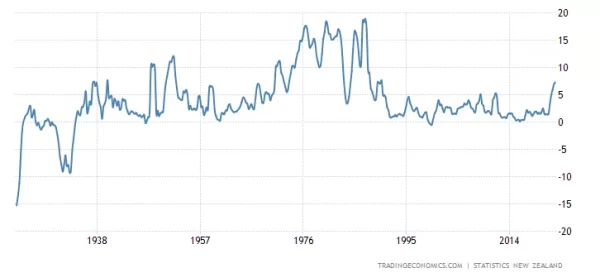

Inflation in New Zealand is the highest since 1990, edging to 7.3% in Q2 2022. The currency is under heavy pressure as the Reserve Bank of New Zealand is trying to reverse the inflationary spiral. The week ahead will give us a valuable clue about the country’s monetary policy, and we are here to talk about that.

What is happening with the New Zealand economy?

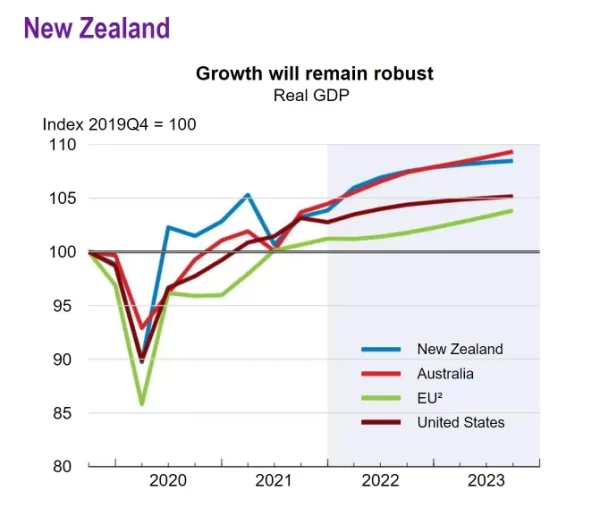

The GDP growth in New Zealand reached 5% in 2021, making the economy one of the fastest-developing in Oceania. However, as the world suffered from geopolitical shocks and supply crunches, inflation started to speed up. Although the direct impact of the Russian invasion of Ukraine is limited due to their small shares in New Zealand’s trade, the indirect effect is present. Rising commodity and energy prices gradually increased the cost of living, pressing on businesses and consumers.

Currently, inflation stays at 7.3%, the highest since 1990, and may become two-digit as tourism rebounds from the Covid-19 lockdowns.

Source: tradingeconomics.com

The unemployment level is at a historic low (3.2%), but the labor market lacks skilled workers. Moreover, when the country reopened the border in March 2022, the outflow of migrants soared. That happened because workers needed new work visas and had to wait till July 2022 to get them. All this increases pressure on the labor market and pushes prices even higher.

Where is it all going?

The Reserve Bank of New Zealand (RBNZ) will publish its Official Cash Rate on Wednesday, October 5, 04:00 GMT+3. The RBNZ’s deputy governor Christian Hawkesby said the bank considered a rate increase between 25 and 75 points before deciding to raise the rate by 50 basis points this month. As he said, once rates get to 4.0-4.25%, the bank will understand the monetary policy and the economic performance better.

As the current rate is at 3.0%, we expect the bank to make at least three consecutive rate changes. The closest one will probably be a 50-basis-point, followed by two 25-s, or a 50 and a 25. We expect the downturn in New Zealand’s economy to slow as the tightening cycle ends.

According to Organization for Economic Co-operation and Development (OECD) report, economic growth will slow from 5.0% in 2021 to 3.0% in 2022 and 2.0% in 2023. Therefore, the country is likely to withstand global recession with its head held high.

New Zealand’s dollar prospects

As the NZD remains under pressure, especially against the strong USD, we can spot signs of an upcoming reversal o a daily chart. First, the RSI is in the oversold zone. Generally a buy signal, it worked four out of five times over the last year.

Moreover, the RBNZ Rate Statement, which comes right after the Cash Rate announcement, may come along with our suggestions on future rate changes. It will give some relief to the NZD bulls and push the NZDUSD pair to the resistance trendline.

A less likely scenario is unexpectedly hawkish comments from the bank’s members that may push the pair above the trendline and bring it to the 50-period MA.

NZDUSD daily chart

Resistance: 0.5800, 0.6000

Support: 0.5560