Key Points:

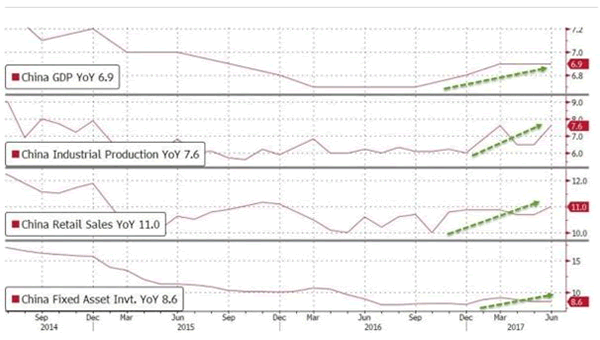

- Chinese GDP Growth rockets to 6.9% y/y.

- Industrial Production also increases to 7.6% y/y.

- However, credit impulse is not yet evident in latest GDP figures.

Markets largely got a shock overnight as China released its latest iteration of GDP growth and Industrial Production figures. Surprisingly, the data showed that the Chinese economy grew by over 6.9% y/y in the second quarter whilst Industrial Production rose to an exceedingly strong 7.6% y/y. Subsequently, the momentum remained in place for the manufacturing powerhouse but it remains to be seen if the trend continues given some of the headwinds facing the economy.

The reason the result is so surprising is the fact that the Chinese economy has undergone some significant shocks in the past three months, which have included a national deleveraging, real estate slow down, and sinking macro indicators. Subsequently, the consensus view was that the major economic indicators would, again, provide a sharp beat and confirm the domestic softness that many have speculated over in the past few weeks.

However, instead we received a July surprise with even Retail Sales figures rising sharply to 11.0% but you would be forgiven for questioning the veracity of the data given that ‘economic data management’ has been known to occur. The narrative around the current results seem to imply that the Asian powerhouse is currently awash in credit and that much of the recent expansion is being driven by consumer demand (as well as exports).

Certainly, the current expansion could be seen as positive or negative depending on your view around the mounting risks of loose and cheap credit. However, it should be noted that China’s recent drive towards fixing some of the financial risk issues within the economy is yet to flow through to the wider macroeconomic indicators.

Subsequently, we are likely to see a lagged response to the latest campaign/credit impulse and this will inexorably impact GDP in the near term. However, it’s relatively clear that the deleveraging process has been successful for Beijing and was particularly well timed. What’s less clear is what role fiscal policy is playing in the broader economic sense given that it has previously been an important part in recent growth figures.

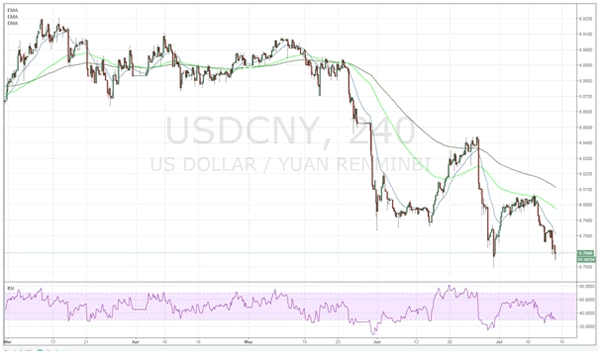

At the time of writing, there has been little impact on the Yuan but Chinese equities have soared in response to the data dump. However, it remains to be seen in the near term if the sentiment remains in place and, subsequently, buoys the Yuan. Ultimately, the impact of the risk deleveraging is likely to flow through to the wider economy over the next few months and it will absolutely affect the positive view that most analysts have taken following the release of the ‘mother of all data dumps’.