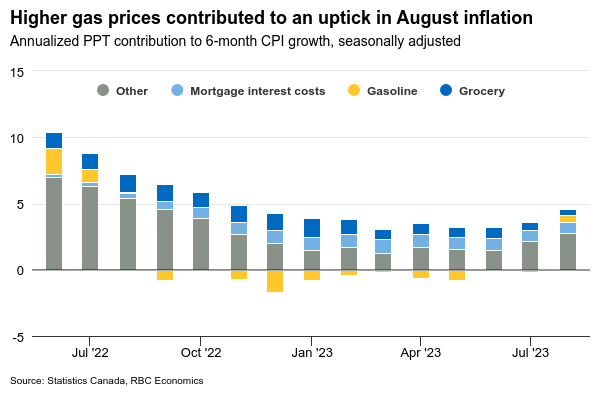

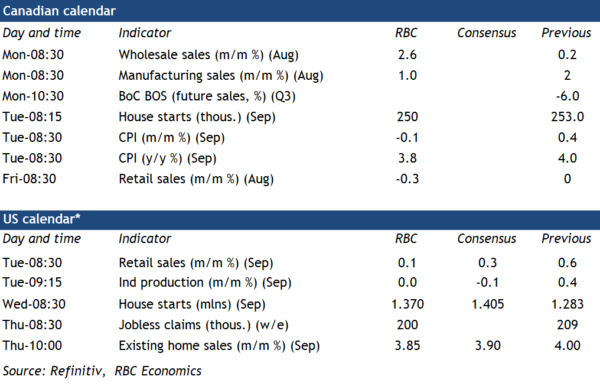

Inflation data and the Bank of Canada’s closely-watched Business Outlook Survey will be front and center in a busy week of Canadian economic data releases. Canadian headline CPI growth is expected to edge down to 3.8% year-over-year in September from August’s 4% print. Year-over-year growth in energy prices likely accelerated – gasoline prices edged lower in September from August but were still up almost 7% from a year ago compared to a 1.5% year-over-year increase in August.

But food price growth is expected to continue to trend lower and the BoC has been more concerned about recent price growth in a range of ‘core’ measures designed to be a better gauge of broader Canadian (as opposed to globally produced) inflation pressures. We look for price growth excluding food and energy prices to slow to 3.3% year-over-year – just above the top end of the central bank’s (1 to 3%) target range despite mortgage interest costs continuing to surge higher. But the closely-watched 3-month rolling average of the BoC’s preferred ‘trim’ and ‘median’ price growth measures both accelerated to a 4 ½% annualized rate in August, adding to concerns that underlying price growth is not slowing despite a softening macroeconomic backdrop. We continue to expect price growth to slow going forward, and that would be consistent with year-over-year price growth ticking lower in each of the ‘trim’, ‘median’, and trim services ex-shelter (sometimes called ‘supercore’) measures in September.

Firms’ price-setting behaviour will also be front-and-center in the BoC’s own Business Outlook Survey. Prior surveys showed that firms’ were making larger and more frequent changes to prices during the initial spike in inflation. Subsequent surveys have suggested that pendulum is swinging back but the BoC’s Deputy Governor Vincent reiterated earlier this month that a return to ‘normal’ price-setting behaviour is needed to get inflation sustainably back to target. Firms’ inflation expectations will also be watched closely along with consumers’ views from the separate Survey of Consumer Expectations. We anticipate the BOS will signal softer business conditions in line with softening in near-term economic growth indicators, and some further easing in labour shortages given a higher unemployment rate and lower job openings.

Week ahead data watch

August retail sales likely edged down 0.3%, according to StatCan’s advanced indicator. We expect lower auto sales (down 1.8% on a seasonally adjusted basis) contributed to much of the slowdown. That decline was offset as Canadians paid more at the pumps, resulting in higher (nominal) gasoline sales. That implies a 1% drop in retail sales in volume terms.

We expect manufacturing sales to increase by 1% in August, in line with StatCan’s preliminary estimate. Most of the growth was seen in petroleum and coal product (higher prices) and food subsectors. ‘Core’ wholesale sales went up by 2.6% during that month, supported by higher sales in the machinery, equipment and supplies subsectors.

September U.S. retail sales likely ticked up 0.1% from the prior month. Unit auto sales recovered (+2%) in September after two consecutive declines in prior months. Gas prices were still high, but growing at a slower pace; sales at gas stations likely remained flat during that month.

U.S. industrial production was likely flat in September. Higher output in the manufacturing sector was offset by lower utility output. Higher hours worked in the manufacturing sector contributed to the former, while a lower number of heating and cooling days dragged the latter down.