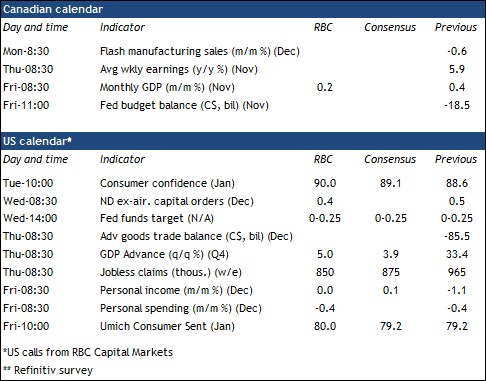

The economic impact of the second wave of virus spread will take center stage next week with the release of November Canadian GDP data – and preliminary estimate for December. We expect a 0.2% increase in November GDP – half Statistics Canada’s earlier 0.4% advance estimate. A pullback in the hospitality sector (food services sales declined 4% in the month) will act to offset continued growth in most other industries and the divergence is expected to grow in December. Most of the economy has been weathering the more limited second wave of restrictions much better than the first – the industrial sector has continued to bounce-back, and business confidence has improved. Economy-wide hours worked dipped 0.3% in December but were still up almost a percent from October after a surprisingly large November increase. But the hospitality sector has been hit hard once again by containment measures, and we expect more weakness in accommodation & food services and a pullback in retail sales will push GDP down 0.4% in December.

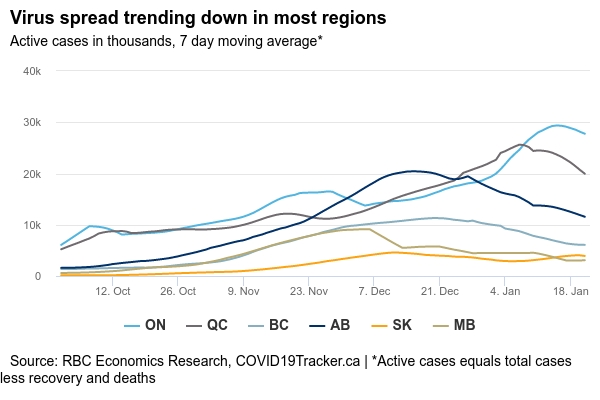

We expect another decline in January with containment measures continuing to strengthen. Still, there is also room for measured optimism that the restrictions on activity over the winter are working with many provinces reporting lower case counts over the last week. And if this trend continues, there could be some gradual easing in restrictions as early as February with more to follow as vaccine distribution ramps up to cover a broader swath of the most vulnerable population in the spring.

Week ahead data watch:

- Canada’s flash December manufacturing sales release should show further resilience. Employment in the sector rose 15k in December to reach pre-shock (Feb 2020) levels.

- We expect US GDP will record slower growth momentum for Q4 2020 as several states imposed restrictions to curtail rising case counts. We expect the quarter to expand by 5%, down from the record breaking 33% increase in the prior quarter.

- We look for little changes in the week’s FOMC meeting with policymakers still firmly committed to maintaining a highly accommodative policy stance.