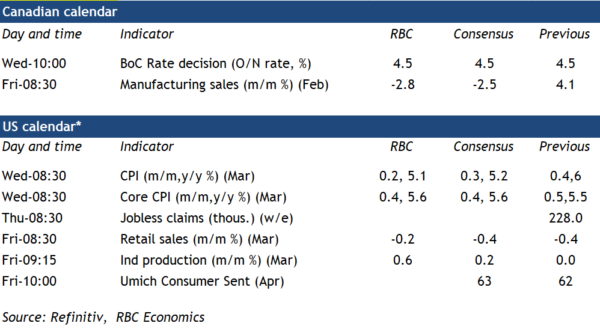

The Bank of Canada likely won’t make any change to the overnight interest rate next week. After announcing a conditional pause on interest rate hikes in January, the central bank is widely expected to make a second consecutive decision to hold. This is despite economic growth that’s been more resilient than expected so far this year. Indeed, though the January Monetary Policy Report anticipated GDP growth of 0.5%, we’re tracking it at closer to 2.5%. And labour markets remain exceptionally tight, with another 35,000 jobs created in March.

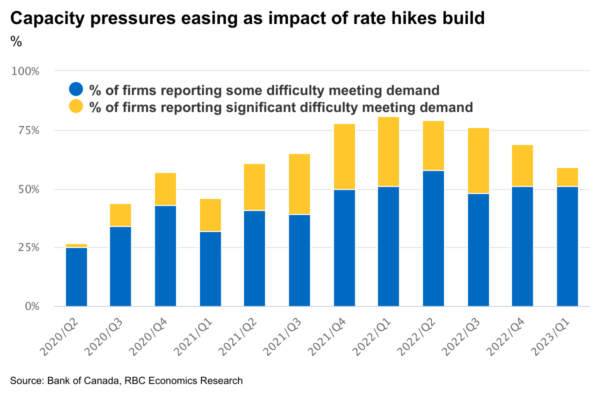

So why hold interest rates again when the economy is still running hot? The BoC’s pause on rate hiking was driven by an expectation that growth would stall through mid-2023, and Governor Macklem said it would take an “accumulation of evidence” to the contrary for it to resume tightening. We don’t think that test has been met yet, and many of the effects of last year’s aggressive increases have yet to ripple through the economy. Businesses in the central bank’s own Q1 Business Outlook Survey continued to expect slower sales growth in the year ahead. And while supply chain constraints continue to ease, concerns remain about credit and the impact of higher interest rates on customer demand. The Survey of Consumer Expectations suggests Canadians will soon cut back on spending as higher interest rates and higher costs for essential goods eat into purchasing power.

Cooler inflation readings have been encouraging—particularly since the softening has come even before the full effect of higher interest rates hits household purchasing power. And the recent round of financial instability is a reminder that aggressive interest rate increases over the last year could yet have unexpected consequences. Inflation (and the broader economy) are still running too hot for the BoC to actively consider cutting interest rates but staying on the sidelines for now looks like an easy decision to make.

Bank of Canada to stay on the sidelines

The U.S. year-over-year CPI inflation rate is expected to fall by almost a full percentage point to 5.1% in March. The pullback is largely from a drop in energy prices, although food price growth has also been edging lower in recent months. ‘Core’ (ex-food & energy) inflation has been ‘stickier’ than expected but is also expected to tick lower. Home rents have been driving a rising share of core price growth but should begin to slow going forward as softer growth in current market rents feeds through gradually to the CPI measure as leases are renewed.

Statistics Canada’s advance estimate of February manufacturing sales showed a 2.8% decline – led by lower sales in the motor vehicle, beverage and tobacco, primary metal and food industries. Lower prices (concentrated in a drop in petroleum prices) would explain about half the nominal February sales drop by our count.

U.S. retail sales likely saw a second consecutive decline in March (-0.2%), largely driven by a price-related drop in gas station sales (-4.5%) but also softer motor vehicle sales. We expect U.S industrial production to tick up 0.6% in March, thanks to a weather-related increase in utility output (7.1%) and manufacturing output (0.2%).