- Stocks edge up as Chinese manufacturing rebound gathers pace in October

- But dollar maintains gains as US election and Fed meeting lurk around the corner

- Pound slips as England back in lockdown, aussie down ahead of RBA

Calm before the storm?

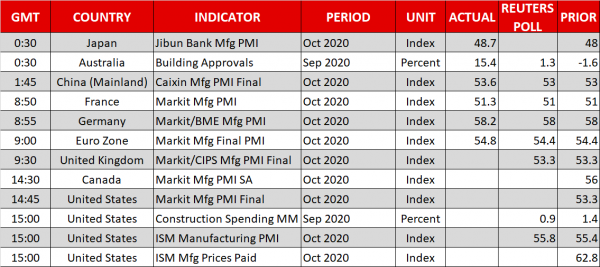

Equities got off to a somewhat positive start on Monday as stronger-than-expected manufacturing PMI data out of China provided investors with some respite from the doom and gloom of the pandemic. A quickening in Chinese manufacturing activity in October reassured markets that the recovery remains on track in at least one part of the world.

A rapid escalation in COVID-19 cases in Europe has plunged much of the continent back into lockdown, with several countries, including France and Germany, announcing tighter restrictions over the past week. European shares plunged last week as it became increasingly doubtful that a double-dip recession can be avoided, and major bourses were mixed at the start of Monday trading.

However, Asian stocks were more buoyant, with Japan’s Nikkei 225 index clocking up gains of 1.8%. US stock futures were also in the green, indicating a rise of 0.9% at the open on Wall Street today.

But those gains are likely to be a short-term correction at best as the steadier mood will probably not hold for long given the major events that are lined up this week.

Markets and the Fed gearing up for the US election

Americans will be voting for a new president and congressmen tomorrow and who wins the White House and which party gets to control Congress looks set to determine the timing and size of the next fiscal stimulus package in the United States. With the effects of the previous stimulus starting to wane and the recovery in Europe now in jeopardy, the need for further fiscal assistance is greater than ever and this is what the Fed is likely to stress when it announces its policy decision a day after the election.

Opinion polls continue to suggest Democratic candidate, Joe Biden, will comfortably win the presidency and if that turns out to be the case and the Trump team does not contest the result, Fed policymakers will probably have an easier time assessing the outlook. As things stand, the chances of a stimulus deal between Republicans and the Democrats are slipping fast, not just right after the election but any time before January when newly elected senators and representatives take up their seats.

The absence of a deal is likely to add pressure on the Fed to do more to support the economy but for now, there are few worry signs from US data, with Friday’s jobs report expected to confirm the improving picture. Hence, any change in tone from the Fed won’t come until December at the earliest.

Caution pulls dollar higher, pound and aussie take a tumble

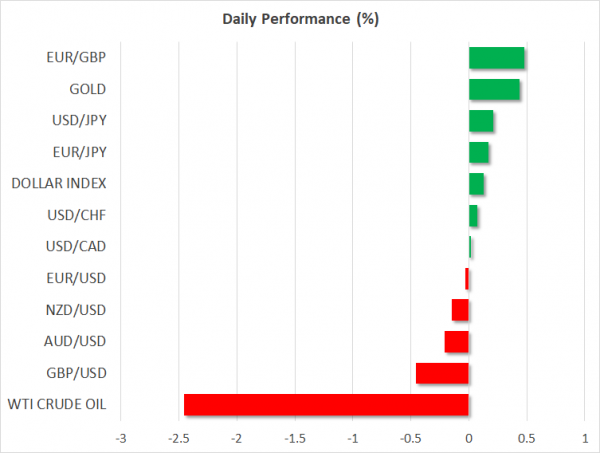

The heightened sense of caution ahead of those crucial events drove investors to the safety of the US dollar, while gold also inched higher. However, the yen surprisingly failed to attract as much interest, suggesting that rising Treasury yields on the back of a relatively stronger US economy were possibly as much a factor in pushing up the greenback.

The same cannot be said, though, for European currencies as both the euro and the pound deepened their 10-day-long slide. Sterling, in particular, stood out as the worst performer on the first trading day of November, dropping below the $1.29 level, with most parts of the United Kingdom now under some form of lockdown.

Prime Minister Johnson announced a one-month lockdown for England on Saturday as regional curbs have failed to stem the surge in Covid cases. In addition to the fresh virus blow for UK businesses, there is still no clarity on where the negotiations for a post-Brexit trade deal are headed. UK-EU negotiators are meeting again this week as the talks enter an intensive phase. An update on the status of those talks is expected mid-week, although there is no guarantee that positive headlines will be able to eclipse the grim virus reality.

The Australian dollar also lagged its peers on Monday as the Reserve Bank of Australia is highly anticipated to deliver more policy easing at its meeting on Tuesday. However, worsening trade ties between Australia and China could be weighing on the aussie too after Beijing announced a ban in some Australian imports, including copper.

The decision provided some support for copper futures, though other commodities like oil struggled. WTI and Brent crude prices have plummeted to 5-month lows today amid the fast-deteriorating demand outlook in the face of fresh lockdowns in major markets.