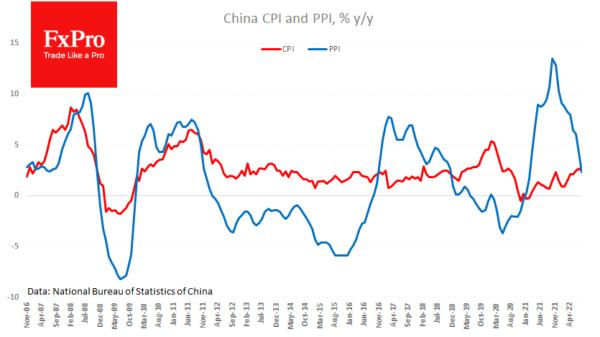

China is at the other end of the spectrum, while the developed world is facing the highest inflation rate in two generations. The published CPI and PPI data for August marked another drop in inflationary pressures and fell well below expectations.

The consumer price index slowed from 2.7% to 2.5% y/y against an expected acceleration to 2.8%. The producer price index fell from 4.2% to 2.3%, substantially below the expected 3.2%. However, it is worth realising that such disinflation results from weak economic growth limited by multiple waves of lockdowns.

Suppressed inflation due to limited consumer demand leads to expectations of further stimulus through bailout programmes, monetary policy easing and attempts to weaken the exchange rate. And this is terrible news for the renminbi, which could come under even greater pressure.

Earlier in the week, the USDCNH stopped at 7.0, pulling back to 6.933 at the time of writing. Likely, we see a tactical break by the bulls near the round level, coinciding with the dollar’s pullback in forex. Potentially, USDCNH could move up to the 7.15 area, repeating the highs of 2019 and 2020, which would help strengthen export competitiveness from China, bringing GDP growth closer to the target.