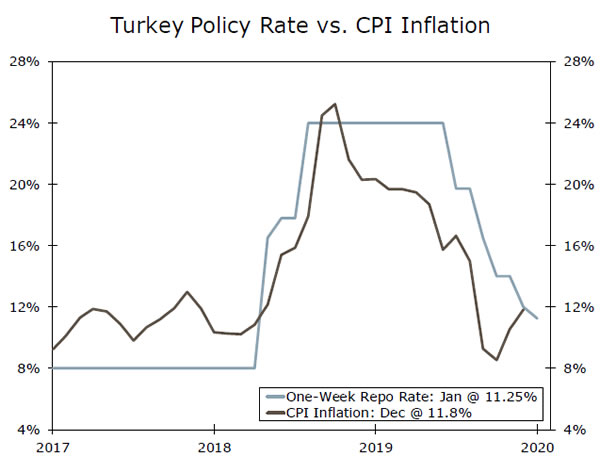

For the majority of 2019, CPI inflation in Turkey had been on a downward trajectory. A stable exchange rate and recovering Turkish economy aided the deflationary process; however, with the Central Bank of Turkey aggressively easing policy rates, inflation has started to tick up slightly. At its latest meeting, the central bank again lowered its one-week repo rate, this time by 75 bps, which has taken real yields in Turkey essentially down to 0%. In this context, investors could be less incentivized to hold Turkish lira, which if this scenario were to materialize, we would expect currency depreciation to fuel inflation and push prices higher in Turkey. The most recent commentary from central bank officials suggests rates could be on hold for now; however, given President Erdogan’s influence over monetary policy, it is likely that interest rate could continue to move lower in the future. Lower rates could also spark renewed inflationary pressures in Turkey.

Previous: 11.84% Consensus: 11.90% (Year-over-Year)

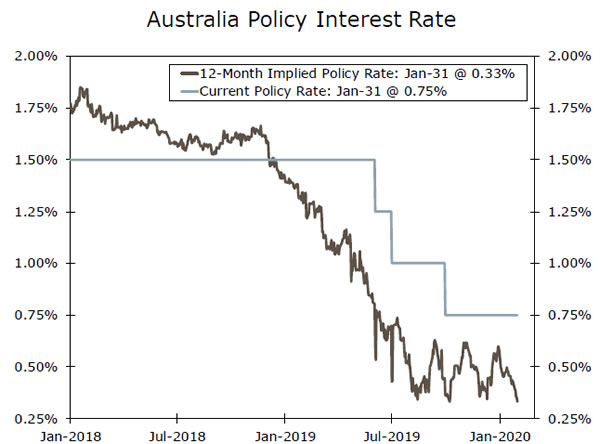

Reserve Bank of Australia • Monday

The Reserve Bank of Australia (RBA) is set to make a decision on its Cash Rate Target next week, with consensus forecasts suggesting the RBA will lower rates 25 bps. Should the RBA cut policy rates 25 bps, rates will be cumulatively 100 bps lower than they were at the beginning of 2019. There is justification for lower rates as inflationary pressures in Australia remain muted, while growth prospects are also relatively subdued. In addition, strong trade linkages with a decelerating China have weighed on the economy as well and have prompted RBA policymakers to take measures to support the economy. On the other hand, Australia’s labor market remains strong with unemployment ticking lower in December, while the pace of job creation remains strong. A Phase I trade deal between the U.S. and China could take some pressure off the Chinese economy, which would likely provide additional support for the Australian economy.

Previous: 0.75% Consensus: 0.75%

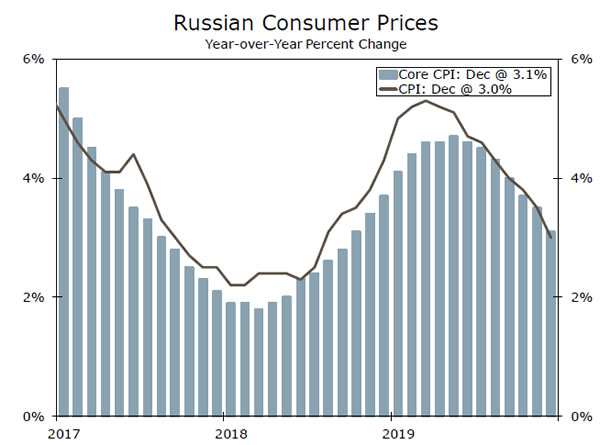

Russia Inflation • Thursday

Inflation in Russia peaked around 5.5% year-over-year in March of 2019; however, prices have steadily come down for the remainder of 2019. Consensus forecasts also suggest that inflation will continue to move lower into 2020. This dynamic is a bit surprising as the Central Bank of Russia aggressively cut policy rates last year, lowering its Key Policy Rate five times to 6.25%. Two possible reasons can explain lower inflation in Russia, one being the ruble’s 12.5% appreciation over the course of 2019, with the other being the effects of an increase to the country’s VAT slowly wearing off. With inflation pressures so muted, the central bank has raised the possibility of lowering Russia’s inflation target, which currently stands at 4.0%. In our view, the central bank will not opt to lower its inflation target as it could damage its credibility and market perception of its ability to manage inflation. The central bank will meet again in early February, where rates are expected to stay steady.

Previous: 3.0% Consensus: 2.5% (Year-over-Year)

Point of View

Interest Rate Watch

January Travails Weigh on Yields

January proved to be quite a momentous month. The financial markets had to maneuver their way through a number of extraneous events ranging from impeachment to the prospect of a broader conflict with Iran, the Boeing 737 MAX production cuts and the coronavirus. February will begin in earnest with the Iowa Caucuses and the presidential race kicking into high gear, which looks like it will begin during Sunday’s Super Bowl advertising.

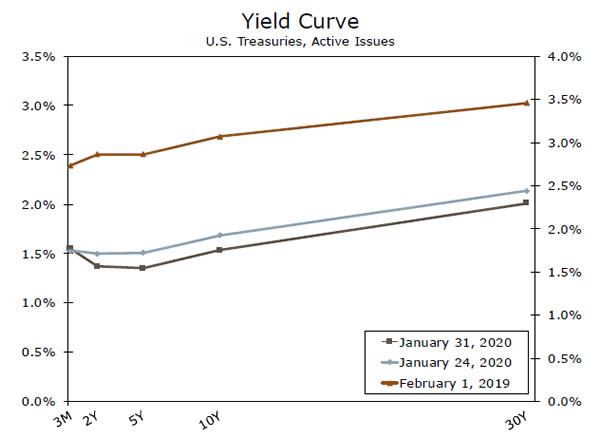

The sudden abundance of outside influences has pulled down interest rates, with the yield on the 10-year Treasury briefly falling below the three-month T-Bill rate and currently remaining roughly 5-7 bps below the federal funds rate at 1.54%.

The bond market is more concerned about the economy than the Fed is. Investors likely fear a repeat of the global slowdown that followed the tsunami and Fukushima nuclear disaster, which crippled global supply chains. While the January FOMC meeting policy statement was consistent with Jay Powell’s refrain that there is a ‘high bar’ for raising or lowering interest rates, the financial markets currently suggest we are much nearer to meeting that high bar for another quarter-point rate.

The bond market’s heightened concern is likely due to the still worsening coronavirus situation in China. While stocks have periodically sold off on reports of infections spreading beyond China, we believe the drop in bond yields is mostly due to fears about what has already transpired in China in regard to travel restrictions and business shutdowns. Once conditions stabilize, we would expect to see bond yields bounce back but that will still likely leave us with a fairly flat yield curve.

There were two other notable shifts in the policy statement. The Fed’s assessment of consumer spending was modestly downgraded and the Fed slightly ratcheted up their frustration with inflation remaining below 2%. Powell made it clear in his press conference that he was weary of the U.S. falling into the same deflationary trap that so many other nation have. This suggest that the bar to a rate cut is probably not as high right now as the bar to rate increase.

Credit Market Insights

Duration Developments

The years-long trend of rising investment grade (IG) bond duration and falling highyield (HY) bond duration accelerated in 2019. Duration—a measure of the effective life of a bond based on its time to maturity, coupon rate and yield—last year rose around 12% to eight years among IG bonds and fell almost 25% to three years among HY bonds, according to Bloomberg Barclays data.

This can be explained by the sharp drop in interest rates last year and differences in the supply & demand of corporate bonds of varying credit quality. In terms of supply, when yields fall IG companies are eager to lock in that lower rate—or ‘term-out’ their debt—by refinancing. As IG firms rollover five-year bonds into 10-year bonds, for example, the effective duration of the IG market rises. HY bonds, on the other hand, are much more likely to be callable. As HY issuers call—or buy back—their bonds before the maturity date, the average duration of the HY market falls, as investors price in a shorter expected life.

Duration can also be thought of simply as interest rate risk. On the demand side, investors appear to be content with shorterduration HY bonds, as spreads remain near record lows. But there is also healthy demand for high quality, long-duration IG bonds, as many institutional investors need to match their long-term liabilities. The uptrend in IG duration and downtrend in HY duration are likely to continue, absent a spike in yields, which we do not expect.

Topic of the Week

Lessons From SARS

Aside from the far more important human considerations of the more than 9,900 confirmed cases of the coronavirus globally and the 213 confirmed deaths, we are charged with considering the economic impact as well.

While this remains a very fluid and uncertain situation, we can look for lessons in a similar episode during the 2002-2003 SARS outbreak which also originated in China and caused more than 700 deaths worldwide.

No comparison is perfect, and this one is complicated by both China’s economic ascent over the past 18 years and that the war in Iraq was just getting underway in 2003. One lesson learned in that period was the need for a more active response from authorities in China, and this time, officials are clamping down hard on travel and extending the Lunar New Year holiday. Those needed measures will restrict more than travel, however and we have dialedback our forecast for Chinese GDP this year to 5.8%.

For the U.S. economy, the knock-on effects are most evident in consumer spending and interruptions in production due to supply chain constraints.

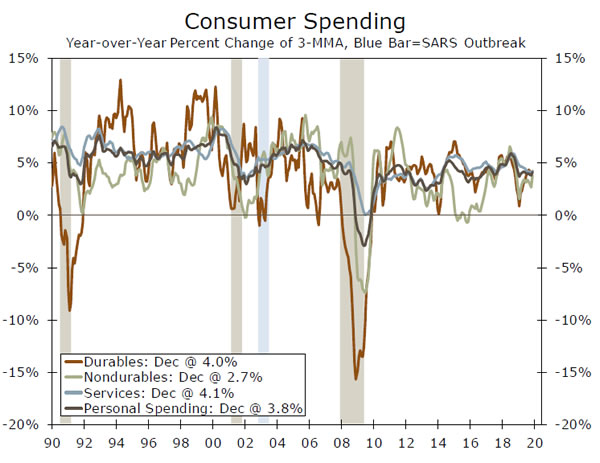

In 2003, consumer confidence was shaken and some categories of spending (air travel, for example) posted sharp declines. As the top chart shows, durable goods outlays fell for a time, but the weakness was only temporary as spending snapped back sharply. Provided the current episode does not become more widespread than the SARS outbreak, consumer spending will likely not be materially affected.

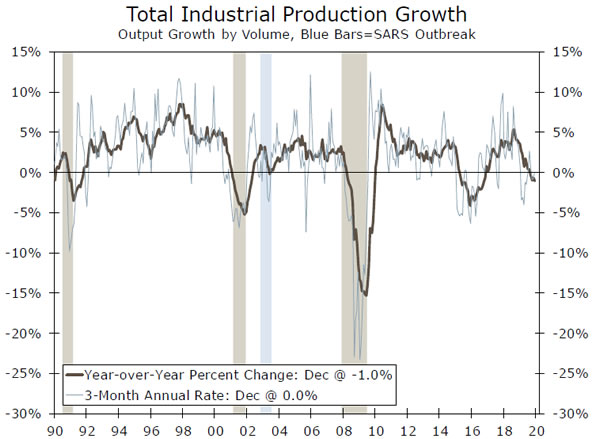

Production outages in China may reverberate in U.S. factories, output did slow briefly during SARS (bottom chart); although the war may have been the larger factor in 2003. China’s bigger role in today’s world economy suggests a better period to consider is the Fukushima nuclear disaster in March 2011 in Japan. But even this presented only temporary headwinds to domestic output. Any U.S. production cuts would likely be brief, but even if they were not, the smaller role for U.S. manufacturing means the threat to broader U.S. growth is limited.