September turned out to be a rough month for equities but a good one for haven currencies as reality caught up with a runaway market. As we head into October, that heightened sense of caution looks set to prevail for a while longer amid intensifying anxiety about the US election and doubts about the sustainability of the global recovery. With not a lot on the economic agenda for the next seven days, jittery traders will be hoping that policymakers on both sides of the Atlantic will flag further monetary easing when the minutes of the Fed’s and ECB’s September meetings are published. The RBA will be in focus too as it holds a policy meeting, while on the data front, the highlights will be Canadian employment, UK monthly GDP and the ISM non-manufacturing PMI in the United States.

RBA moving closer to rate cut

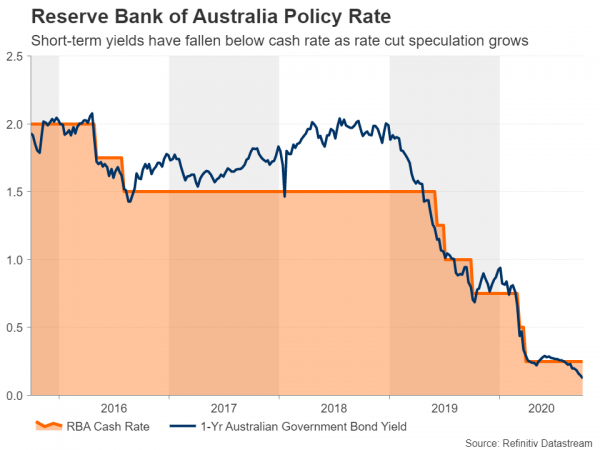

As the Fed and ECB hold their nerve, one central bank that could be ready to add more stimulus as early as next week is the Reserve Bank of Australia, which meets on Tuesday. Up until a week ago, the RBA stood out as being one of the few central banks in the world that held onto a pinch of optimism in its near-term outlook. But all of that changed dramatically when the Bank’s deputy governor, Guy Debelle, struck an unexpectedly downbeat note in a speech. Australia’s short-dated government bond (AGB) yields tumbled in response in anticipation of an imminent rate cut to 0.1% from the current record low of 0.25%.

However, although bond yields have been shaken, interest rate futures are not yet pricing a rate cut, at least not this year. It’s possible, of course, that the RBA could choose other options such as expanding its yield curve control to include AGBs with a maturity of greater than three years (currently, the RBA targets 3-year bonds at 0.25%). But if policymakers are indeed becoming more worried about the economy, the most likely outcome on Tuesday is that they will stand pat and set the criteria for further easing at one of the upcoming meetings. The reason for this is that the Australian government will unveil its new budget on the same day as the policy meeting and so apart from wanting to avoid an obvious clash, the RBA will want to see what kind of additional fiscal measures ministers will announce before it decides its next move.

The Australian dollar is at major risk of a substantial selloff should the RBA surprise with fresh policy action or provide explicit easing signals. However, having already slipped sharply on the back of the speculation, the aussie could be in line for a big upside push should the RBA only go as far as sounding slightly more dovish.

ECB hawks rear their ugly heads

European data will take a backseat in the coming week with mainly second-tier releases to look forward to. Still, given the recent signs that the Eurozone recovery is floundering, traders might keep a closer watch on them than usual. In particular, the September services PMI due on Monday could attract some attention if there is an upward revision in the final reading following the shock plunge in the flash estimate. German industrial orders (Tuesday) and production (Wednesday) for August will offer another clue as to the strength of Europe’s economic rebound.

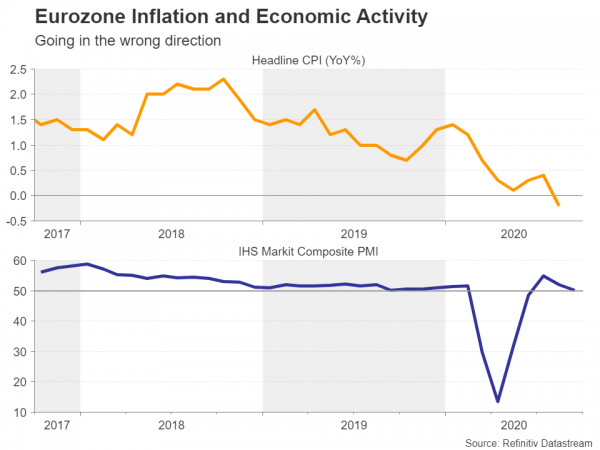

But the real focal point for the euro next week will be the European Central Bank’s meeting minutes from the September gathering due on Thursday. Recent reports suggest there is a growing split within the Governing Council about the need for additional stimulus as well as about how much flexibility the pandemic emergency purchase programme should have. Germany is apparently not happy about the ECB buying a disproportionate amount of Italian government bonds and the Bundesbank’s Weidmann is advocating an early exit from the programme. Frustratingly for President Lagarde, the push-back from the hawks comes at a time when the economy is treading water and deflationary risks are on the rise.

Should the minutes confirm the growing tensions at the decision-making table, the euro is likely to take a hit as the fading prospect of further monetary stimulus would coincide with a possible delay to the European Union’s recovery fund amid a row about what conditions should be attached to qualify for the grants.

The euro is already under pressure lately from a resurgent US dollar and increased risk aversion, as well as from an unrelenting surge in coronavirus cases across Europe that has cast a shadow over the fragile recovery.

UK data to stress long road to recovery

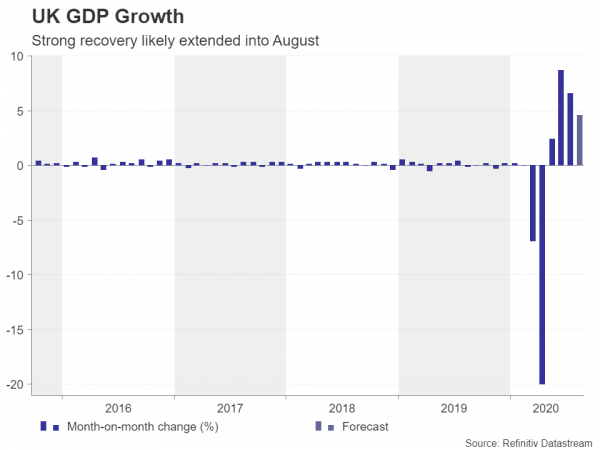

Across the English Channel, the monthly print on GDP will come under the spotlight on Friday as the Bank of England ponders what its next policy response should be. The British economy has so far staged a reasonable comeback during its reopening phase. But with a third of the population in the United Kingdom now under some form of regional lockdown, the recovery is under threat.

The effect of those local restrictions is unlikely to show up in the August numbers, however, when the hospitality sector had a bumper month, boosted by the government’s ‘Eat Out to Help Out’ scheme. Industrial production and trade figures are also due on Friday and sterling could enjoy a small lift if the data point to a further closing of the output gap caused by the pandemic.

The pound is being supported lately by dimming expectations that the BoE will cut rates to negative in the near future just as the chances of a Brexit deal have ebbed over the past week. With no apparent progress made in the last round of negotiations before Boris Johnson’s October 15 deadline and the EU beginning legal proceeding against the UK for its plans to breach the Withdrawal Agreement, it’s looking like another case of the talks entering the 11th hour before a deal can be agreed.

In the meantime, however, traders should be wary about any negative headlines that could catapult the pound ahead of that crunch time.

Fed to deliver more of the same in minutes

There’s been no shortage of Fed speakers in the past couple of weeks spreading the central bank’s latest message on the economy. Hence, it’s highly unlikely the minutes of the September 15-16 meeting out on Wednesday will add anything new to the conversation about whether the Federal Reserve should be doing more to support the recovery.

Nevertheless, the minutes might reveal policymakers’ views on what additional measures the Fed could take should America’s virus turnaround run into trouble. While officials have been keen to reassure markets that accommodative policy is here to stay, they’ve so far steered clear of discussing what other tools the Fed would consider using in its fight against the pandemic.

The recent announcement of a revamped policy framework has allowed the Fed to deflect attention away from this issue and buy itself some time while Congress debates a new fiscal stimulus package and the presidential nominees hit the campaign trail. Talks on another virus relief bill finally seem to be headed in the right direction and a deal could soon be within reach.

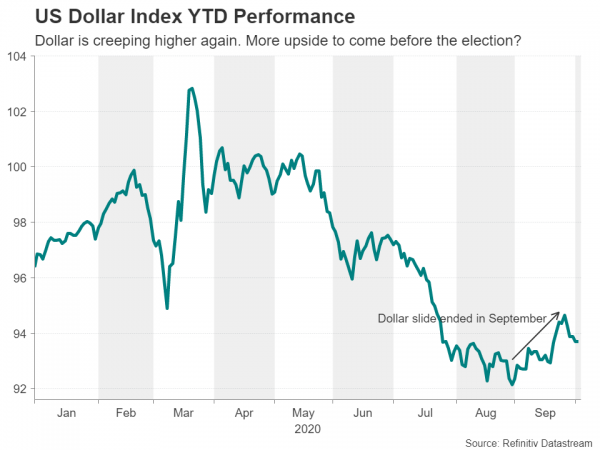

If lawmakers are able to strike an agreement, that would take the pressure off the Fed to pump more stimulus. It would also boost risk assets, lifting stocks, but probably weigh on the dollar as safe havens would fall out of favour. However, with the election less than a month away, the rising angst about the outcome would probably limit the greenback’s losses, especially now that President Trump has tested positive for COVID-19, which has added an entirely new element of uncertainty.

In terms of data, the ISM non-manufacturing PMI on Monday will be the main release that could have the most impact on the dollar.

Loonie hoping for a further bounce in jobs

The Canadian dollar’s 5½-month-long uptrend versus its US counterpart came to an abrupt end in September even as Canada’s economy continues to make solid progress in climbing out of the virus slump. Both consumption and the labour market have rebounded strongly, and the additional spending announced by the government recently should keep the recovery going.

But with risk appetite running low lately and Canada not being excluded from the second virus wave, not to mention the weaker oil prices, the loonie has corrected lower over the past month. Friday’s employment report for September is unlikely to change that trend even if new jobs continue to rise at an impressive pace and the unemployment rate falls into the single digits.