Oil started the week with a 2.5% jump, picking up on news of Saudi Arabia’s surprise decision to voluntarily cut production by 1M BPD. In addition, OPEC+ agreed to Russia’s production cut from next year.

These measures look like an impressive attempt to increase energy prices, giving traders a sense of increased energy shortages for at least the coming quarters.

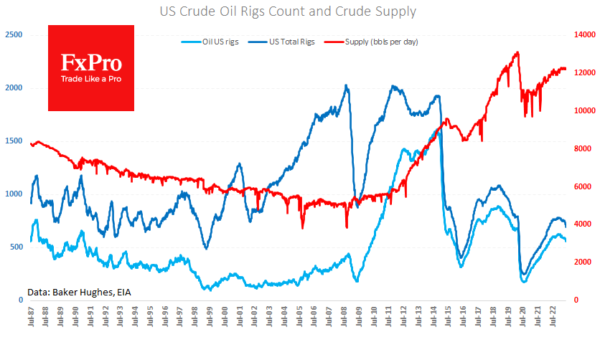

On the US side, news on production levels is also working to support this perception. The latest data from Baker Hughes noted a drop of 15 oil production rigs to 555 – the lowest since April 2022.

Since the start of the year, US production has been close to 12.2M BPD, which is only a modest 2.5% higher than exactly a year ago. Thus, US producers are in no hurry to take the market share that Saudi Arabia and Russia are willing to give up. There are two reasons for this.

Firstly, producers need to be more impressed by prices. Technically, they are near the 2018 peak, which is not low by historical standards. But here, one must add significantly higher market interest rates and a pronounced green agenda of financial institutions.

Secondly, the apathy of the major oil producers could result from lower demand in key areas, forming a bearish market environment.

Judging by the fact that WTI closed the gap before the end of Monday and lost another 1.8% on Tuesday, traders in the market are leaning towards the second scenario, which makes us assume a further downside in the price.

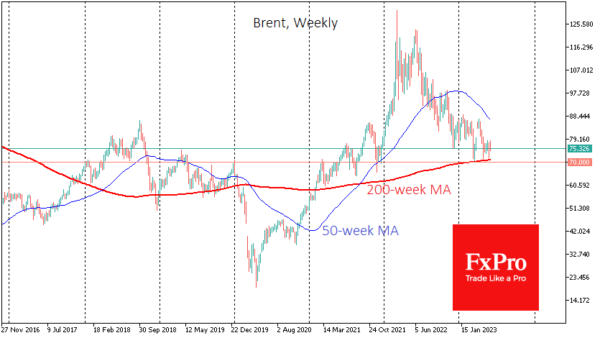

On the other hand, Saudi Arabia has stepped up its efforts to cut production as soon as the price of Brent drops to around $71 and WTI touches $65. Therefore, downside play is worth being cautious when approaching these levels.

That said, a breakout of these levels could look like a capitulation and trigger a big sell-off, like those in 2014 and 2020, when oil producers lost coordination. Technically, these levels coincided with price consolidation under the 200-week average. The market has already tested these levels ($67/bbl. WTI and 70.80/bbl. Brent) but bounced back.