Chinese stocks dropped as the market reacted to the spreading coronavirus disease. The Shanghai Composite Index dropped by 9%, which was the biggest one-day decline since 2015. The disease has affected more than 14,500 people, killed more than 360 people, and disrupted worldwide trade and supply chains. Multinationals that have exposure in China have been forced to make difficult decisions with limited information. For example, Apple announced that it would temporarily close stores in China. Airlines have suspended flights to China, which will have a negative impact on how companies do business. Meanwhile, futures tied to the Dow and Nasdaq rose by 180 and 75-points respectively.

Sterling declined by 30 basis points during the Asian session. This is the first trading day after the country left the European Union on Friday night. The market is now focused on a post-Brexit deal between the country and the EU. Challenges of the negotiations are already emerging as both sides have set out opposing stances on whether a deal will include alignment on rules. Boris Johnson has said that the UK will maintain high standards without the compulsion of a treaty. The EU is expected to oppose this. Michel Barnier, the bloc’s chief negotiator, is expected to say that the UK must align its processes to EU rules.

Traders will focus on the manufacturing sector as Markit releases manufacturing data for January. Data from Australia showed that the AIG manufacturing index declined from 48.3 to 45.4. In Japan, manufacturing PMI improved slightly from 48.4 to 48.8. In China, the PMI declined from 51.5 to 51.1. This happened as China remained in lockdown as the coronavirus spread. Later today, we will receive PMI data from European countries and the United States. The ISM manufacturing PMI data is expected to have risen from 47.2 to 48.5.

EUR/USD

The EUR/USD pair was relatively unchanged during the Asian session. The pair is trading at 1.1081, which is close to where it ended the week. This price is along the 14-day and 28-day exponential moving averages. The pair is also forming a cup pattern on the hourly chart. The RSI, which was previously at 82 has dropped to the current 65. It’s possible that the cup pattern will continue and that the pair will continue moving upwards.

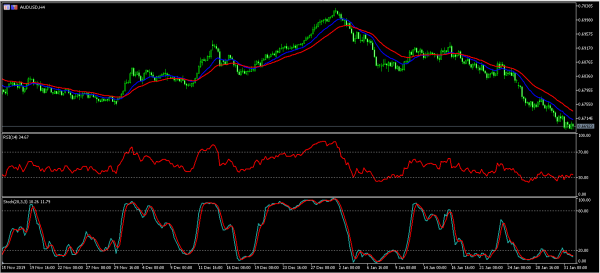

AUD/USD

The AUD/USD pair declined to an intraday low of 0.6682. This is the lowest level since October 3 last year. The price is slightly below the 14-day and 28-day exponential moving averages. The RSI and Stochastic oscillators show that the pair is in the oversold zone. The pair may continue to drop as the uncertainty over coronavirus continues. Australia has one of the biggest exposures to China.

GBP/USD

The GBP/USD pair declined to an intraday low of 1.3158 from Friday’s high of 1.3210. The 14-day and 28-day exponential moving averages appear to be making a crossover. The same is true with the signal line and histogram line of the MACD. The moving average of oscillator has continued to decline. The pair may continue to decline as Brexit negotiations continue.